Audi 2014 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2014 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL PERFORMANCE INDICATORS

NET WORTH // FINANCIAL POSITION

174

>>

interest from the measurement of pension obligations. As of

the balance sheet date, the equity ratio for the Audi Group

was 37.8 (41.1) percent.

The non-current liabilities of the Audi Group were up

26.0 percent to EUR 12,844 (10,194) million as of the end of

2014. This rise was driven in part by higher provisions for

pensions due to interest rate factors, and especially by vol-

ume-related higher obligations from sales operations.

The 14.2 percent increase in current liabilities to EUR 18,725

(16,398) million is above all attributable to the higher trade

payables that are a direct consequence of the higher business

volume, along with the rise in negative fair values of derivative

financial instruments, in particular as a result of the apprecia-

tion of the U.S. dollar against the euro.

FINANCIAL POSITION

Cash flow from operating activities for the Audi Group reached

EUR 7,421 (6,778) million in the 2014 fiscal year and there-

fore exceeded the previous year’s high level.

Disregarding the change in participations, the cash used in

investing activities for current operations rose to EUR 4,259

(3,553) million over the same period. Of the total investments

in property, plant and equipment and intangible assets, the

Automotive segment accounted for EUR 4,229 (3,544) million

and the Motorcycles segment for EUR 61 (50) million. The focus

of our investment activity was on the expansion of our interna-

tional production network as well as on new products and pio-

neering drive technologies. The changes in participations result-

ed in additional investment by the Audi Group amounting to

EUR 191 (36) million. Mainly as a result of a restructuring of

current cash funds into fixed deposits with a longer investment

horizon, and taking into account the changes in cash deposits

and loans extended, cash flow from investing activities came to

EUR 8,940 (2,674) million. Net cash flow for the 2014 fiscal

year once again reached the high level of EUR 2,970 (3,189)

million despite the higher capital investments. After elimination

of the cash used for changes in participations, net cash flow was

EUR 3,162 (3,225) million. As in previous years, the Audi Group

financed all investments in operating activities entirely from its

own resources and in addition generated a substantial surplus.

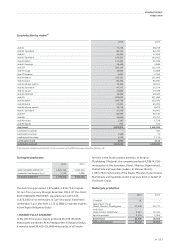

Condensed cash flow statement of the Audi Group

EUR million

2014 2013

Cash flow from operating

activities 7,421 6,778

Investing activities attributable to

operating activities –4,450 – 3,589

of which investments in

property, plant and equipment – 2,979 – 2,386

of which development costs – 1,311 – 1,207

of which acquisition and

sale of participations – 191 – 36

Net cash flow 2,970 3,189

Change in investments in securities

and loans extended – 4,490 916

Cash flow from investing activities –8,940 – 2,674

Cash flow from financing activities –1,501 – 1,726

Change in cash and cash

equivalents due to changes

in exchange rates 171 – 120

Change in cash and cash

equivalents – 2,850 2,258

Net liquidity was increased to EUR 16,328 (14,716) million as

of December 31, 2014. This sum includes an amount of

EUR 54 (69) million on deposit at Volkswagen Bank GmbH,

Braunschweig, for the financing of independent dealers and

which is only available to a limited extent. Furthermore, the

Audi Group has adequate committed but currently unused

external credit lines. As of December 31, 2014, other financial

obligations, comprising ordering commitments in particular,

amounted to EUR 4,973 (3,736) million. Further details are

given in Section 41 of the Notes: “Other financial obligations.”

The principles of financial management are explained

under the strategy goal “Superior financial

strength” on page 148.