Audi 2014 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2014 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

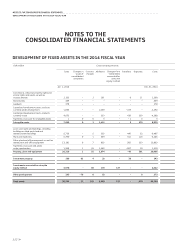

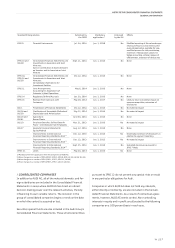

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

GENERAL INFORMATION

226

>>

GENERAL INFORMATION

AUDI AG has the legal form of a German stock corporation

(Aktiengesellschaft). Its registered office is at Ettinger Strasse,

Ingolstadt, and the Company is recorded in the Commercial

Register of Ingolstadt under HR B 1.

Around 99.55 percent of the subscribed capital of AUDI AG is

held by Volkswagen AG, Wolfsburg, with which a control and

profit transfer agreement exists. The Consolidated Financial

Statements of AUDI AG are included in the Consolidated

Financial Statements of Volkswagen AG, which are held on

file at the Local Court of Wolfsburg. The purpose of the

Company is the development, production and sale of motor

vehicles, other vehicles and engines of all kinds, together

with their accessories, as well as machinery, tools and

other technical articles.

/

ACCOUNTING PRINCIPLES

AUDI AG prepares its Consolidated Financial Statements on

the basis of the International Financial Reporting Standards

(IFRS) and the interpretations of the International Financial

Reporting Standards Interpretations Committee (IFRS IC).

All pronouncements of the International Accounting Standards

Board (IASB), whose application is mandatory in the European

Union (EU), have been observed. The prior-year figures have

been calculated according to the same principles.

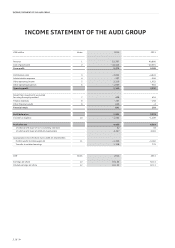

The Income Statement is prepared according to the interna-

tionally practiced cost of sales method.

AUDI AG prepares its Consolidated Financial Statements in

euros (EUR). All figures have been rounded in accordance with

standard commercial practice, with the result that minor dis-

crepancies may occur when adding these amounts.

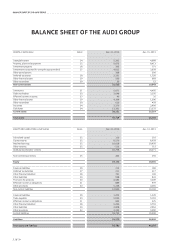

The Consolidated Financial Statements provide a true and

fair view of the net worth, financial position and financial

performance of the Audi Group.

The requirements of Section 315a of the German Commercial

Code (HGB) regarding the preparation of Consolidated Finan-

cial Statements in accordance with IFRS, as endorsed by the EU,

are met.

All requirements that must be applied under German commer-

cial law are additionally observed in preparing the Consoli-

dated Financial Statements. In addition, the requirements of

the German Corporate Governance Code have been adhered to.

The Board of Management prepared the Consolidated Financial

Statements on February 9, 2015. This date marks the end of

the adjusting events period.

//

EFFECTS OF NEW OR REVISED STANDARDS

The Audi Group has implemented all of the accounting stan-

dards whose application became mandatory with effect from

the 2014 fiscal year.

IFRS 10 governs the determination of the entities to be

included in consolidation and the form of inclusion of subsidi-

aries in the Consolidated Financial Statements. IFRS 10 has

resulted in a standardized control concept. Control exists when

decision-making rights are held with respect to the relevant

activities that can be used to affect own variable returns. Near-

ly all control relationships within the Audi Group are based on

voting or similar rights. All of the material special purpose

entities and/or structured entities are already consolidated.

The revision of the control concept therefore does not result in

any changes. In other words, no companies need to be consoli-

dated for the first time or removed from the group of consoli-

dated companies.

IFRS 11 governs the definition and reporting of joint arrange-

ments. The standard distinguishes between joint operations

and joint ventures. A joint operation exists when the compa-

nies with joint control have rights to the assets and obligations

for the liabilities resulting from the joint activity. With joint

ventures, by contrast, the companies are only entitled to a

share of the net assets. Applying IFRS 11 does not result in any

changes for the Audi Group.

IFRS 12 deals with the disclosure requirements for subsidiaries,

joint arrangements, associated companies and structured enti-

ties. The extent of the information that must be disclosed is

increased by IFRS 12.

The other accounting standards to be applied for the first time

in the 2014 fiscal year have no significant impact on the presen-

tation of net worth, financial position and financial performance.

//

NEW OR REVISED STANDARDS NOT APPLIED

The following new or revised accounting standards already

approved by the IASB were not applied in the Consolidated

Financial Statements for the 2014 fiscal year because their

application was not yet mandatory: