Audi 2014 Annual Report Download - page 241

Download and view the complete annual report

Please find page 241 of the 2014 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTES TO THE INCOME STATEMENT

>>

241

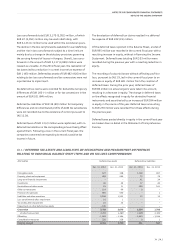

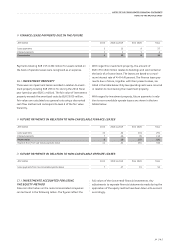

Loss carryforwards total EUR 3,170 (3,052) million, of which

EUR 47 (3,051) million may be used indefinitely, with

EUR 3,123 (1) million to be used within the next eleven years.

The decline in the loss carryforwards available for use indefinitely

and the rise in loss carryforwards subject to a time limit are

mainly due to a change in the statutory provisions governing

the carrying forward of losses in Hungary. Overall, loss carry-

forwards in the amount of EUR 3,117 (3,049) million were

classed as unusable. In the 2014 fiscal year, the realization of

tax losses led to a reduction in current income tax expense of

EUR 1 (43) million. Deferred tax assets of EUR 482 (416) million

relating to tax loss carryforwards and tax concessions were not

reported due to impairment.

No deferred tax claims were recorded for deductible temporary

differences of EUR 160 (–) million or for tax concessions in the

amount of EUR 101 (84) million.

Deferred tax liabilities of EUR 34 (40) million for temporary

differences and non-distributed profits of AUDI AG subsidiaries

were not recorded due to the existence of control pursuant to

IAS 12.39.

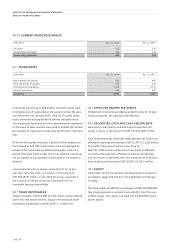

Deferred taxes of EUR 13 (2) million were capitalized, with no

deferred tax liabilities in the corresponding amount being offset

against them. Following a loss in the current fiscal year, the

companies concerned are expecting to record a positive tax

income in future.

The devaluation of deferred tax claims resulted in a deferred

tax expense of EUR 222 (19) million.

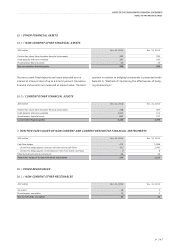

Of the deferred taxes reported in the Balance Sheet, a total of

EUR 995 million was recorded in the current fiscal year with a

resulting increase in equity, without influencing the Income

Statement. Deferred taxes totaling EUR 353 million were

recorded during the previous year with a resulting reduction in

equity.

The recording of actuarial losses without affecting profit or

loss, pursuant to IAS 19, led in the current fiscal year to an

increase in equity of EUR 401 million from the creation of

deferred taxes. During the prior year, deferred taxes of

EUR 83 million on actuarial gains were taken into account,

resulting in a decrease in equity. The change in deferred taxes

on the effects recognized in equity for derivative financial

instruments and securities led to an increase of EUR 594 million

in equity in the course of the year. Deferred taxes amounting

to EUR 270 million were recorded from these effects during

the previous year.

Deferred taxes posted directly in equity in the current fiscal year

are broken down in detail in the Statement of Comprehensive

Income.

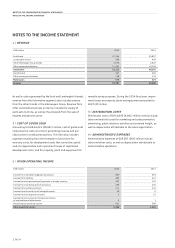

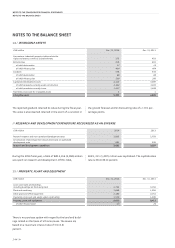

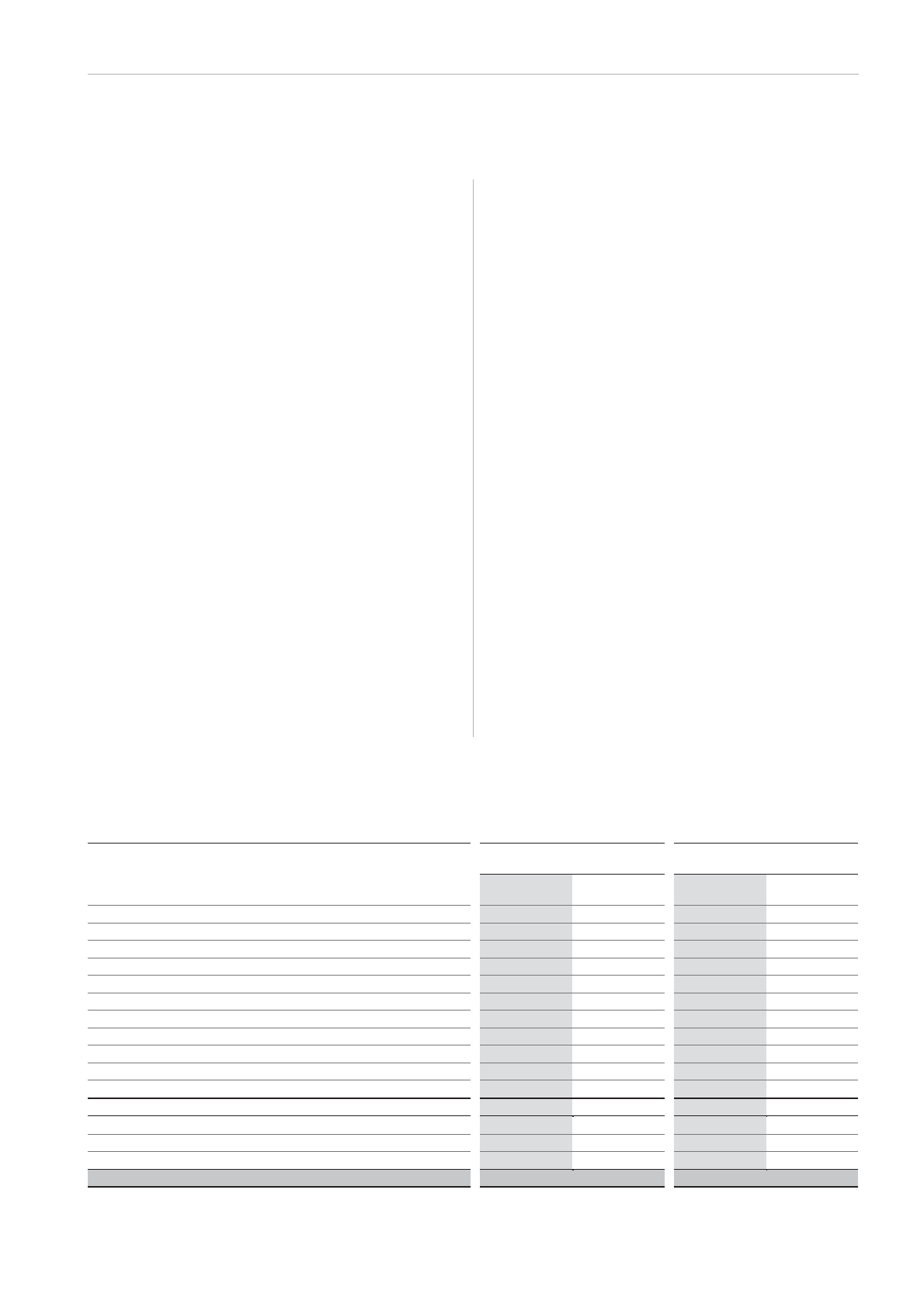

10.1 /

DEFERRED TAX ASSETS AND LIABILITIES ON RECOGNITION AND MEASUREMENT DIFFERENCES

RELATING TO INDIVIDUAL BALANCE SHEET ITEMS AND ON TAX LOSS CARRYFORWARDS

EUR million

Deferred tax assets Deferred tax liabilities

Dec. 31, 2014 Dec. 31, 2013 Dec. 31, 2014 Dec. 31, 2013

Intangible assets 127 128 1,158 997

Property, plant and equipment 289 266 72 76

Long-term financial investments – – 41 24

Inventories 49 39 17 42

Receivables and other assets 81 11 550 541

Other current assets 114 99 0 –

Provisions for pensions 985 550 – 1

Liabilities and other provisions 2,288 1,552 15 19

Loss carryforwards after impairment 16 1 – –

Tax credits after impairment 10 33 – –

Impairment on other deferred tax assets – 189 – – –

Gross value 3,768 2,678 1,854 1,700

of which non-current 1,702 1,280 1,289 1,325

Offsetting – 1,643 – 1,184 – 1,643 – 1,184

Consolidation measures 226 226 0 1

Carrying amount 2,351 1,720 211 517