Audi 2014 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2014 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294

|

|

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

GENERAL INFORMATION

>>

227

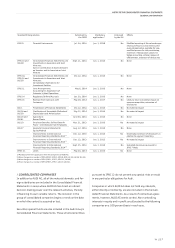

Standard/Interpretation Published by

the IASB

Mandatory

application 1) Endorsed

by the EU

Effects

IFRS 9 Financial Instruments Jul. 24, 2014 Jan. 1, 2018 No Modified reporting of fair value changes

relating to financial instruments previ-

ously categorized as available for sale,

modified process for risk provisioning,

extension of designation options for

hedge accounting, simpler reviews of

effectiveness, extension of disclosures

IFRS 10 and

IAS 28

Consolidated Financial Statements and

Investments in Associates and Joint

Ventures:

Sale or Contribution of Assets between

an Investor and its Associate or Joint

Venture

Sept. 11, 2014 Jan. 1, 2016 No None

IFRS 10,

IFRS 12 and

IAS 28

Consolidated Financial Statements and

Investments in Associates and Joint

Ventures:

Consolidation Exemptions for

Investment Entities

Dec.12, 2014 Jan. 1, 2016 No None

IFRS 11 Joint Arrangements:

Accounting for Acquisitions of

Interests in Joint Operations

May 6, 2014 Jan. 1, 2016 No None

IFRS 14 Regulatory Deferral Accruals Jan. 30, 2014 Jan. 1, 2016 No None

IFRS 15 Revenue from Contracts with

Customers

May 28, 2014 Jan. 1, 2017 No Likely to have no material impact on

revenue recognition, extension of

disclosures

IAS 1 Presentation of Financial Statements Dec.12, 2014 Jan. 1, 2016 No No material impact

IAS 16 and

IAS 38

Clarification of Acceptable Methods of

Depreciation and Amortization

May 12, 2014 Jan. 1, 2016 No No material impact

IAS 16 and

IAS 41

Agriculture:

Bearer Plants

June 30, 2014 Jan. 1, 2016 No None

IAS 19 Employee Benefits: Defined Benefit

Plans – Contributions from Employees

Nov. 21, 2013 Jan. 1, 2016 Yes No material impact

IAS 27 Separate Financial Statements:

Equity Method

Aug. 12, 2014 Jan. 1, 2016 No None

Improvements to International

Financial Reporting Standards 2012 2) Dec. 12, 2013 Jan. 1, 2016 Yes Essentially extension of disclosures in

relation to segment reporting

Improvements to International

Financial Reporting Standards 2013 3) Dec. 12, 2013 Jan. 1, 2015 Yes No material impact

Improvements to International

Financial Reporting Standards 2014 4) Sept. 25, 2014 Jan. 1, 2016 No Extended disclosures pursuant to

IFRS 7 likely

IFRIC 21 Levies May 20, 2013 Jan. 1, 2015 Yes None

1) Mandatory first-time application from the perspective of AUDI AG.

2) Minor changes to a number of IFRS (IFRS 2, IFRS 3, IFRS 8, IFRS 13, IAS 16/38, IAS 24).

3) Minor changes to a number of IFRS (IFRS 1, IFRS 3, IFRS 13, IAS 40)

4) Minor changes to a number of IFRS (IFRS 5, IFRS 7, IAS 19, IAS 34).

/

CONSOLIDATED COMPANIES

In addition to AUDI AG, all of the material domestic and for-

eign subsidiaries are included in the Consolidated Financial

Statements in cases where AUDI AG has direct or indirect

decision-making power over the relevant activities, thereby

influencing its own variable returns. The inclusion in the

group of consolidated companies begins or ends on the date

on which the control is acquired or lost.

Securities special funds are also included in the Audi Group’s

Consolidated Financial Statements. These structured entities

pursuant to IFRS 12 do not present any special risks or result

in any particular obligations for Audi.

Companies in which AUDI AG does not hold any interests,

either directly or indirectly, are also included in the Consoli-

dated Financial Statements. As a result of contractual agree-

ments, however, AUDI AG exerts control. Non-controlling

interests in equity and in profit are allocated to the following

companies on a 100 percent basis in each case.