AT&T Wireless 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T 09 AR 85

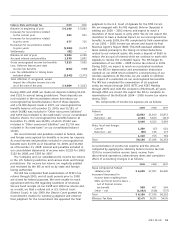

managers, which management has determined approximates

fair value. Private equity investments are often valued initially

based upon cost; however, valuations are reviewed utilizing

available market data to determine if the carrying value

of these investments should be adjusted. Such market data

primarily includes observations of the trading multiples

of public companies considered comparable to the private

companies being valued. Investments in real assets funds

are stated at the aggregate net asset value of the units

of these funds, which management has determined

approximates fair value. Real assets and natural resource

investments are valued either at amounts based upon

appraisal reports prepared by appraisers or at amounts

as determined by an internal appraisal performed by the

investment manager, which management has determined

approximates fair value.

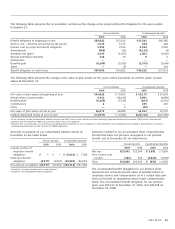

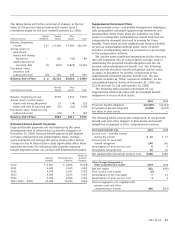

Purchases and sales of securities are recorded as of the

trade date. Realized gains and losses on sales of securities

are determined on the basis of average cost. Interest income

is recognized on the accrual basis. Dividend income is

recognized on the ex-dividend date.

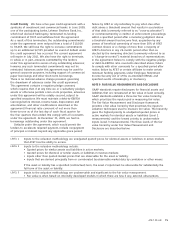

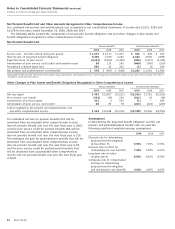

Fair Value Measurement

GAAP standards require disclosures for financial assets and

liabilities that are remeasured at fair value at least annually.

GAAP standards establish a three-tier fair value hierarchy,

which prioritizes the inputs used in measuring fair value.

These tiers include: Level 1, defined as observable inputs such

as quoted prices in active markets; Level 2, defined as inputs

other than quoted prices in active markets that are either

directly or indirectly observable; and Level 3, defined as

unobservable inputs in which little or no market data exists,

therefore requiring an entity to develop its own assumptions.

See Note 9 “Fair Value Measurement and Disclosure” for a

discussion of fair value hierarchy that prioritizes the inputs

to valuation techniques used to measure fair value.

At December 31, 2009, AT&T securities represented less than

one-half of a percent of assets held by our pension plans and

VEBA trusts.

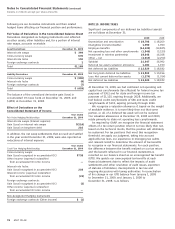

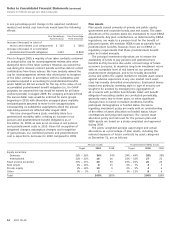

Investment Valuation

Investments are stated at fair value. Fair value is the price that

would be received to sell an asset or paid to transfer a liability

in an orderly transaction between market participants at the

measurement date. See “Fair Value Measurement” for further

discussion.

Investments in securities traded on a national securities

exchange are valued at the last reported sales price on the

last business day of the year. If no sale was reported on

that date, they are valued at the last reported bid price.

Investments in securities not traded on a national securities

exchange are valued using pricing models, quoted prices of

securities with similar characteristics or discounted cash flows.

Over-the-counter (OTC) securities and government obligations

are valued at the bid price or the average of the bid and

asked price on the last business day of the year from

published sources where available and, if not available, from

other sources considered reliable. Depending on the types

and contractual terms of OTC derivatives, fair value is

measured using a series of techniques, such as Black-Scholes

option pricing model, simulation models or a combination of

various models.

Common/collective trust funds and 103-12 investment

entities are valued at quoted redemption values that represent

the net asset values of units held at year-end which

management has determined approximates fair value.

Alternative investments, including investments in private

equities, private bonds, limited partnerships, hedge funds,

real assets and natural resources, do not have readily

available market values. These estimated fair values may

differ significantly from the values that would have been

used had a ready market for these investments existed, and

such differences could be material. Private equity, private

bonds, limited partnership interests, hedge funds and other

investments not having an established market are valued

at net asset values as determined by the investment