AT&T Wireless 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

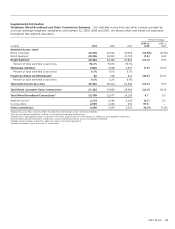

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

40 AT&T 09 AR

primarily related to lower revenues from operator services

and retail payphone operations.

Operating expenses decreased $308, or 10.3%, in 2009

and increased $946, or 46.4%, in 2008. The changes were

primarily due to charges of $550 and $978 associated with

our workforce reductions in 2009 and 2008 as a result of the

restructure of our operations from a collection of regional

companies to a single national approach.

Our Other segment operating results consist primarily of

Sterling, customer information services (primarily operator

services and payphone), corporate and other operations.

Sterling provides business-integration software and services.

Operating revenues decreased $311, or 15.2%, in 2009

and $187, or 8.4%, in 2008. The decrease in 2009 is primarily

due to reduced revenues from our operator services, retail

payphone operations and Sterling. The 2008 decline is

of $453 and lower sales agency revenue of approximately $113

due to the sale of the independent line of business segment of

the L.M. Berry Company. This decrease was partially offset by

increased Internet advertising revenue of $196.

Operating expenses decreased $216, or 5.7%, in 2009

largely driven by decreases in depreciation and amortization

expense of $140, product related costs of $74, advertising

costs of $44, and professional and contracted expense of $17.

These expense decreases were partially offset by an increase

in pension/OPEB and other benefit costs of $66. Operating

expenses decreased $203, or 5.1%, in 2008 largely driven by

decreased depreciation and amortization of $135 resulting

from use of an accelerated method of amortization for the

customer list acquired as part of the BellSouth acquisition,

and lower employee, professional and contract related

expenses. These expense decreases were partially offset by

increased YELLOWPAGES.COM, LLC (YPC) expansion costs.

Operating Results

Our Advertising Solutions segment operating income margin

was 25.7% in 2009, 31.2% in 2008 and 31.8% in 2007.

The decrease in the segment operating income margin in

both 2009 and 2008 was primarily the result of decreased

operating revenues.

Operating revenues decreased $693, or 12.6%, in 2009

largely driven by continuing declines in print revenue of

$774 and lower sales agency revenue of $34 due to the sale

of the independent line of business segment of the L.M. Berry

Company. This decrease was partially offset by Internet

advertising revenue growth of $132. The ongoing economic

recession has reduced demand for advertising and customers

have continued to shift to Internet-based search services,

although the recession has also curbed search usage by

consumers. Operating revenues decreased $349, or 6%, in

2008 largely driven by continuing declines in print revenue

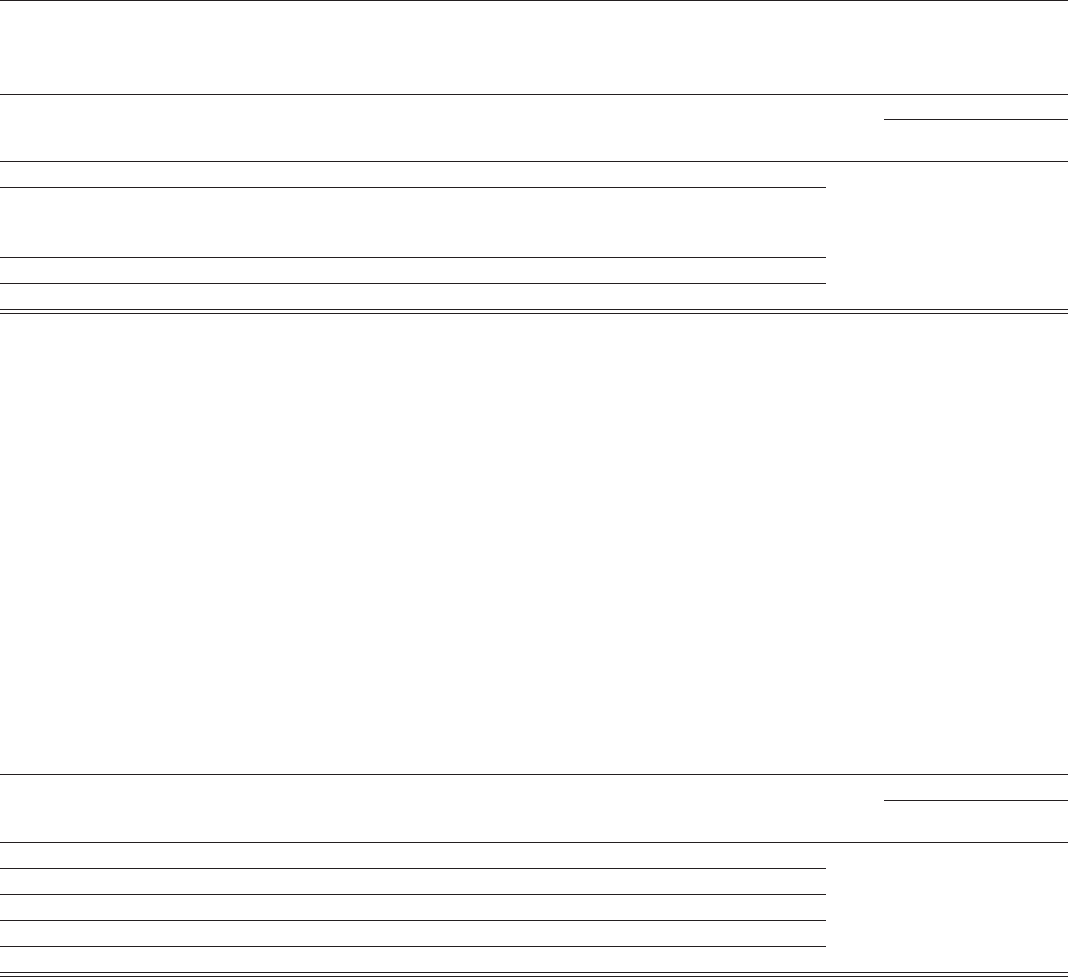

Other

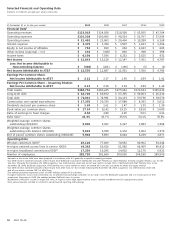

Segment Results

Percent Change

2009 vs. 2008 vs.

2009 2008 2007 2008 2007

Total Segment Operating Revenues $1,731 $2,042 $2,229 (15.2)% (8.4)%

Total Segment Operating Expenses 2,678 2,986 2,040 (10.3) 46.4

Segment Operating Income (Loss) (947) (944) 189 (0.3) —

Equity in Net Income of Affiliates 706 794 645 (11.1) 23.1

Segment Income (Loss) $ (241) $ (150) $ 834 (60.7)% —

Advertising Solutions

Segment Results

Percent Change

2009 vs. 2008 vs.

2009 2008 2007 2008 2007

Total Segment Operating Revenues $4,809 $5,502 $5,851 (12.6)% (6.0)%

Segment operating expenses

Operations and support 2,922 2,998 3,066 (2.5) (2.2)

Depreciation and amortization 649 789 924 (17.7) (14.6)

Total Segment Operating Expenses 3,571 3,787 3,990 (5.7) (5.1)

Segment Income $1,238 $1,715 $1,861 (27.8)% (7.8)%