AT&T Wireless 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

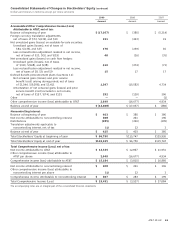

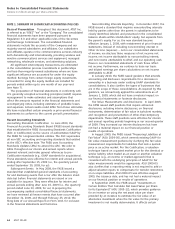

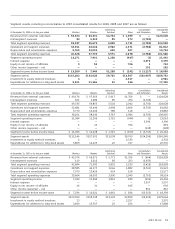

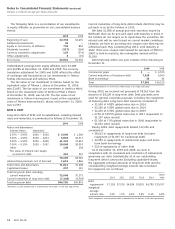

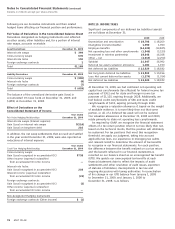

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

68 AT&T 09 AR

at the balance sheet dates. We translate our share of their

revenues and expenses using average rates during the year.

The resulting foreign currency translation adjustments are

recorded as a separate component of accumulated other

comprehensive income in the accompanying consolidated

balance sheets. We do not hedge foreign currency translation

risk in the net assets and income we report from these

sources. However, we do hedge a large portion of the

foreign currency exchange risk involved in anticipation of

highly probable foreign currency-denominated transactions,

which we explain further in our discussion of our methods

of managing our foreign currency risk (see Note 9).

NOTE 2. ACQUISITIONS, DISPOSITIONS, AND

OTHER ADJUSTMENTS

Acquisitions

Centennial In November 2009, we acquired the assets

of Centennial, a regional provider of wireless and wired

communications services with approximately 865,000

customers as of December 31, 2009. Total consideration of

$2,961 included $955 in cash for the redemption of

Centennial’s outstanding common stock and liquidation of

outstanding stock options and $2,006 for our acquisition of

Centennial’s outstanding debt (including liabilities related to

assets subject to sale, as discussed below), of which we repaid

$1,957 after closing in 2009. The preliminary fair value

measurement of Centennial’s net assets at the acquisition

date resulted in the recognition of $1,276 of goodwill, $647

of spectrum licenses, and $273 of customer lists and other

intangible assets for the Wireless segment. The Wireline

segment added $339 of goodwill and $174 of customer lists

and other intangible assets from the acquisition. The

acquisition of Centennial impacted our Wireless and Wireline

segments, and we have included Centennial’s operations in

our consolidated results since the acquisition date. As the

value of certain assets and liabilities are preliminary in nature,

they are subject to adjustment as additional information is

obtained about the facts and circumstances that existed at

the acquisition date. When the valuation is final, any changes

to the preliminary valuation of acquired assets and liabilities

could result in adjustments to identified intangibles and

goodwill. See Notes 6 and 8 for additional information

regarding the impact of the Centennial acquisition on our

goodwill and other intangibles and our long-term debt

repayment for 2009.

Wireless Properties Transactions In May 2009, we

announced a definitive agreement to acquire certain wireless

assets from Verizon Wireless (VZ) for approximately $2,350

in cash. The assets primarily represent former Alltel Wireless

assets. We will acquire wireless properties, including

licenses and network assets, serving approximately

1.5 million subscribers in 79 service areas across 18 states.

In October 2009, the Department of Justice (DOJ) cleared

our acquisition of Centennial, subject to the DOJ’s condition

that we divest Centennial’s operations in eight service areas

in Louisiana and Mississippi. We are in the process of

amount of the original estimate of undiscounted cash flows

are recognized. The increase in the carrying value of the

associated long-lived asset is depreciated over the

corresponding estimated economic life.

Software Costs It is our policy to capitalize certain costs

incurred in connection with developing or obtaining internal-

use software. Capitalized software costs are included in

“Property, Plant and Equipment” on our consolidated balance

sheets and are primarily amortized over a three-year period.

Software costs that do not meet capitalization criteria are

expensed immediately.

Goodwill and Other Intangible Assets Goodwill

represents the excess of consideration paid over the fair value

of net assets acquired in business combinations. Goodwill

and other indefinite-lived intangible assets are not amortized

but are tested at least annually for impairment. We have

completed our annual goodwill impairment testing for 2009,

which did not result in an impairment.

Intangible assets that have finite useful lives are amortized

over their useful lives, a weighted-average of 8.1 years.

Customer relationships are amortized using primarily the

sum-of-the-months-digits method of amortization over the

expected period in which those relationships are expected

to contribute to our future cash flows based in such a way as

to allocate it as equitably as possible to periods during which

we expect to benefit from those relationships.

A significant portion of intangible assets in our Wireless

segment are Federal Communications Commission (FCC)

licenses that provide us with the exclusive right to utilize

certain radio frequency spectrum to provide wireless

communications services. While FCC licenses are issued for a

fixed time (generally 10 years), renewals of FCC licenses have

occurred routinely and at nominal cost. Moreover, we have

determined that there are currently no legal, regulatory,

contractual, competitive, economic or other factors that limit

the useful lives of our FCC licenses, and therefore the FCC

licenses are indefinite-lived intangible assets under the

GAAP standards for goodwill and other intangible assets.

In accordance with GAAP, we test wireless FCC licenses

for impairment on an aggregate basis, consistent with the

management of the business on a national scope. During the

fourth quarter of 2009, we completed the annual impairment

tests for indefinite-lived wireless FCC licenses. These annual

impairment tests resulted in no material impairment of

indefinite-lived wireless FCC licenses. We recorded an

immaterial $18 impairment to wireline licenses we no

longer plan to use.

Advertising Costs Advertising costs for advertising

products and services or for promoting our corporate image

are expensed as incurred.

Foreign Currency Translation We are exposed to

foreign currency exchange risk through our foreign affiliates

and equity investments in foreign companies. Our foreign

subsidiaries and foreign investments generally report their

earnings in their local currencies. We translate our share of

their foreign assets and liabilities at exchange rates in effect