AT&T Wireless 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

72 AT&T 09 AR

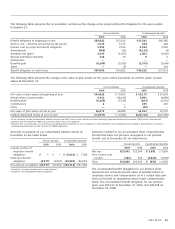

Certain facilities and equipment used in operations are

leased under operating or capital leases. Rental expenses

under operating leases were $2,889 for 2009, $2,733 for

2008 and $2,566 for 2007. At December31,2009, the future

minimum rental payments under non-cancelable operating

leases for the years 2010 through 2014 were $2,429, $2,276,

$2,057, $1,859 and $1,707, with $10,230 due thereafter.

Certain real estate operating leases contain renewal options

that may be exercised. Capital leases are not significant.

American Tower Corp. Agreement

In August 2000, we reached an agreement with American

Tower Corp. (American Tower) under which we granted

American Tower the exclusive rights to lease space on a

number of our communications towers. In exchange, we

received a combination of cash and equity instruments as

complete prepayment of rent with the closing of each leasing

agreement. The value of the prepayments was recorded as

deferred revenue and recognized in income as revenue over

the life of the leases. The balance of deferred revenue was

$509 in 2009, $539 in 2008 and $569 in 2007.

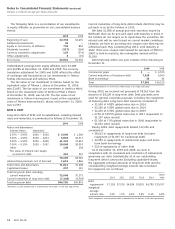

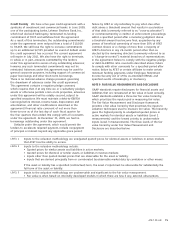

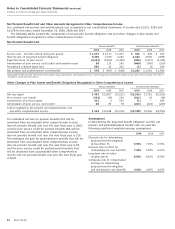

NOTE 5. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment is summarized as follows at

December 31:

Lives (years) 2009 2008

Land — $ 1,724 $ 1,730

Buildings 35-45 24,271 23,372

Central office equipment 3-10 78,314 75,054

Cable, wiring and conduit 10-50 74,325 72,109

Other equipment 5-15 39,918 34,434

Software 3-5 8,841 8,348

Under construction — 3,159 3,532

230,552 218,579

Accumulated depreciation

and amortization 130,459 119,491

Property, plant and

equipment – net $100,093 $ 99,088

Our depreciation expense was $15,959 in 2009, $15,313 in

2008 and $15,625 in 2007.

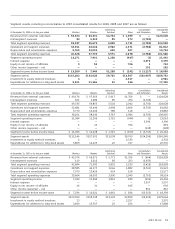

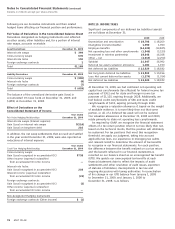

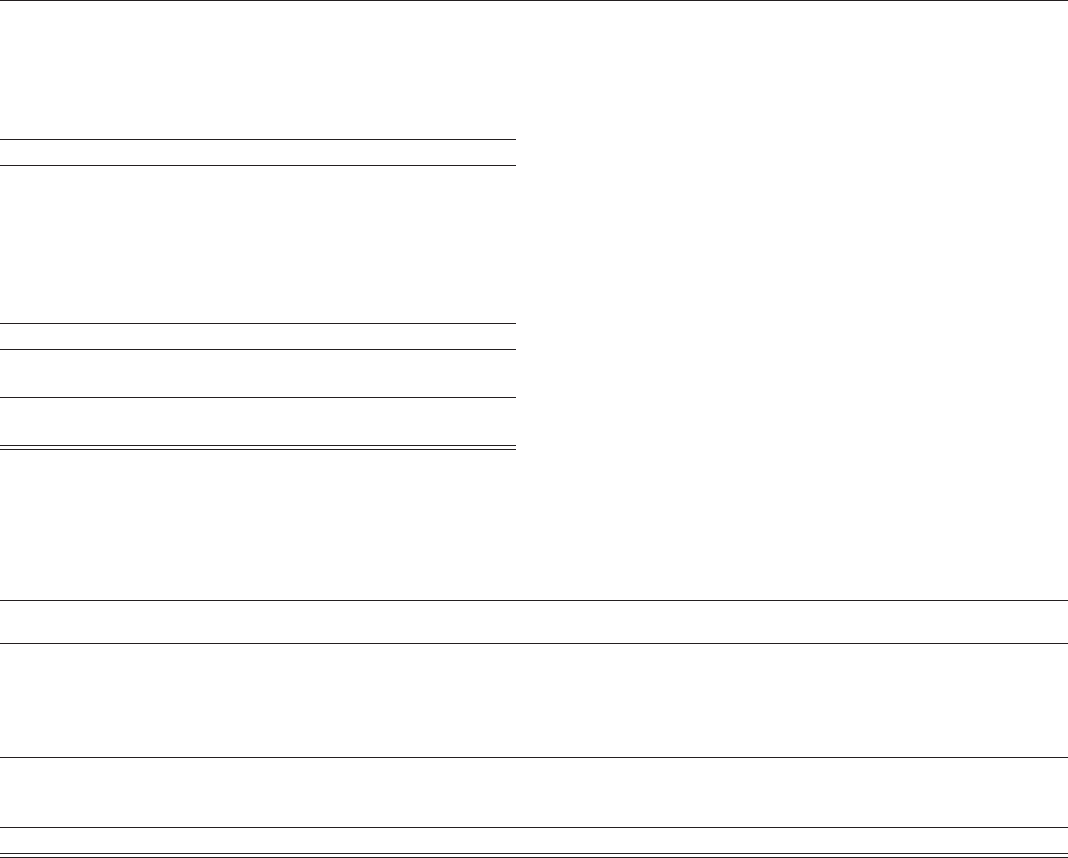

NOTE 6. GOODWILL AND OTHER INTANGIBLE ASSETS

Changes in the carrying amounts of goodwill, by segment, for the years ended December 31, 2009 and 2008, are as follows:

Advertising

Wireless Wireline Solutions Other Total

Balance as of January 1, 2008 $ 32,713 $ 31,301 $ 5,788 $ 911 $ 70,713

Goodwill acquired 264 185 — — 449

Goodwill adjustments for prior-year acquisitions

and tax adjustments 990 (95) (26) — 869

Other (116) (10) (68) (8) (202)

Balance as of December 31, 2008 33,851 31,381 5,694 903 71,829

Goodwill acquired 1,276 344 36 — 1,656

Other (90) (117) 1 (20) (226)

Balance as of December 31, 2009 $35,037 $31,608 $5,731 $883 $73,259

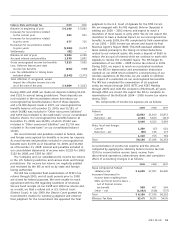

or wireless FCC licenses in 2009 and 2008. Goodwill in the

Other segment as of January 1, 2008, is net of a $1,791

impairment that was recognized in a prior period. We review

other long-lived assets for impairment whenever events or

circumstances indicate that the carrying amount may not

be recoverable over the remaining life of the asset or

asset group.

Goodwill acquired relates primarily to the acquisition of

Centennial and a provider of mobile application solutions

(see Note 2). Changes to goodwill include adjustments

totaling $90 related to wireless liabilities in connection with

a business combination and disposition of a wireline entity

for $117 in 2009.

Goodwill and wireless FCC licenses are not amortized but

tested annually as of October 1 for impairment as required

by GAAP. The carrying amounts of goodwill, by segment

(which is the same as reporting unit for Wireless, Wireline and

Advertising Solutions), at December 31, 2009 were Wireless

$35,037; Wireline $31,608; Advertising Solutions $5,731;

and Other $883 and at December 31, 2008 were Wireless

$33,851; Wireline $31,381; Advertising Solutions $5,694; and

Other $903. Within the Other segment, goodwill associated

with our Sterling operations was $477 for 2009 and 2008.

Additionally, FCC licenses are tested for impairment on an

aggregate basis, consistent with the management of the

business on a national scope. These annual impairment

tests resulted in no impairment of indefinite-lived goodwill