AT&T Wireless 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T 09 AR 73

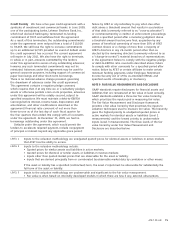

NOTE 7. EQUITY METHOD INVESTMENTS

Investments in partnerships, joint ventures and less-than-

majority-owned subsidiaries in which we have significant

influence are accounted for under the equity method.

Our investments in equity affiliates include primarily

international investments. As of December 31, 2009, our

investments in equity affiliates included a 9.8% interest in

Télefonos de México, S.A. de C.V. (Telmex), Mexico’s national

telecommunications company, and an 8.8% interest in

América Móvil S.A. de C.V. (América Móvil), primarily a wireless

provider in Mexico with telecommunications investments in

the United States and Latin America. In 2007, Telmex’s Board

of Directors and shareholders approved a strategic initiative

to split off its Latin American businesses and its Mexican

yellow pages business to a new holding company, Telmex

Internacional, S.A.B. de C.V. (Telmex Internacional).

Our investment in Telmex Internacional is 9.9%. We are a

member of a consortium that holds all of the class AA shares

of Telmex stock, representing voting control of the company.

Another member of the consortium, Carso Global Telecom,

S.A. de C.V. (CGT), has the right to appoint a majority of the

directors of Telmex. We also are a member of a consortium

that holds all of the class AA shares of América Móvil stock,

representing voting control of the company. Another member

of the consortium has the right to appoint a majority of the

directors of América Móvil. On January 13, 2010, América

Móvil announced that its Board of Directors had authorized it

to submit an offer for 100% of the equity of CGT, a holding

company that owns 59.4% of Telmex and 60.7% of Telmex

Internacional, in exchange for América Móvil shares; and an

offer for Telmex Internacional shares not owned by CGT, to be

purchased for cash or to be exchanged for América Móvil

shares, at the election of the shareholders.

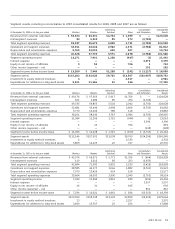

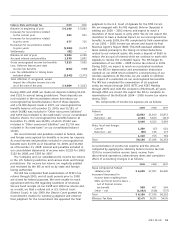

Amortized intangible assets are definite-life assets, and as

such, we record amortization expense based on a method that

most appropriately reflects our expected cash flows from

these assets with a weighted-average amortization period of

8.1 years (8.0 years for customer lists and relationships and

9.6 years for other). Amortization expense for definite-life

intangible assets was $3,755 for the year ended December

31, 2009, $4,570 for the year ended December 31, 2008, and

$5,952 for the year ended December 31, 2007. Amortization

expense is estimated to be $2,977 in 2010, $1,994 in 2011,

$1,315 in 2012, $730 in 2013 and $346 in 2014. In 2009,

Mobility wrote off $4,889 in fully amortized intangible assets

(primarily customer lists).

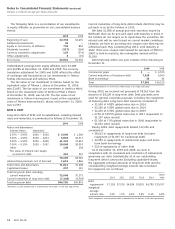

Licenses include wireless FCC licenses of $48,650 at

December 31, 2009, and $47,267 at December 31, 2008,

that provide us with the exclusive right to utilize certain radio

frequency spectrum to provide wireless communications

services. While FCC licenses are issued for a fixed time, renewals

of FCC licenses have occurred routinely and at nominal cost.

Moreover, we have determined that there are currently no legal,

regulatory, contractual, competitive, economic or other factors

that limit the useful lives of our FCC licenses and therefore

we treat the FCC licenses as indefinite-lived intangible assets.

In 2009, we recorded an immaterial $18 impairment to

wireline licenses we no longer plan to use.

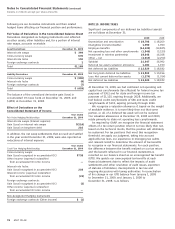

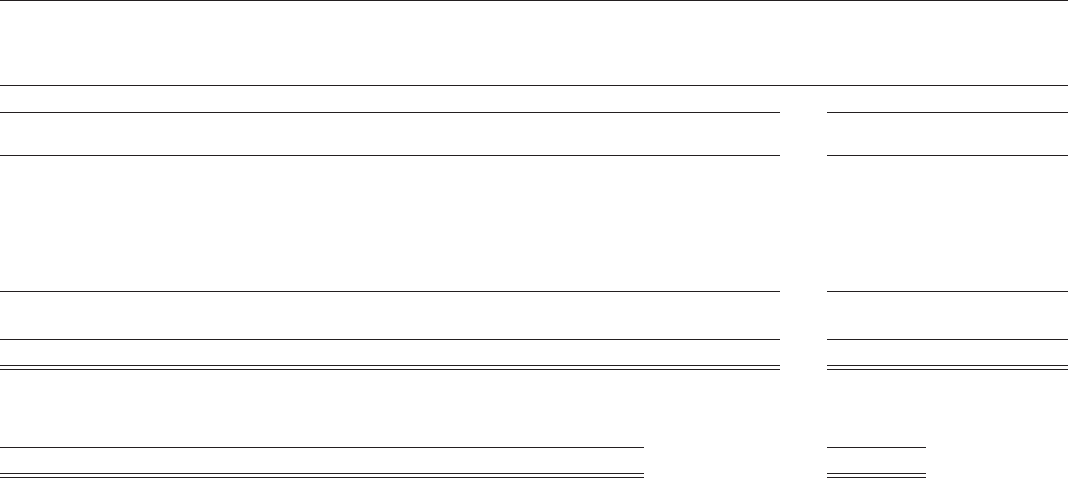

Our other intangible assets are summarized as follows:

December 31, 2009 December 31, 2008

Gross Carrying Accumulated Gross Carrying Accumulated

Other Intangible Assets Amount Amortization Amount Amortization

Amortized intangible assets:

Customer lists and relationships:

AT&T Mobility $ 5,804 $ 3,097 $10,429 $ 6,409

BellSouth 9,215 5,597 9,215 4,062

ATTC 3,134 2,377 3,100 2,038

Other 926 588 788 441

Subtotal 19,079 11,659 23,532 12,950

Other 1,176 767 1,724 1,130

Total $20,255 $12,426 $25,256 $14,080

Indefinite-life intangible assets not subject to amortization:

Licenses $48,759 $47,306

Trade name 5,235 5,230

Total $53,994 $52,536