AT&T Wireless 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

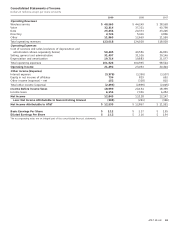

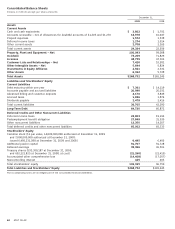

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

50 AT&T 09 AR

expectation that regulatory and legislative decisions relating

to the telecom sector will continue to be sensitive to

investment.

Cash Used in or Provided by Financing Activities

We paid dividends of $9,670 in 2009, $9,507 in 2008 and

$8,743 in 2007, reflecting dividend rate increases. In

December 2009, our Board of Directors approved a 2.4%

increase in the quarterly dividend from $0.41 to $0.42 per

share. This follows a 2.5% dividend increase approved by

AT&T’s Board in December 2008. Dividends declared by our

Board of Directors totaled $1.65 per share in 2009, $1.61 per

share in 2008 and $1.47 per share in 2007. Our dividend

policy considers both the expectations and requirements of

stockholders, internal requirements of AT&T and long-term

growth opportunities. It is our intent to provide the financial

flexibility to allow our Board of Directors to consider dividend

growth and to recommend an increase in dividends to be paid

in future periods. All dividends remain subject to approval by

our Board of Directors.

During 2009, we received net proceeds of $8,161 from the

issuance of $8,228 in long-term debt. Debt proceeds were

used for general corporate purposes, including the repayment

of maturing debt. Long-term debt issuances consisted of:

• $1,000of4.85%globalnotesduein2014.

• $2,250of5.80%globalnotesduein2019.

• $2,250of6.55%globalnotesduein2039.

• £750of5.875%globalnotesduein2017(equivalentto

$1,107 when issued).

• £1,100of7.0%globalnotesduein2040(equivalentto

$1,621 when issued).

We entered into cross-currency swaps to exchange the

above foreign currency proceeds and the future principal and

interest payments to U.S. dollars.

During 2009, debt repayments totaled $13,236 and

consisted of:

• $8,633inrepaymentsoflong-termdebt(includes

repayment of $1,957 for Centennial debt).

• $4,583inrepaymentsofcommercialpaperandshort-

term bank borrowings.

• $20inrepaymentsofotherdebt.

At December 31, 2009, we had $7,361 of debt maturing

within one year, which included $7,328 of long-term debt

maturities and $33 of other borrowings. Debt maturing within

one year includes the following notes that may be put back to

us by the holders:

• $1,000ofannualputresetsecuritiesissuedbyBellSouth

Corporation can be put each April until maturity in 2021.

• Anaccretingzero-couponnotemayberedeemedeach

May, excluding May 2011, until maturity in 2022. If the

zero-couponnote(issuedforprincipalof$500in2007)

is held to maturity, the redemption amount will be

$1,030.

We have a five-year credit agreement with a syndicate of

The decrease in current tax payments was partially offset

by an increase in audit-related payments in 2009.

We anticipate using approximately $2,350 of cash in 2010

tocompletetheacquisitionofvariousassetsfromVerizon

that it was required to divest as part of its acquisition

of Alltel.

During 2008, our primary source of funds was cash from

operating activities of $33,656 compared to $34,242 in 2007.

Operating cash flows decreased primarily due to increased

tax payments of $1,294 partially offset by improvement in

operating income excluding depreciation. During 2008, tax

payments were higher primarily due to increased income.

Cash Used in or Provided by Investing Activities

During 2009, cash used in investing activities consisted of:

• $16,595incapitalexpenditures,excludinginterestduring

construction.

• $740ininterestduringconstruction.

• $787,netofcashacquired,relatedtotheacquisitionof

Centennial.

• $111relatedtospectrumandlicenses.

• $85relatedtootheracquisitions.

During 2009, cash provided by investing activities consisted of:

• $287fromdispositionsofnon-strategicassets.

• $55fromthesaleofsecurities,netofinvestments.

• $51relatedtootheractivities.

Our capital expenditures are primarily for our wireless

and wireline subsidiaries’ networks, our U-verse services, and

support systems for our communications services. Total capital

spending in 2009 was $16,595, which was a $3,081 decrease

from 2008. Capital spending in our Wireless segment,

excluding interest during construction, only increased 1%

for 2009; the modest increase in capital spending reflected a

6% increase in network expenditures, tempered by reductions

in non-network spending. Expenditures were used for network

capacity growth, integration and upgrades to our Universal

Mobile Telecommunications System/High-Speed Packet Access

network, as well as for IT and other support systems for our

wireless service. Capital expenditures in our Wireline segment,

excluding interest during construction, which represented

64.3% of our capital expenditures, decreased 21% for 2009,

reflecting decreased spending on U-verse services as the

upgrades to our existing network become more mature. In

addition, capital expenditures decreased due to less spending

on wireline voice services, and lower DSL and High Capacity

volumes. The Other segment capital expenditures were less

than 2% of total capital expenditures for 2009. Included in

the Other segment are equity investments, which should be

self funding as they are not direct AT&T operations; as well

as corporate, diversified business and Sterling operations,

which we expect to fund using cash from operations.

We expect to fund any Advertising Solutions segment

capital expenditures using cash from operations. We expect

total 2010 capital investment to be in the $18 billion to

$19 billion range. This level of investment is framed by the