AT&T Wireless 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

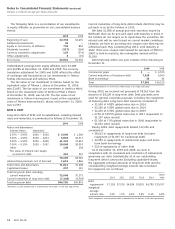

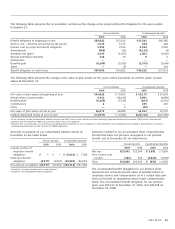

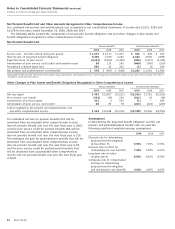

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

76 AT&T 09 AR

At the end of the first quarter of 2009 and at the end of

2008, we concluded that the severity in the decline in market

values of these assets had led to an other-than-temporary

impairment, writing them down $102 in 2009 and $332 in

2008, and recording the amount in Other Income (Expense).

Our short-term investments, other short-term and

long-term held-to-maturity investments (including money

market securities) and customer deposits are recorded at

amortized cost, and the respective carrying amounts

approximate fair values.

Our investment securities maturing within one year are

recorded in “Other current assets,” and instruments with

maturities of more than one year are recorded in “Other

Assets” on the consolidated balance sheets.

Derivative Financial Instruments

We employ derivatives to manage certain market risks,

primarily interest rate risk and foreign currency exchange risk.

This includes the use of interest rate swaps, interest rate

locks, foreign exchange forward contracts and combined

interest rate foreign exchange contracts (cross-currency

swaps). We do not use derivatives for trading or speculative

purposes. We record derivatives on our consolidated balance

sheets at fair value (all of our derivatives are Level 2).

Cash flows associated with derivative instruments are

presented in the same category on the consolidated

statements of cash flows as the item being hedged.

The majority of our derivatives are designated as either

a hedge of the fair value of a recognized asset or liability

or of an unrecognized firm commitment (fair value hedge),

or a hedge of a forecasted transaction or of the variability

of cash flows to be received or paid related to a recognized

asset or liability (cash flow hedge). Only a portion of our

foreign exchange forward contracts are not designated to

receive hedge accounting.

Fair Value Hedging We designate our fixed-to-floating

interest rate swaps as fair value hedges. The purpose of these

swaps is to manage interest rate risk by managing our mix

of fixed-rate and floating-rate debt. These swaps involve

the receipt of fixed rate amounts for floating interest rate

payments over the life of the swaps without exchange of the

underlying principal amount. Accrued and realized gains or

losses from interest rate swaps impact interest expense on

the consolidated statements of income. Unrealized gains on

interest rate swaps are recorded at fair market value as assets,

and unrealized losses on interest rate swaps are recorded at

fair market value as liabilities. We record changes in the fair

value of the swaps, along with the changes in the fair value of

the hedged asset or liability that is attributable to the hedged

risk. Changes in the fair value of the interest rate swaps offset

changes in the fair value of the fixed-rate notes payable they

hedge due to changes in the designated benchmark interest

rate and are recognized in interest expense, though they net

to zero. Realized gains or losses upon early termination of our

fair value hedges would be recognized in interest expense.

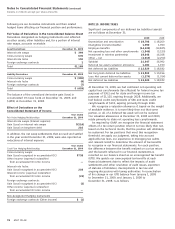

The asset’s or liability’s fair value measurement level with the

fair value hierarchy is based on the lowest level of any input

that is significant to the fair value measurement. Valuation

techniques used need to maximize the use of observable

inputs and minimize the use of unobservable inputs.

The valuation methodologies described above may produce

a fair value calculation that may not be indicative of net

realizable value or reflective of future fair values. AT&T

believes its valuation methods are appropriate and consistent

with other market participants. The use of different method-

ologies or assumptions to determine the fair value of certain

financial instruments could result in a different fair value

measurement at the reporting date. There have been no

changes in the methodologies used at December 31, 2009

and 2008. See Note 11 for disclosures relating to pension

and other postemployment benefits.

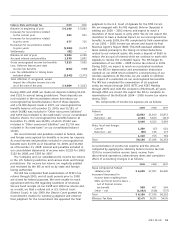

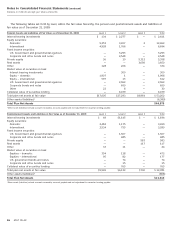

Long-Term Debt and Other Financial Instruments

The carrying amounts and estimated fair values of our

long-term debt, including current maturities and other

financial instruments, are summarized as follows at

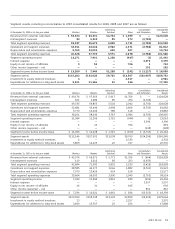

December 31:

2009 2008

Carrying Fair Carrying Fair

Amount Value Amount Value

Notes and debentures $71,811 $75,212 $70,208 $70,955

Commercial paper — — 4,575 4,575

Bank borrowings 33 33 41 41

Available-for-sale

securities 1,885 1,885 1,632 1,632

The fair values of our notes and debentures were estimated

based on quoted market prices, where available, or on the

net present value method of expected future cash flows

using current interest rates. The carrying value of debt with

an original maturity of less than one year approximates

market value.

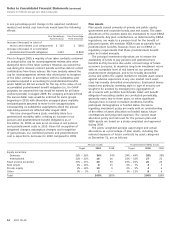

Investment Securities

Our investment securities consist of available-for-sale

instruments which include $1,574 of equities, $226 in

government fixed income bonds and $85 of other securities.

Substantially all of our available-for-sale securities are Level 1

and Level 2. Realized gains and losses on these securities are

included in “Other income (expense) – net” in the consolidated

statements of income using the specific identification method.

Unrealized gains and losses, net of tax, on available-for-sale

securities are recorded in accumulated other comprehensive

income (accumulated OCI). Unrealized losses that are

considered other than temporary are recorded in other

income (expense) – net, with the corresponding reduction

to the carrying basis of the investment.