AT&T Wireless 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

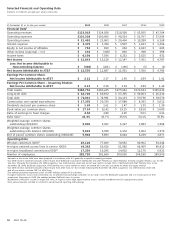

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

36 AT&T 09 AR

higher commission rates. Interconnect and other costs also

increased by $141 due to increased usage and integration

costs related to the 2007 acquisition of Dobson. The increase

in reseller costs in 2008 was attributable to higher license,

maintenance and other reseller costs, partially offset by cost

reductions from the migration of network usage from the

T-Mobile USA (T-Mobile) network in California and Nevada

to our networks in these states.

These increases were partially offset by incollect roaming

cost decreases of $249 and network system cost decreases

of $132. The decrease in network system costs was the

result of benefits from network and systems integration

and cost-reduction initiatives of $218, decreases in data

processing and payroll costs of $109, partially offset by

incremental rents related to Dobson and general building

expense increases of $124, and hurricane and other

incremental network cost increases of $99.

Depreciation and amortization decreased $5, or 0.1%, in

2009 and decreased $1,309, or 18.5%, in 2008. Amortization

expense decreased $450, or 21.8%, in 2009 due to lower

amortization of intangibles attributable to the BellSouth

acquisition, partially offset by amortization of intangible assets

attrib utable to subscribers added in the November 2009

acquisition of Centennial and the 2007 acquisition of Dobson.

Deprec iation expense increased $445, or 12.0%, in 2009 due

to ongoing capital spending for network upgrades and

expan sion, partially offset by certain network assets becoming

fully depreciated.

Depreciation expense decreased $539, or 12.7%, in 2008.

Depreciation expense decreased $695 in 2008 due to certain

network assets becoming fully depreciated and decreased

$612 due to Time Division Multiple Access (TDMA) assets

being depreciated on an accelerated basis through 2007.

These decreases were partly offset by incremental depre-

ciation on capital assets placed in service during 2008.

Amortization expense decreased $770, or 27.2%, in 2008

due to declining amortization of identified intangible assets,

most of which are amortized using the sum-of-the-months-

digits method of amortization, partially offset by Dobson

intangible assets acquired by AT&T Mobility.

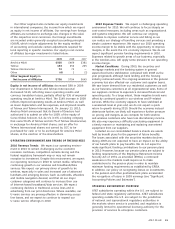

Operations and support expenses increased $2,080, or

6.4%, in 2009, compared to an increase of $3,896, or 13.6%, in

2008. The increase in 2009 was primarily due to the following:

• equipmentcostincreasesof$1,246,reflectingthehigher

cost of acquiring more advanced integrated devices

compared to prior periods;

• Interconnect,universalservicefee(USF)andreseller

expense increases of $426 due to higher network traffic

and revenue growth;

• upgradecommissionsandresidualexpenseincreasesof

$313 due to sales and upgrades to more advanced

devices;

• customerservicecostincreasesof$214duetocustomer

growth; and

• Finance,IT,andotheradministrativecostincreasesof

$306.

These increases were partially offset by selling expense

decreases of $337, attributable to lower traditional handset

sales exceeding the impact of the sale of more advanced

integrated devices and roaming expense decreases of $165

due to usage and rate declines. Total equipment costs

continue to be higher than equipment revenues due to the

sale of discounted devices in connection with promotions.

The increase in 2008 was primarily due to the following:

• equipmentsalesexpenseincreaseof$2,005;

• upgradecommissionsandresidualexpenseincreases

of $745;

• sellingexpenseincreaseof$362andcustomerservice

cost increase of $159;

• USFincreaseof$204andresellerexpenseincreaseof

$145; and

• Finance,IT,andotheradministrativecostincreases

of $538.

The increase in equipment sales expense, commission

expense, and selling expense resulted from an increase in

sales of higher-cost 3G devices, the introduction of Apple

iPhone 3G handsets in 2008, an increase in the number of

handset accessory sales, lower per-unit accessory costs

compared to 2007, and higher handset upgrade volume.

The increase in commission expense is also attributable to

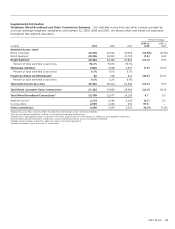

Wireless Supplementary Operating and Financial Data

Percent Change

2009 vs. 2008 vs.

2009 2008 2007 2008 2007

Wireless Customers (000) 85,120 77,009 70,052 10.5% 9.9%

Net Customer Additions (000) 7,278 6,699 7,315 8.6 (8.4)

Total Churn 1.48% 1.68% 1.67% (20) bps 1 bps

Postpaid Customers (000) 65,146 60,098 55,310 8.4% 8.7%

Net Postpaid Customer Additions (000) 4,323 4,634 3,982 (6.7) 16.4

Postpaid Churn 1.16% 1.19% 1.27% (3) bps (8) bps