AT&T Wireless 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

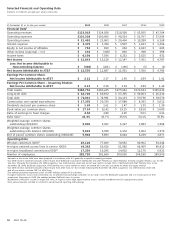

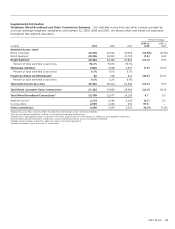

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

38 AT&T 09 AR

utilities on all buildings; credit and collection functions; and

corporate support costs, such as finance, legal, human

resources and external affairs. Pension and postretirement

costs, net of amounts capitalized are also included to the

extent that they are associated with these employees.

The 2009 decrease was primarily due to lower employee-

related costs of $918, primarily related to workforce

reductions. Other cost reductions included decreases in traffic

compensation (related to lower international long-distance

revenues and lower volume of calls from our declining

national mass-market customer base), including portal fees,

of $655, nonemployee-related expenses, such as bad debt

expense, materials and supplies costs, of $441 and $134

related to contract services.

Partially offsetting these decreases was an increase in

pension/OPEB expense of $1,370 due to a lower-than-

expected return on assets and an increase in amortization

of actuarial losses, both primarily from investment losses

in 2008. See Note 11 for more information related to

pension/OPEB expense.

The major decreases in 2008 were $633 in traffic

compensation (related to lower international long-distance

revenue, and lower volume of calls from our declining

national mass-market customer base), including portal fees,

and $618 of pension/OPEB expense. Other cost reductions

included decreases in other support cost of $616 primarily

due to higher advertising costs incurred in 2007 for brand

advertising and rebranding related to the BellSouth acquisition

and lower compensation expense of $420 reflecting shifts of

workforce levels to sales organizations.

Partially offsetting these decreases, operation and support

expenses increased by $1,135, related to higher nonemployee-

related expenses, such as contract services, agent commissions

and materials and supplies. Other increases were salary and

wages of $423; and higher cost of equipment sales and

related U-verse network integration of $60.

Depreciation and amortization expenses decreased

$113, or 0.9%, in 2009 and $210, or 1.6%, in 2008. The 2009

decrease was primarily related to lower amortization of

intangibles for the customer lists associated with ATTC,

BellSouth and Yahoo! partially offset by the inclusion of

Centennial related depreciation starting in the fourth quarter

of 2009. The 2008 decline was a result of decreasing intangible

amortization partially offsetting increased depreciation

resulting from capital additions.

IP data revenues increased $1,969, or 17.8%, in 2009 and

increased $1,537, or 16.1%, in 2008 primarily driven by AT&T

U-verse expansion and growth in IP-based strategic business

services, which include Ethernet, virtual private networks

(VPN), application and managed services. Strategic business

service revenues increased $603 in 2009 and $741 in 2008,

driven mostly by VPN, and U-verse video service increased

$980 in 2009 and $402 in 2008. Broadband high-speed

Internet access increased IP data revenues $300 in 2009 and

$497 in 2008. The increase in IP data revenues in 2009 and

2008 reflects continued growth in the customer base and

migration from other traditional circuit-based services.

Traditional packet-switched data services, which include

frame relay and asynchronous transfer mode services,

decreased $536, or 20.8%, in 2009 and $423, or 14.1%, in

2008. This decrease is primarily due to lower demand as

customers continue to shift to IP-based technology such as

VPN, DSL and managed Internet services, and the continuing

economic recession. We expect these traditional, circuit-based

services to continue to decline as a percentage of our overall

data revenues.

Other operating revenues decreased $439, or 7.0%, in

2009 and increased $426, or 7.2%, in 2008. Major items

included are integration services and customer premises

equipment, government-related services and outsourcing,

which account for more than 60% of total revenue for all

periods. Equipment sales and related network integration

revenues decreased $405 in 2009 primarily due to

economic pressures, and increased $260 in 2008, driven

by an increase in management services partially offset by

reduced equipment sales and related network integration.

Governmental profes sional services revenue decreased

$116 in 2009 driven by the divestiture of a professional

services business in 2009 and increased $100 in 2008

driven by growth across various contracts.

Operations and support expenses decreased $794, or

1.7%, in 2009 and $737, or 1.6 %, in 2008. Operations and

support expenses consist of costs incurred to provide our

products and services, including costs of operating and

maintaining our networks and personnel costs, such as salary,

wage and bonus accruals. Costs in this category include our

repair technicians and repair services, certain network

planning and engineering expenses, operator services,

information technology and property taxes. Operations and

support expenses also include bad debt expense; advertising

costs; sales and marketing functions, including customer

service centers; real estate costs, including maintenance and