AT&T Wireless 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T 09 AR 35

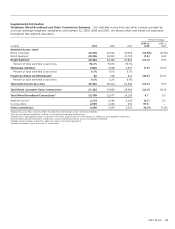

rate for postpaid customers was 1.16% for 2009 and 1.19%

for 2008, down from 1.27% for 2007. The decline in postpaid

churn reflects network enhancements and broader coverage,

more affordable rate plans and exclusive devices, and free

mobile-to-mobile calling among our wireless customers.

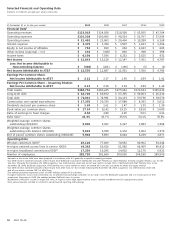

Wireless Operating Results

Our Wireless segment operating income margin was 24.8%

in 2009, 22.5% in 2008 and 16.4% in 2007. The higher margin

in 2009 was primarily due to revenue growth of $4,262, while

the higher margin in 2008 was primarily due to revenue

growth of $6,651. Each revenue increase exceeded the

corresponding operating expense increase of $2,075 in 2009

and $2,587 in 2008. The expense increase for 2008 is net of

a decrease in depreciation and amortization of $1,309.

Service revenues are comprised of local voice and data

services, roaming, long-distance and other revenue. Service

revenues increased $4,247, or 9.6%, in 2009 and $5,732, or

14.8%, in 2008. The increases consisted of the following:

• Dataservicerevenueincreasesof$3,539,or33.4%,in

2009 and $3,647, or 52.5%, in 2008. The increases were

primarily due to the increased number of subscribers and

heavier usage by subscribers of advanced handsets and

other data-centric emerging devices, such as netbooks,

eReaders, and mobile navigation devices. The increases

in data service ARPU of 22.0% in 2009 and 33.8% in

2008 reflect this trend. Our significant data growth also

reflects an increased number of subscribers using our

3Gnetwork.Dataservicerevenuesrepresentedapproxi-

mately 29.0% and 23.9% of our Wireless segment service

revenues in 2009 and 2008.

• Voiceandotherservicerevenueincreasesof$708,or

2.1%, in 2009 and $2,085, or 6.6%, in 2008. The increase

in 2009 was due to a 9.4% increase in the average number

ofwirelesscustomers,downfrom14.0%in2008.Voice

and other service ARPU declined 6.7% in 2009 and 6.5%

in 2008.

Equipment revenues increased $15, or 0.3%, in 2009 and

increased $919, or 22.9%, in 2008. The lower incremental

increase in 2009 was due to lower traditional handset sales,

offset by sales of more advanced integrated devices. The

increase in 2008 was due to higher handset revenues,

reflecting higher gross customer additions, and customer

upgrades to more advanced devices.

As the wireless industry continues to mature, we believe

that future wireless growth will become increasingly depen-

dent on our ability to offer innovative services, which will

encourage existing customers to upgrade their current

services and devices and will attract customers from other

providers, as well as on our ability to minimize customer

churn. Average service revenue per user (ARPU) in 2009 was

flat compared to 2008 after increasing 1% in 2008 compared

to 2007 primarily due to increased data services ARPU growth

offsetting declining voice and other service ARPU. ARPU

from postpaid customers increased 2.7% in 2009 and 3.7%

in 2008, reflecting usage of more advanced handsets, such

as Apple iPhone 3GS, by these customers, evidenced by a

23.5% increase in postpaid data services ARPU in 2009 and

a 36.4% increase in postpaid data services ARPU in 2008.

The continued increase in postpaid data services revenue was

related to increased use of text messaging, Internet access,

e-mail and other data services. We expect continued growth

from data services, as more customers purchase advanced

integrated devices and other emerging devices, such as

netbooks, eReaders, and mobile navigation devices, and

broadband laptop cards, and as we continue to expand our

network. The growth in data services ARPU in 2009 was offset

by a 6.7% decline in voice ARPU and the growth in data

services ARPU in 2008 was partially offset by a 6.5% decline

invoiceandotherserviceARPU.Voiceandotherservice

ARPU in 2009 and 2008 declined due to lower access

charges, roaming revenues, and long-distance usage. Increases

in our FamilyTalk® and reseller customer base, which have

lower ARPU than traditional postpaid customers, have also

contributed to these declines. For 2009, roaming revenues

were lower due to a decline in domestic roaming activity.

For 2008, roaming revenues were lower due to acquisitions

and rate negotiations as part of roaming cost savings

initiatives, which slowed international growth, and lower

regulatory cost recovery charges. We expect continued

pressure on voice and other service ARPU.

The effective management of customer churn is also

critical to our ability to maximize revenue growth and to

maintain and improve margins. Customer churn is calculated

by dividing the aggregate number of wireless customers who

cancel service during each month in a period by the total

number of wireless customers at the beginning of each month

in that period. Our customer churn rate was 1.48% for 2009,

down from 1.68% for 2008 and 1.67% for 2007. The churn