AT&T Wireless 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

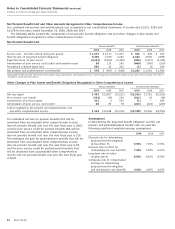

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

80 AT&T 09 AR

For both wage and pension band increases, there is a

potential cost-of-living increase based on the Consumer

Price Index for the third year. These agreements also

provide for continued health care coverage with reasonable

cost sharing.

For the remaining approximately 26,000 employees, the

agreement provides for a four-year term with provisions

substantially similar to the provisions of the ratified

agreements discussed above, with a wage increase in year

four of 2.75 percent and a potential cost-of-living increase

in year four instead of in year three.

On February 8, 2010, the Company and the CWA

announced a tentative agreement covering approximately

30,000 core wireline employees in the nine-state former

BellSouth region, subject to ratification by those covered

employees. The tentative agreement provides for a three-year

term and, for the vast majority of those covered employees,

a 3 percent wage increase in years one and two, a wage

increase in year three of 2.75 percent, and pension band

increases of 2 percent for each year of the agreement.

These agreements also provide for continued health care

coverage with reasonable cost sharing.

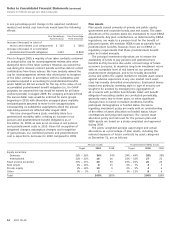

In August 2009, retirees were informed of medical and

drug coverage changes. In addition, we adopted changes to

our pension plans consistent with the Pension Protection

Act of 2006 (PPA). Because of these modifications, our

amortization of prior service (benefit) cost also changed,

reducing costs by $128 in the third quarter of 2009. In the

fourth quarter of 2009, our pension and postretirement costs

have decreased, which is consistent with reductions that

began in August 2009. These modifications will decrease

costs in 2010.

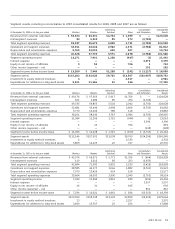

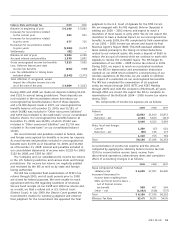

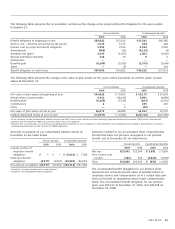

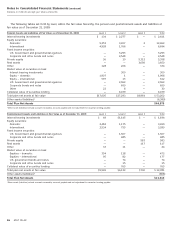

Obligations and Funded Status

For defined benefit pension plans, the benefit obligation is

the “projected benefit obligation,” the actuarial present value,

as of our December 31 measurement date, of all benefits

attributed by the pension benefit formula to employee service

rendered to that date. The amount of benefit to be paid

depends on a number of future events incorporated into the

pension benefit formula, including estimates of the average

life of employees/survivors and average years of service

rendered. It is measured based on assumptions concerning

future interest rates and future employee compensation levels.

For postretirement benefit plans, the benefit obligation

is the “accumulated postretirement benefit obligation,” the

actuarial present value as of a date of all future benefits

attributed under the terms of the postretirement benefit plan

to employee service rendered to the valuations date.

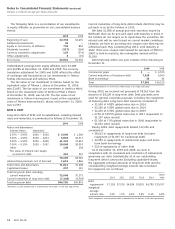

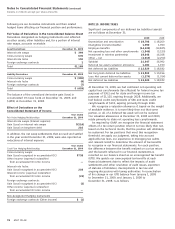

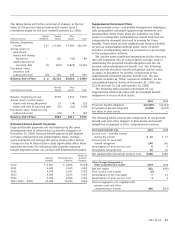

NOTE 11. PENSION AND POSTRETIREMENT BENEFITS

Pension Benefits and Postretirement Benefits

Substantially all of our U.S. employees are covered by one of

our noncontributory pension and death benefit plans. Many of

our management employees participate in pension plans that

have a traditional pension formula (i.e., a stated percentage

of employees’ adjusted career income) and a frozen cash

balance or defined lump sum formula. In 2005, the

management pension plan for those employees was amended

to freeze benefit accruals previously earned under a cash

balance formula. Each employee’s existing cash balance

continues to earn interest at a variable annual rate. After this

change, those management employees, at retirement, may

elect to receive the portion of their pension benefit derived

under the cash balance or defined lump sum as a lump sum

or an annuity. The remaining pension benefit, if any, will be

paid as an annuity if its value exceeds a stated monthly

amount. Management employees of former ATTC, BellSouth,

AT&T Mobility and new hires after 2006 participate in cash

balance pension plans. Nonmanagement employees’ pension

benefits are generally calculated using one of two formulas:

benefits are based on a flat dollar amount per year according

to job classification or are calculated under a cash balance

plan that is based on an initial cash balance amount and

a negotiated annual pension band and interest credits.

Most nonmanagement employees can elect to receive their

pension benefits in either a lump sum payment or an annuity.

We also provide a variety of medical, dental and life

insurance benefits to certain retired employees under various

plans and accrue actuarially determined postretirement

benefit costs as active employees earn these benefits.

On December 31, 2009, the AT&T Pension Plan and the

Cingular Wireless Pension Plan were merged into the AT&T

Puerto Rico Pension Benefit Plan. At November 1, 2008,

BellSouth pension plans and U.S. Domestic ATTC bargained

employees were merged into the AT&T Pension Benefit Plan.

At December 31, 2007, defined benefit pension plans formerly

sponsored by Ameritech Publishing Ventures and AT&T

Mobility were merged in the AT&T Pension Benefit Plan.

During 2009, union contracts covering 120,000 collectively

bargained wireline employees expired. As of January 31, 2010,

86,000 employees covered by these expired collectively

bargained wireline contracts have ratified new labor contracts.

In the absence of an effective contract, the union is entitled

to call a work stoppage.

For approximately 60,000 employees covered by these

ratified agreements, the agreements provide for a three-year

term and, for the vast majority of those covered employees,

a 3 percent wage increase in years one and two, a wage

increase in year three of 2.75 percent, and pension band

increases of 2 percent for each year of the agreement.