AT&T Wireless 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

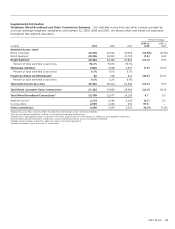

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

44 AT&T 09 AR

segment. However, we expect both losses of revenue share

in local service and gains resulting from business initiatives,

especially in the area of bundling of products and services,

including wireless and video, large-business data services

and broadband. In most markets, we compete with large

cable companies, such as Comcast Corporation, Cox

Communications, Inc. and Time Warner Cable Inc., for local,

high-speed Internet and video services customers and

other smaller telecommunications companies for both

long-distance and local services customers.

Our wireline subsidiaries generally remain subject to

regulation by state regulatory commissions for intrastate

services and by the FCC for interstate services. In contrast,

our competitors are often subject to less or no regulation in

providing comparable voice and data services or the extent

of regulation is in dispute. Under the Telecom Act, companies

seeking to interconnect to our wireline subsidiaries’ networks

and exchange local calls enter into interconnection agree-

ments with us. Any unresolved issues in negotiating those

agreements are subject to arbitration before the appropriate

state commission. These agreements (whether fully agreed-

upon or arbitrated) are then subject to review and approval

by the appropriate state commission.

In a number of the states in which we operate as an ILEC,

state legislatures or the state public utility commissions have

concluded that the voice telecommunications market is

competitive and have allowed for greater pricing flexibility

for nonbasic residential retail services, including bundles,

promotions and new products and services. While it has been

a number of years since we have been allowed to raise local

service rates in certain states, some of these state actions

have been challenged by certain parties and are pending

court review.

In addition to these rates and service regulations noted

above, our wireline subsidiaries (excluding rural carrier

affiliates) operate under state-specific elective “price-cap

regulation” for retail services (also referred to as “alternative

regulation”) that was either legislatively enacted or authorized

by the appropriate state regulatory commission. Under

price-cap regulation, price caps are set for regulated services

and are not tied to the cost of providing the services or to

rate-of-return requirements. Price-cap rates may be subject

to or eligible for annual decreases or increases and also may

be eligible for deregulation or greater pricing flexibility if the

associated service is deemed competitive under some state

regulatory commission rules. Minimum customer service

standards may also be imposed and payments required

if we fail to meet the standards.

We continue to lose access lines due to competitors

(e.g., wireless, cable and VoIP providers) who can provide

comparable services at lower prices because they are not

subject to traditional telephone industry regulation (or the

The NPRM states that the proposed rules would apply

to all platforms over which broadband Internet access

services are provided, including mobile wireless broadband,

while recognizing that different platforms involve significantly

different technologies, market structures, patterns of

consumer usage and regulatory history. The comment

cycle on the NPRM concludes in the first quarter of 2010.

We are unable to determine the impact of this proceeding

on our operating results and financial condition at this time.

COMPETITION

Competition continues to increase for telecommunications

and information services. Technological advances have

expanded the types and uses of services and products

available. In addition, lack of or a reduced level of regulation

of comparable alternatives (e.g., cable, wireless and VoIP

providers) has lowered costs for these alternative communi-

cations service providers. As a result, we face heightened

competition as well as some new opportunities in significant

portions of our business.

Wireless

We face substantial and increasing competition in all aspects

of our wireless business. Under current FCC rules, six or

more PCS licensees, two cellular licensees and one or more

enhanced specialized mobile radio licensees may operate

in each of our service areas, which results in the potential

presence of multiple competitors. Our competitors are

principally three national (Verizon Wireless, Sprint Nextel Corp.

and T-Mobile) and a larger number of regional providers of

cellular, PCS and other wireless communications services.

More than 95% of the U.S. population lives in areas with

three mobile telephone operators and more than half the

population lives in areas with at least five competing carriers.

We may experience significant competition from companies

that provide similar services using other communications

technologies and services. While some of these technologies

and services are now operational, others are being developed

or may be developed in the future. We compete for customers

based principally on price, service offerings, call quality,

coverage area and customer service.

Wireline

Our wireline subsidiaries expect continued competitive

pressure in 2010 from multiple providers, including wireless,

cable and other VoIP providers, interexchange carriers

and resellers. In addition, economic pressures are forcing

cus tomers to terminate their traditional local wireline service

and substitute wireless and Internet-based services,

intensifying a pre-existing trend toward wireless and Internet

use. At this time, we are unable to quantify the effect of

competition on the industry as a whole or financially on this