AT&T Wireless 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

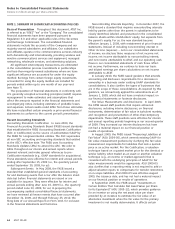

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

66 AT&T 09 AR

Employee Separations In accordance with GAAP, we

established obligations for expected termination benefits

provided under existing plans to former or inactive

employees after employment but before retirement.

These benefits include severance payments, workers’

compensation, disability, medical continuation coverage,

and other benefits. At December 31, 2009, we had

severance accruals of $676 and at December 31, 2008,

we had severance accruals of $752.

Split-Dollar Life Insurance In 2007, the EITF ratified the

consensus on new guidance related to the accounting for

endorsement split-dollar life insurance arrangements and

collateral assignment split-dollar life insurance arrangements.

The new guidance covers split-dollar life insurance

arrangements (where the company owns and controls the

policy) and provides that an employer should recognize a

liability for future benefits in accordance with GAAP standards

for an employer’s accounting for postretirement benefits

other than pensions. The new guidance became effective for

fiscal years that began after December 15, 2007 (i.e., as of

January 1, 2008, for us), and we recorded additional

postretirement liabilities of $101 and a decrease, net of

taxes, to retained earnings of $63.

Income Taxes We adopted GAAP standards for income

taxes, as amended, as of January 1, 2007. With our adoption

of those amended standards, we provide deferred income

taxes for temporary differences between the carrying amounts

of assets and liabilities for financial reporting purposes and

the computed tax basis of those assets and liabilities (per the

amended standards). Under the amended standards, the tax

basis of assets and liabilities are based on amounts that meet

the recognition threshold and are measured pursuant to the

measurement requirement in those standards. To the extent

allowed by GAAP, we provide valuation allowances against

the deferred tax assets for which the realization is uncertain.

We review these items regularly in light of changes in federal

and state tax laws and changes in our business.

We report, on a net basis, taxes imposed by governmental

authorities on revenue-producing transactions between us and

our customers in our consolidated statements of income.

Cash Equivalents Cash and cash equivalents include all

highly-liquid investments with original maturities of three

months or less, and the carrying amounts approximate fair

value. At December 31, 2009, we held $437 in cash and

$3,365 in money market funds and other cash equivalents.

Investment Securities See Note 9 for disclosures related

to our investment securities, including available-for-sale

securities.

Revenue Recognition Revenues derived from wireless,

local telephone, long-distance, data and video services are

recognized when services are provided. This is based upon

either usage (e.g., minutes of traffic processed), period of time

(e.g., monthly service fees) or other established fee schedules.

Software In October 2009, the FASB issued “Certain

Revenue Arrangements That Include Software Elements”

(ASU 2009-14), which clarifies the guidance for allocating

and measuring revenue, including how to identify software

that is out of the scope. ASU 2009-14 amends accounting

and reporting guidance for revenue arrangements involving

both tangible products and software that is “more than

incidental to the tangible product as a whole.” That type

of software and hardware will be outside of the scope of

software revenue guidance, and the hardware components

will also be outside of the scope of software revenue

guidance and may result in more revenue recognized at the

time of the hardware sale. Additional disclosures will discuss

allocation of revenue to products and services in our sales

arrangements and the significant judgments applied in the

revenue allocation method, including impacts on the timing

and amount of revenue recognition. ASU 2009-14 will be

effective prospectively for revenue arrangements entered

into or materially modified in fiscal years beginning on or

after June 15, 2010 (i.e., the year beginning January 1, 2011,

for us). ASU 2009-14 has the same effective date, including

early adoption provisions, as ASU 2009-13. Companies must

adopt ASU 2009-14 and ASU 2009-13 at the same time.

We are currently evaluating the impact on our financial

position and results of operations.

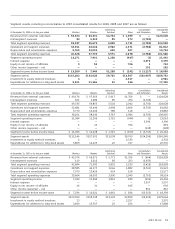

Valuation and Other Adjustments Included in the

current liabilities reported on our consolidated balance sheets

are acquisition-related accruals established prior to 2009.

The liabilities include accruals for severance, lease termi–

nations and equipment removal costs associated with our

acquisitions of AT&T Corp. (ATTC), BellSouth Corporation

(BellSouth), and Dobson Communications Corporation

(Dobson). Following is a summary of the accruals recorded

at December 31, 2008, cash payments made during 2009,

and the adjustments thereto:

12/31/08 Cash Adjustments 12/31/09

Balance Payments and Accruals Balance

Severance accruals

paid from:

Company funds $140 $(108) $ (26) $ 6

Pension and

postemployment

benefit plans 103 (5) — 98

Lease terminations1 387 (53) (122) 212

Equipment removal

and other

related costs 88 (38) (27) 23

Total $718 $(204) $(175) $339

1 Adjustments and accruals include a $106 reversal of BellSouth lease termination costs,

with an offset to goodwill.