AT&T Wireless 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T 09 AR 65

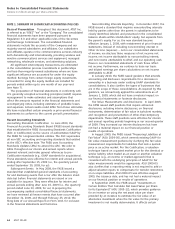

disclosures. We adopted the new guidance for the year ended

December 31, 2009. This guidance significantly increased the

amount of annual disclosures for plan assets in our annual

report, and it will increase our future interim disclosures in

that regard (see Note 11).

Business Combinations In December 2007, the FASB

amended GAAP for acquisitions, requiring that costs incurred

to effect the acquisition (i.e., acquisition-related costs) be

recognized separately from the acquisition. Under prior

guidance, restructuring costs that the acquirer expected but

was not obligated to incur, which included changes to benefit

plans, were recognized as if they were a liability assumed at

the acquisition date. Amended GAAP for acquisitions requires

the acquirer to recognize those costs separately from the

business combination. We adopted the new guidance as of

January 1, 2009, and applied it to acquisitions consummated

after 2008, including the Centennial Communications, Corp.

(Centennial) acquisition, as discussed in Note 2.

Equity Method Investments Accounting In November

2008, the Emerging Issues Task Force (EITF) reached a

consensus on new clarification guidance regarding the

application of the equity method. It states equity method

investments should be recognized using a cost accumulation

model. It also requires that equity method investments as

a whole be assessed for other-than-temporary impairment

in accordance with existing GAAP for equity method

investments. The new guidance was effective, on a

prospective basis, for initial or additional equity method

investments transactions and subsequent impairments

recognized in interim and annual periods that began on or

after December 15, 2008 (i.e., as of January 1, 2009, for us).

The new guidance did not have a material impact on our

financial position or results of operations.

Revenue Arrangements with Multiple Deliverables In

October 2009, the FASB issued “Multiple-Deliverable Revenue

Arrangements” (ASU 2009-13), which addresses how revenues

should be allocated among all products and services included

in our sales arrangements. It establishes a selling price

hierarchy for determining the selling price of each product

or service, with vendor-specific objective evidence (VSOE)

at the highest level, third-party evidence of VSOE at the

intermediate level, and a best estimate at the lowest level.

It replaces “fair value” with “selling price” in revenue

allocation guidance, eliminates the residual method as an

acceptable allocation method, and requires the use of the

relative selling price method as the basis for allocation.

It also significantly expands the disclosure requirements for

such arrangements, including, potentially, certain qualitative

disclosures. ASU 2009-13 will be effective prospectively

for sales entered into or materially modified in fiscal years

beginning on or after June 15, 2010 (i.e., the year beginning

January 1, 2011, for us). The FASB permits early adoption

of ASU 2009-13, applied retrospectively, to the beginning of

the year of adoption. We are currently evaluating the impact

on our financial position and results of operations.

investments that are required or permitted by GAAP to be

measured or disclosed at fair value on a recurring or

nonrecurring basis. It requires disclosures by major category

of investment about certain attributes (e.g., applicable

redemption restrictions, unfunded commitments to the issuer

of the investments, and the investment strategies of that

issuer). ASU 2009-12 was effective for interim and annual

periods ending on or after December 15, 2009 (i.e., the year

ended December 31, 2009, for us). See Note 11 for the

impact of our adoption of ASU 2009-12.

In January 2010, the FASB issued “Fair Value Measurements

and Disclosures—Improving Disclosures about Fair Value

Measurements” (ASU 2010-06), which requires new

disclosures and reasons for transfers of financial assets and

liabilities between Levels 1 and 2. ASU 2010-06 also clarifies

that fair value measurement disclosures are required for each

class of financial asset and liability, which may be a subset of

a caption in the consolidated balance sheets, and those

disclosures should include a discussion of inputs and valuation

techniques. It further clarifies that the reconciliation of Level 3

measurements should separately present purchases, sales,

issuances, and settlements instead of netting these changes.

With respect to matters other than Level 3 measurements,

ASU 2010-06 is effective for fiscal years and interim periods

beginning on or after December 15, 2009 (i.e., the quarter

ending March 31, 2010, for us). New guidance related to

Level 3 measurements is effective for fiscal years and interim

periods beginning on or after December 15, 2010 (i.e., the

quarter ending March 31, 2011, for us). We are currently

evaluating the impact of ASU 2010-06 on our disclosures.

See Note 9 for fair value measurements and disclosures

for our investment securities and derivatives.

Derivative Instruments and Hedging Activities Disclosures

In March 2008, the FASB amended the disclosure

requirements for derivative instruments and hedging activities.

The new guidance requires enhanced disclosures about an

entity’s derivative and hedging activities to improve the

transparency of financial reporting. We adopted the new

guidance as of January 1, 2009, which increased our

quarterly and annual disclosures but did not have an impact

on our financial position and results of operations. See

Note 9 for a comprehensive discussion of our derivatives

and hedging activities, including the underlying risks that

we are managing as a company, and the new disclosure

requirements under GAAP.

Pension and Other Postretirement Benefits In

December 2008, the FASB issued a staff position that

amended an employer’s disclosure requirements for pensions

and other postretirement benefits. The new guidance replaced

the requirement to disclose the percentage of fair value

of total plan assets with a requirement to disclose the fair

value of each major asset category. It also amended GAAP

standards for fair value measurements to clarify that defined

benefit pension or other postretirement plan assets were

not subject to other prevailing GAAP standards for fair value