AT&T Wireless 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

82 AT&T 09 AR

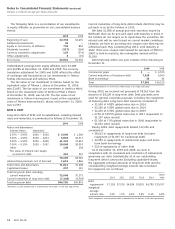

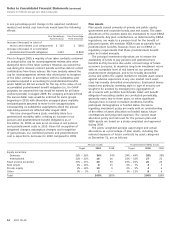

Assumptions

In determining the projected benefit obligation and the net

pension and postemployment benefit cost, we used the

following significant weighted-average assumptions:

2009 2008 2007

Discount rate for determining

projected benefit obligation

at December 31 6.50% 7.00% 6.50%

Discount rate in effect for

determining net cost (benefit) 7.00% 6.50% 6.00%

Long-term rate of return

on plan assets 8.50% 8.50% 8.50%

Composite rate of compensation

increase for determining

projected benefit obligation

and net pension cost (benefit) 4.00% 4.00% 4.00%

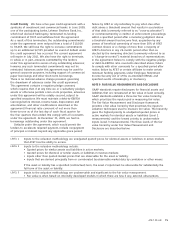

The estimated net loss for pension benefits that will be

amortized from accumulated other comprehensive income

into net periodic benefit cost over the next fiscal year is $683,

and the prior service credit for pension benefits that will be

amortized from accumulated other comprehensive income

into net periodic benefit cost over the next fiscal year is $16.

The estimated net gain for postretirement benefits that will be

amortized from accumulated other comprehensive income

into net periodic benefit cost over the next fiscal year is $8,

and the prior service credit for postretirement benefits that

will be amortized from accumulated other comprehensive

income into net periodic benefit cost over the next fiscal year

is $625.

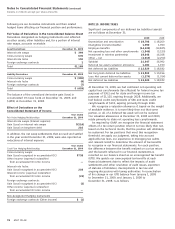

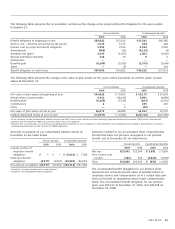

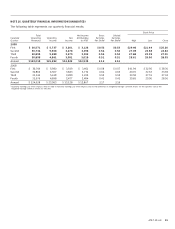

Net Periodic Benefit Cost and Other Amounts Recognized in Other Comprehensive Income

Our combined net pension and postretirement cost recognized in our consolidated statements of income was $1,921, $324 and

$1,078 for the years ended December 31, 2009, 2008 and 2007.

The following tables present the components of net periodic benefit obligation cost and other changes in plan assets and

benefit obligations recognized in other comprehensive income:

Net Periodic Benefit Cost

Pension Benefits Postretirement Benefits

2009 2008 2007 2009 2008 2007

Service cost – benefits earned during the period $ 1,070 $ 1,173 $ 1,257 $ 334 $ 429 $ 511

Interest cost on projected benefit obligation 3,355 3,319 3,220 2,434 2,550 2,588

Expected return on plan assets (4,561) (5,602) (5,468) (955) (1,327) (1,348)

Amortization of prior service cost (credit) and transition asset 58 133 142 (469) (360) (359)

Recognized actuarial (gain) loss 656 10 241 (1) (1) 294

Net pension and postretirement cost (benefit)1 $ 578 $ (967) $ (608) $1,343 $ 1,291 $ 1,686

1 During 2009, 2008 and 2007, the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 reduced postretirement benefit cost by $255, $263 and $342. This effect is

included in several line items above.

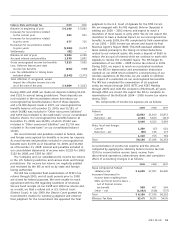

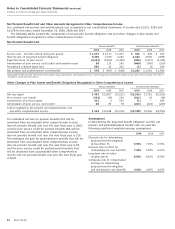

Other Changes in Plan Assets and Benefit Obligations Recognized in Other Comprehensive Income

Pension Benefits Postretirement Benefits

2009 2008 2007 2009 2008 2007

Net loss (gain) $ 435 $13,857 $(2,131) $(1,242) $1,716 $(2,525)

Prior service cost (credit) (392) (16) 139 (322) 32 (28)

Amortization of net loss (gain) 412 4 154 (1) — 181

Amortization of prior service cost (credit) 69 83 78 (223) (222) (223)

Total recognized in net pension and postretirement cost

and other comprehensive income $ 524 $13,928 $(1,760) $(1,788) $1,526 $(2,595)