AT&T Wireless 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T 09 AR 69

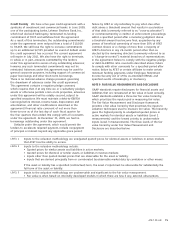

finalizing definitive agreements and seeking regulatory

approvals to sell all eight Centennial service areas ultimately

identified in that ruling. We anticipate we will close the sales

during the first half of 2010. As of December 31, 2009, the

fair value of the assets subject to the sale, net of related

liabilities, was $282. These net assets include property, plant

and equipment, spectrum licenses, customer lists and other

intangible assets, and working capital, which are not deemed

material for isolated presentation as assets held for sale and

liabilities related to assets held for sale in our consolidated

balance sheet as of December 31, 2009, and we included

these net assets in our Other current assets balance.

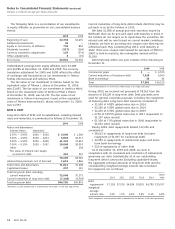

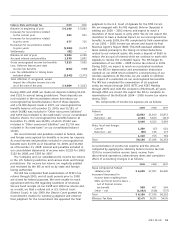

Dobson In November 2007, we acquired Dobson for

approximately $2,500. Under the purchase method of

accounting, the transaction was valued, for accounting

purposes, at $2,580. Our December 31, 2007 consolidated

balance sheet included the preliminary valuation of the fair

value of Dobson’s assets and liabilities, including goodwill

of $2,623, FCC licenses of $2,230, customer lists of $517

and other intangible assets totaling $8 associated with this

transaction. Final adjustments to the preliminary valuation

included an increase to goodwill of $990, a decrease in

licenses of $781 and a decrease in customer lists of $12.

The resulting balances are $3,613 for goodwill, $1,449 for

licenses and $505 for customer lists. Adjustments were

primarily related to changes in the valuation of certain

licenses and an increase in the estimate of relative obso-

lescence of property, plant and equipment resulting in a

decrease in value and shorter average remaining economic

life, and an adjustment to the value of the markets included

in the divestiture order by the FCC. Pursuant to the order,

we exchanged certain properties, spectrum and $355 in cash

for other licenses and properties. Deferred tax adjustments

are associated with the above mentioned items. Dobson

marketed wireless services under the Cellular One brand and

had provided roaming services to AT&T subsidiaries since

1990. Dobson had 1.7 million subscribers across 17 states.

Dobson’s operations were incorporated into our wireless

operations following the date of acquisition.

Other Acquisitions During 2009, we acquired a provider

of mobile application solutions and a security consulting

business for a combined $50 before closing costs. The fair

value of the acquired businesses’ net assets resulted in the

recognition of $41 of goodwill and $3 in customer lists and

other intangible assets.

During 2008, we acquired Easterbrooke Cellular

Corporation, Windstream Wireless, Wayport Inc. and the

remaining 64% of Edge Wireless for a combined $663,

recording $449 in goodwill. The acquisitions of these

companies are designed to expand our wireless and

Wi-Fi coverage area.

During 2007, we acquired Interwise®, a global provider of

voice, Web and video conferencing services to businesses,

for $122 and Ingenio®, a provider of Pay Per Call® technology

for directory and local search business, for $195, net of cash.

We recorded $304 of goodwill related to these acquisitions.

Dispositions

In 2009, we sold a professional services business for $174

and eliminated $113 of goodwill.

In April 2008, we sold to Local Insight Regatta Holdings,

Inc., the parent company of Local Insight Yellow Pages, the

Independent Line of Business segment of the L.M. Berry

Company for $230.

In May 2007, we sold to Clearwire Corporation (Clearwire),

a national provider of wireless broadband Internet access,

education broadband service spectrum and broadband radio

service spectrum valued at $300. Sale of this spectrum was

required as a condition to the approval of our acquisition

of BellSouth.

Other Adjustments

As ATTC and BellSouth stock options that were converted

at the time of the respective acquisitions are exercised, the

tax effect on those options may further reduce goodwill.

During 2008, we recorded $1 in related goodwill reductions

for ATTC and $9 for BellSouth.

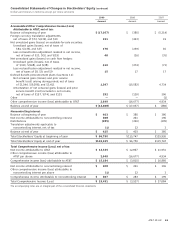

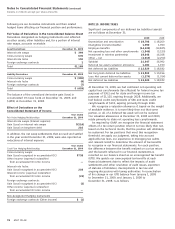

NOTE 3. EARNINGS PER SHARE

A reconciliation of the numerators and denominators of basic

earnings per share and diluted earnings per share for

income from continuing operations for the years ended

December31,2009, 2008 and 2007, are shown in the

table below:

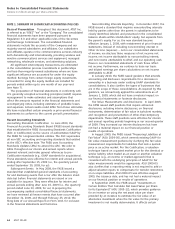

Year Ended December 31, 2009 2008 2007

Numerators

Numerator for basic earnings

per share:

Net income attributable

to AT&T $12,535 $12,867 $11,951

Dilutive potential common shares:

Other share-based payment 10 9 8

Numerator for diluted

earnings per share $12,545 $12,876 $11,959

Denominators (000,000)

Denominator for basic earnings

per share:

Weighted-average number

of common shares outstanding 5,900 5,927 6,127

Dilutive potential common shares:

Stock options 3 9 24

Other share-based payment 21 22 19

Denominator for diluted

earnings per share 5,924 5,958 6,170

Basic earnings per share $ 2.12 $ 2.17 $ 1.95

Diluted earnings per share $ 2.12 $ 2.16 $ 1.94