AT&T Wireless 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

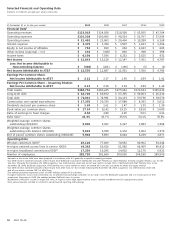

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

32 AT&T 09 AR

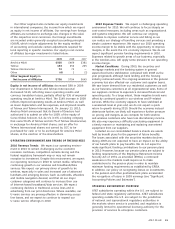

Interest expense decreased $11, or 0.3%, in 2009 and

$117, or 3.3%, in 2008. Interest expense decreased slightly

during 2009 due to an increase in interest charged during

construction, which is capitalized instead of expensed. In

2008, interest expense declined primarily due to a decrease

in our weighted-average interest rate and an increase in

interest charged during construction, partially offset by an

increase in our average debt balances.

Equity in net income of affiliates decreased $85, or

10.4%, in 2009, primarily due to foreign currency translation

losses at América Móvil S.A. de C.V. (América Móvil), Télefonos

de México, S.A. de C.V. (Telmex) and Telmex Internacional,

S.A.B. de C.V. (Telmex Internacional), partially offset by

improved results at América Móvil. Equity in net income of

affiliates increased $127, or 18.4%, in 2008, primarily due to

improved results from our investments in América Móvil,

Telmex and Telmex Internacional, partially offset by foreign

currency translation losses.

Other income (expense) – net We had other income

of $152 in 2009, other expense of $328 in 2008 and other

income of $810 in 2007. Results for 2009 included a $112

gain on the sale of investments, $100 of interest and

leveraged lease income, and $42 of gains on the sale of a

professional services business, partially offset by $102 of

asset impairments.

Other expense for 2008 included losses of $467 related

to asset impairments, partially offset by $156 of interest and

leveraged lease income. Other income for 2007 included

$810 related to a $409 gain on a spectrum license exchange,

$215 of interest and leveraged lease income and a $161 gain

on the sale of non-strategic assets and investments.

Income taxes decreased $880, or 12.5%, in 2009 and

increased $784, or 12.5%, in 2008. The decrease in 2009 was

due to lower income before taxes and the recognition of

benefits related to audit issues and judicial developments,

while the increase in 2008 was primarily due to higher income

before taxes. Our effective tax rate in 2009 was 32.4%,

compared to 34.9% in 2008 and 34.0% in 2007. The decrease

in our effective tax rate in 2009 was primarily due to the

recognition of benefits related to audit issues and judicial

developments. The increase in our effective tax rate in 2008

was primarily due to higher income before taxes, which

resulted in a greater percentage of our income being taxed

at marginal rates.

Cost of services and sales expenses increased $849, or

1.7%, in 2009 and $2,755, or 5.9%, in 2008. The increase in

2009 was primarily due to higher upgrade costs and higher

equipment costs related to advanced integrated devices, along

with an increase in pension/OPEB expenses. Pension/OPEB

expense increased due to lower-than-expected return on

assets and an increase in amortization of actuarial losses,

both primarily from investment losses in 2008. Partially

offsetting these increases were decreases in employee-related

costs primarily driven by workforce reductions. The increase

in 2008 was primarily due to higher equipment costs related

to increased sales of advanced integrated devices. Also

increasing 2008 expenses was severance associated with

announced workforce reductions and hurricane-related

expenses affecting both the Wireless and Wireline segments.

Selling, general and administrative expenses decreased

$119, or 0.4%, in 2009 and increased $1,380, or 4.6%, in

2008. The decrease in 2009 was primarily due to declines in

employee-related costs (excluding pension/OPEB) due to

workforce reductions, decreases in materials and supplies

expense along with decreases in wireless advertising and

promotions expense. These decreases were partially offset

by an increase in pension/OPEB expense, and higher

commissions, customer service costs and IT/Interconnect

costs resulting from wireless subscriber growth along with

increased support for data services and integrated devices.

The increase in 2008 was primarily due to higher commissions

and residuals due to the growth in wireless subscribers, and

higher severance associated with announced workforce

reductions. Partially offsetting these increases in 2008 were

merger-integration costs recognized in 2007 and not in 2008.

Depreciation and amortization expenses decreased $169,

or 0.8%, in 2009 and $1,694, or 7.9%, in 2008. The decrease

in 2009 was primarily due to the declining amortization of

identifiable intangible assets, primarily customer relationships,

partially offset by increased depreciation resulting from capital

additions. The decrease in 2008 was primarily due to lower

amortization expense on intangible assets.