AT&T Wireless 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T 09 AR 79

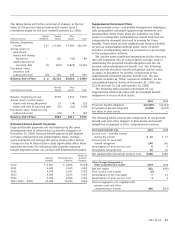

judgment to the U.S. Court of Appeals for the Fifth Circuit.

We are engaged with the IRS Appeals Division (Appeals) in

settling our 2000 – 2002 returns and expect to reach a

resolution of most issues in early 2010. We do not expect the

resolution to have a material impact on our unrecognized tax

benefits. In early 2009, the IRS completed its field examination

of our 2003 – 2005 income tax returns and issued its final

Revenue Agent’s Report (RAR). This RAR assessed additional

taxes related primarily to the timing of certain deductions

related to our network assets. We made a deposit of $650 to

reduce the accrual of interest while we continue to work with

Appeals to resolve the contested issues. The IRS began its

examination of our 2006 – 2008 income tax returns in 2009.

During 2010, we expect to reach an accelerated resolution

with the IRS for depreciation and amortization deductions

claimed on our 2008 return related to a restructuring of our

wireless operations. At this time, we are unable to estimate

the impact of a resolution on our unrecognized tax benefits.

The IRS has completed the examination of all acquired

entity tax returns through 2003 (ATTC and AT&T Mobility

through 2005) and, with the exception of BellSouth, all years

through 2001 are closed. We expect the IRS to complete its

examination of the BellSouth 2004 – 2005 income tax returns

during 2010.

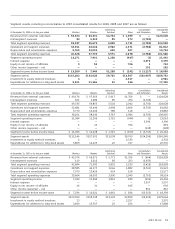

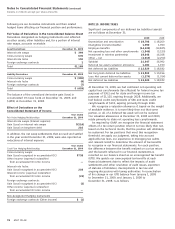

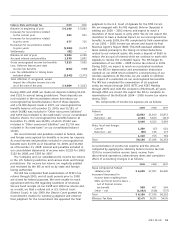

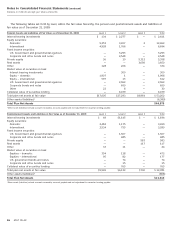

The components of income tax expense are as follows:

2009 2008 2007

Federal:

Current $2,852 $1,160 $5,872

Deferred – net 2,194 5,163 (413)

5,046 6,323 5,459

State, local and foreign:

Current 1,200 (13) 621

Deferred – net (90) 726 173

1,110 713 794

Total $6,156 $7,036 $6,253

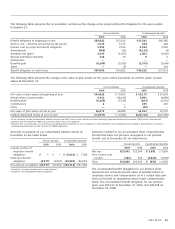

A reconciliation of income tax expense and the amount

computed by applying the statutory federal income tax rate

(35%) to income before income taxes, income from

discontinued operations, extraordinary items and cumulative

effect of accounting changes is as follows:

2009 2008 2007

Taxes computed at federal

statutory rate $ 6,649 $7,057 $6,440

Increases (decreases) in

income taxes resulting from:

State and local income taxes –

net of federal income

tax benefit 559 497 549

Other – net (1,052) (518) (737)

Total $ 6,156 $7,036 $6,252

Effective Tax Rate 32.4% 34.9% 34.0%

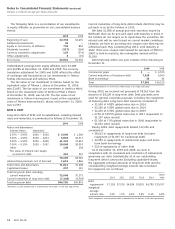

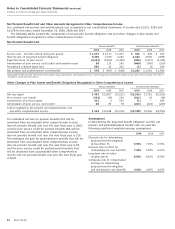

Federal, State and Foreign Tax 2009 2008

Balance at beginning of year $ 6,190 $ 5,901

Increases for tax positions related

to the current year 982 811

Increases for tax positions related

to prior years 877 715

Decreases for tax positions related

to prior years (1,984) (1,237)

Settlements (81) —

Balance at end of year 5,984 6,190

Accrued interest and penalties 1,539 1,802

Gross unrecognized income tax benefits 7,523 7,992

Less: Deferred federal and state

income tax benefits (892) (998)

Less: Tax attributable to timing items

included above (2,542) (3,371)

Total UTB that, if recognized, would

impact the effective income tax rate

as of the end of the year $ 4,089 $ 3,623

During 2009 and 2008, we made net deposits totaling $1,151

and $191 to several taxing jurisdictions. These deposits are

not included in the reconciliation above but reduce our

unrecognized tax benefits balance. Net of these deposits

and a $1,000 deposit made in 2007, our unrecognized tax

benefits balance at December 31, 2009, was $5,181, of

which $4,882 was included in “Other noncurrent liabilities”

and $299 was included in “Accrued taxes” on our consolidated

balance sheets. Our unrecognized tax benefits balance at

December 31, 2008, was $6,801, of which $5,042 was

included in “Other noncurrent liabilities” and $1,759 was

included in “Accrued taxes” on our consolidated balance

sheets.

We record interest and penalties related to federal, state

and foreign unrecognized tax benefits in income tax expense.

Accrued interest and penalties included in unrecognized tax

benefits were $1,539 as of December 31, 2009, and $1,802

as of December 31, 2008. Interest and penalties included in

our consolidated statements of income were $(215) for 2009,

$152 for 2008, and $303 for 2007.

The Company and our subsidiaries file income tax returns

in the U.S. federal jurisdiction and various state and foreign

jurisdictions. Our income tax returns are regularly audited

and reviewed by the IRS as well as by state and foreign

taxing authorities.

The IRS has completed field examinations of AT&T’s tax

returns through 2005, and all audit periods prior to 1998

are closed for federal purposes. We were unable to reach

agreement with the IRS regarding treatment of Universal

Service Fund receipts on our 1998 and 1999 tax returns and,

as a result, we filed a refund suit in U.S. District Court

(District Court). In July 2009, the District Court granted the

Government’s motion for summary judgment and entered

final judgment for the Government. We appealed the final