AT&T Wireless 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

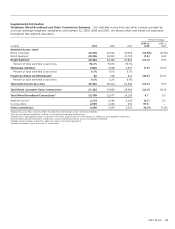

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

48 AT&T 09 AR

OTHER BUSINESS MATTERS

Retiree Phone Concession Litigation In May 2005, we were

served with a purported class action in U.S. District Court,

Western District of Texas (Stoffels v. SBC Communications Inc.),

in which the plaintiffs, who are retirees of Pacific Bell

Telephone Company, Southwestern Bell and Ameritech,

contend that the telephone concession provided by the

company is, in essence, a “defined benefit plan” within the

meaning of ERISA, as amended. In October 2006, the Court

certified two classes. The issue of whether the concession

is an ERISA pension plan was tried before the judge in

November 2007. In May 2008, the court ruled that the

concession was an ERISA pension plan. We asked the court to

certify this ruling for interlocutory appeal, and in August 2008,

the court denied our request. In May 2009, we filed a motion

for reconsideration with the trial court. That motion is

pending. A trial on the appropriate remedy has been set for

June 1, 2010. We believe that an adverse outcome having

a material effect on our financial statements in this case

is unlikely, but we will continue to evaluate the potential

impact of this suit on our financial results as it progresses.

NSA Litigation Twenty-four lawsuits were filed alleging

that we and other telecommunications carriers unlawfully

provided assistance to the National Security Agency (NSA) in

connection with intelligence activities that were initiated

following the events of September 11, 2001. In the first filed

case, Hepting et al v. AT&T Corp., AT&T Inc. and Does 1-20,

a purported class action filed in U.S. District Court in the

Northern District of California, plaintiffs alleged that the

defendants disclosed and are currently disclosing to the

U.S. Government content and call records concerning

communications to which Plaintiffs were a party. Plaintiffs

sought damages, a declaratory judgment, and injunctive relief

for violations of the First and Fourth Amendments to the

United States Constitution, the Foreign Intelligence

Surveillance Act (FISA), the Electronic Communications Privacy

Act, and other federal and California statutes. We filed a

motion to dismiss the complaint. The United States asserted

the “state secrets privilege” and related statutory privileges

and also filed a motion asking the court to dismiss the

complaint. The Court denied the motions, and we and the

United States appealed. In August 2008, the U.S. Court of

Appeals for the Ninth Circuit remanded the case to the district

court without deciding the issue in light of the passage of the

FISA Amendments Act, a provision of which addresses the

allegations in these pending lawsuits (immunity provision).

The immunity provision requires the pending lawsuits to be

dismissed if the Attorney General certifies to the court either

that the alleged assistance was undertaken by court order,

certification, directive, or written request or that the telecom

New Accounting Standards

Revenue Arrangements with Multiple Deliverables In

October 2009, the Financial Accounting Standards Board

(FASB) issued “Multiple-Deliverable Revenue Arrange ments”

(Accounting Standards Update (ASU) 2009-13), which

addresses how revenues should be allocated among all

products and services included in our sales arrangements. It

establishes a selling price hierarchy for determining the selling

price of each product or service, with vendor-specific

objective evidence (VSOE) at the highest level, third-party

evidence of VSOE at the intermediate level, and a best

estimate at the lowest level. It replaces “fair value” with

“selling price” in revenue allocation guidance, eliminates the

residual method as an acceptable allocation method, and

requires the use of the relative selling price method as the

basis for allocation. It also significantly expands the disclosure

requirements for such arrangements, including, potentially,

certain qualitative disclosures. ASU 2009-13 will be effective

prospectively for sales entered into or materially modified in

fiscal years beginning on or after June 15, 2010 (i.e., the year

beginning January 1, 2011, for us). The FASB permits early

adoption of ASU 2009-13, applied retrospectively, to the

beginning of the year of adoption. We are currently evaluating

the impact on our financial position and results of operations.

Software In October 2009, the FASB issued “Certain

Revenue Arrangements That Include Software Elements”

(ASU 2009-14), which clarifies the guidance for allocating and

measuring revenue, including how to identify software that is

out of the scope. ASU 2009-14 amends accounting and

reporting guidance for revenue arrangements involving both

tangible products and software that is “more than incidental

to the tangible product as a whole.” That type of software and

hardware will be outside of the scope of software revenue

guidance, and the hardware components will also be outside

of the scope of software revenue guidance and may result in

more revenue recognized at the time of the hardware sale.

Additional disclosures will discuss allocation of revenue to

products and services in our sales arrangements and the

significant judgments applied in the revenue allocation

method, including impacts on the timing and amount of

revenue recognition. ASU 2009-14 will be effective prospec-

tively for revenue arrangements entered into or materially

modified in fiscal years beginning on or after June 15, 2010

(i.e., the year beginning January 1, 2011, for us). ASU 2009-14

has the same effective date, including early adoption

provisions, as ASU 2009-13. Companies must adopt

ASU 2009-14 and ASU 2009-13 at the same time. We are

currently evaluating the impact on our financial position

and results of operations.

See Note 1 for a discussion of recently issued or adopted

accounting standards.