AT&T Wireless 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T 09 AR 51

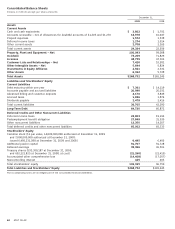

Total capital increased $2,665 in 2009 compared to a decrease

of $8,121 in 2008. The 2009 total capital increase was due

to increased retained earnings and an increase in other

comprehensive income, partially offset by a $2,910 decrease

in debt, all factors which lowered the debt ratio in 2009.

The primary factor contributing to the increase in our 2008

debt ratio was the $16,677 increase in accumulated other

comprehensive loss that reflected a decrease in retirement

plans funded status and an increase in debt of $10,876

related to our financing activities. Our stockholders’ equity

balance was down $19,020 primarily due to the decrease in

retirement plan funded status.

CO N TR ACTUA L O BL IGATIONS,

CO M MI TMENTS AN D CONT I NGENCI E S

Current accounting standards require us to disclose our

material obligations and commitments to making future

payments under contracts, such as debt and lease

agreements, and under contingent commitments, such as debt

guarantees. We occasionally enter into third-party debt

guarantees, but they are not, nor are they reasonably likely

to become, material. We disclose our contractual long-term

debt repayment obligations in Note 8 and our operating lease

payments in Note 5. Our contractual obligations do not

include expected pension and postretirement payments as we

maintain pension funds and Voluntary Employee Beneficiary

Association trusts to fully or partially fund these benefits

(see Note 11). In the ordinary course of business, we routinely

enter into commercial commitments for various aspects of

our operations, such as plant additions and office supplies.

However, we do not believe that the commitments will have a

material effect on our financial condition, results of operations

or cash flows.

Our contractual obligations as of December 31, 2009, are

in the following table. The purchase obligations that follow

are those for which we have guaranteed funds and will be

funded with cash provided by operations or through

incremental borrowings. The minimum commitment for certain

obligations is based on termination penalties that could be

paid to exit the contract. Since termination penalties would

not be paid every year, such penalties are excluded from the

table. Other long-term liabilities were included in the table

based on the year of required payment or an estimate of the

year of payment. Such estimate of payment is based on a

review of past trends for these items, as well as a forecast

of future activities. Certain items were excluded from the

following table as the year of payment is unknown and could

not be reliably estimated since past trends were not deemed

to be an indicator of future payment.

investment and commercial banks. In June 2009, one of the

participating banks, Lehman Brothers Bank, Inc., which had

declared bankruptcy, terminated its lending commitment of

$535 and withdrew from the agreement. As a result of this

termination, the outstanding commitments under the agree-

ment were reduced from a total of $10,000 to $9,465.

We still have the right to increase commitments up to an

additional $2,535 provided no event of default under the

credit agreement has occurred. The current agreement will

expire in July 2011. We also have the right to terminate, in

whole or in part, amounts committed by the lenders under

this agreement in excess of any outstanding advances;

however, any such terminated commitments may not be

reinstated. Advances under this agreement may be used for

general corporate purposes, including support of commercial

paper borrowings and other short-term borrowings. There is

no material adverse change provision governing the

drawdown of advances under this credit agreement.

This agreement contains a negative pledge covenant,

which requires that, if at any time we or a subsidiary pledges

assets or otherwise permits a lien on its properties, advances

under this agreement will be ratably secured, subject to

specified exceptions. We must maintain a debt-to-EBITDA

(earnings before interest, income taxes, depreciation and

amortization, and other modifications described in the

agreement) financial ratio covenant of not more than three-

to-one as of the last day of each fiscal quarter for the four

quarters then ended. We comply with all covenants under

the agreement. At December 31, 2009, we had no borrowings

outstanding under this agreement.

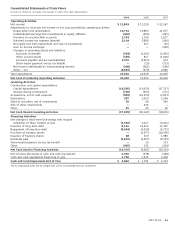

During 2009, the following other financing activities

occurred:

• Wereceived$483relatedtoderivativecollateral;$261

was a return of collateral we posted to derivative

counterparties in 2008 and $222 was collateral we

collected from counterparties in 2009.

• Wepaid$275tominorityinterestholders.

• Wereceivedproceedsof$28fromtheissuanceof

treasury shares related to the settlement of share-based

awards.

We plan to fund our 2010 financing activities through a

combination of cash from operations and debt issuances.

The timing and mix of debt issuance will be guided by credit

market conditions and interest rate trends. The emphasis

of our financing activities will be the payment of dividends,

subject to approval by our Board of Directors, and the

repayment of debt.

Other

Our total capital consists of debt (long-term debt and debt

maturing within one year) and stockholders’ equity. Our

capital structure does not include debt issued by our inter-

national equity investees. Our debt ratio was 41.3%, 43.7%

and 35.6% at December 31, 2009, 2008 and 2007. The debt

ratio is affected by the same factors that affect total capital.