AT&T Wireless 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

34 AT&T 09 AR

Dobson Acquisition

In November 2007, we acquired Dobson Communications

Corporation (Dobson). Dobson marketed wireless services

under the Cellular One brand and had provided roaming

services to AT&T subsidiaries since 1990. Dobson had

1.7 million subscribers across 17 states, mostly in rural

and suburban areas. Dobson was incorporated into our

wireless operations subsequent to its acquisition.

Wireless Customer and Operating Trends

As of December 31, 2009, we served 85.1 million wireless

customers, compared to 77.0 million at December 31, 2008,

and 70.1 million at December 31, 2007. Approximately 59%

of our wireless customer net additions in 2009 were postpaid

customer additions which were lower than the impact in the

prior year, as we saw a significant increase in gross and net

additions in our reseller customer business in 2009. Sales of

emerging devices, such as netbooks and eReaders, are largely

included in our reseller customer base. We expect continued

growth in sales of emerging devices. Improvement in our

postpaid churn levels since 2007 contributed to our net

additions and retail customer growth in 2009 and 2008.

This improvement was attributable to network enhancements,

attractive products and services offerings, including Apple

iPhone, customer service improvements, and continued high

levels of advertising.

Gross customer additions were 21.4 million in 2009 and

2008. Postpaid customer gross additions have continued

to increase due to attractive plan offerings and exclusive

product offerings such as Apple iPhone, and unique quick

messaging devices.

Centennial Acquisition

In November 2009, we acquired Centennial Communications,

Corp. (Centennial), a regional provider of wireless and

wired communications services with approximately 865,000

customers as of December 31, 2009, and its operations

have been included in our consolidated results since the

acquisition date.

Wireless Properties Transactions

In May 2009, we announced a definitive agreement to

acquire certain wireless assets from Verizon Wireless (VZ)

for approximately $2,350 in cash. The assets primarily

represent former Alltel Wireless assets. We will acquire

wireless properties, including licenses and network assets,

serving approximately 1.5 million subscribers in 79 service

areas across 18 states. In October 2009, the Department

of Justice (DOJ) cleared our acquisition of Centennial,

subject to the DOJ’s condition that we divest Centennial’s

operations in eight service areas in Louisiana and Mississippi.

We are in the process of finalizing definitive agreements and

seeking regulatory approvals to sell all eight Centennial

service areas ultimately identified in that ruling. We anticipate

we will close the sales during the first half of 2010. As of

December 31, 2009, the fair value of the assets subject

to the sale, net of related liabilities, was $282. Since the

properties we will acquire use a different network technology

than our Global System for Mobile Communication (GSM)

technology, we expect to incur additional costs to convert

that network and subscriber handsets to our GSM technology.

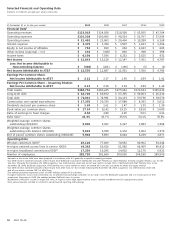

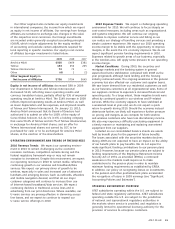

Wireless

Segment Results

Percent Change

2009 vs. 2008 vs.

2009 2008 2007 2008 2007

Segment operating revenues

Service $48,657 $44,410 $38,678 9.6% 14.8%

Equipment 4,940 4,925 4,006 0.3 22.9

Total Segment Operating Revenues 53,597 49,335 42,684 8.6 15.6

Segment operating expenses

Operations and support 34,561 32,481 28,585 6.4 13.6

Depreciation and amortization 5,765 5,770 7,079 (0.1) (18.5)

Total Segment Operating Expenses 40,326 38,251 35,664 5.4 7.3

Segment Operating Income 13,271 11,084 7,020 19.7 57.9

Equity in Net Income of Affiliates 9 6 16 50.0 (62.5)

Segment Income $13,280 $11,090 $ 7,036 19.7% 57.6%