THQ 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

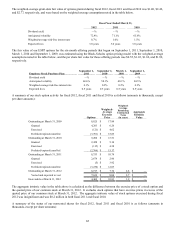

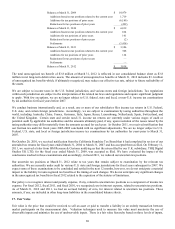

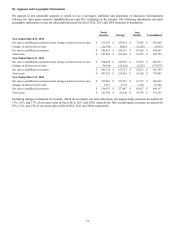

21. Quarterly Financial Data (Unaudited)

Twelve Months Ended March 31, 2012

Quarter Ended

(

Amounts in thousands, exce

p

t

p

er share data

)

June 30,

2011

Sept. 30,

2011

Dec. 31,

2011

March 31,

2012

Fiscal

2012

Net sales $ 195,153 $ 146,004 $ 305,449 $ 184,235

$ 830,841

Gross mar

g

in 55,031

(

13,031

)

48,244 4,317 94,561

Restructurin

g

(

140

)

6,082

(

480

)

1,341 6,803

O

p

eratin

g

loss

(

37,743

)

(

96,869

)

(

54,631

)

(

52,906

)

(

242,149

)

Net loss attributable to THQ Inc.

(

a

)

(

38,445

)

(

92,385

)

(

55,879

)

(

55,797

)

(

242,506

)

Loss

p

er share

—

b

asic $

(

0.56

)

$

(

1.35

)

$

(

0.82

)

$

(

0.82

)

$

(

3.55

)

Loss

p

er share

—

dilute

d

$

(

0.56

)

$

(

1.35

)

$

(

0.82

)

$

(

0.82

)

$

(

3.55

)

Twelve Months Ended March 31, 2011

Quarter Ended

(

Amounts in thousands, exce

p

t

p

er share data

)

June 30,

2010

Sept. 30,

2010

Dec. 31,

2010

March 31,

2011

Fiscal

2011

Net sales $ 149,379 $ 77,053 $ 314,589 $ 124,237

$ 665,258

Gross

p

rofit 34,433 11,305 61,951 38,024 145,713

Restructurin

g

168

(

161

)

140 455 602

O

p

eratin

g

loss

(

27,680

)

(

42,335

)

(

16,108

)

(

49,571

)

(

135,694

)

Net loss attributable to THQ Inc.

(

a

)

(

30,110

)

(

46,985

)

(

14,947

)

(

b

)

(

44,056

)

(

c

)

(

136,098

)

Loss

p

er share

—

b

asic $

(

0.44

)

$

(

0.69

)

$

(

0.22

)

$

(

0.65

)

$

(

2.00

)

Loss

p

er share

—

dilute

d

$

(

0.44

)

$

(

0.69

)

$

(

0.22

)

$

(

0.65

)

$

(

2.00

)

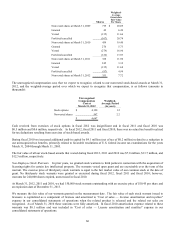

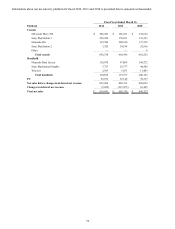

(a) Includes business realignment and related charges and adjustments related to severance and cancellation of games which are not classified as

restructuring, as follows (income/(expense)):

Quarter Ended Full Fiscal

Yea

r

(

Amounts in thousands

)

June 30 Se

p

tembe

r

30 Decembe

r

31 March 31

Fiscal 2012 $

(

4,831

)

$

(

39,004

)

$

(

4,010

)

$

(

61,456

)

$

(

109,301

)

Fiscal 2011

—

—

(

10,766

)

(

1,777

)

(

12,543

)

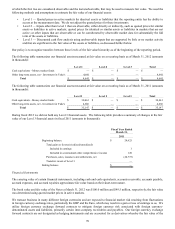

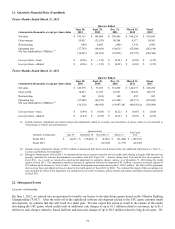

(b) Includes license impairment charges of $30.3 million on unreleased kids' movie-based licensed titles (for additional information see "Note 5 —

Licenses and Software Development").

(c) During the fourth quarter of fiscal 2011, we determined that interest expense related to our convertible debt offering in August 2009 had not been

properly capitalized to software development in accordance with ASC Topic 835 — Interest, during fiscal 2010 and the first three quarters of

fiscal 2011. As a result, we recorded an out-of-period adjustment to capitalize interest expense as of December 31, 2010 during the fourth

quarter of fiscal 2011. The adjustment included an increase in capitalized software development of $4.1 million, a decrease in interest expense of

$3.8 million, and a decrease in "Cost of sales — Software development amortization and royalties" of $0.3 million. The effect of this adjustment

decreased our basic and diluted net loss per share for the fourth quarter of fiscal 2011 by $0.06. We evaluated the impact of this accounting error

and concluded the effect of this adjustment was immaterial to our trend of earnings, and the interim and annual consolidated financial statements

of fiscal 2011.

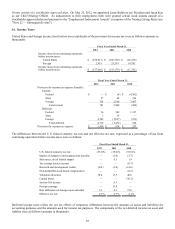

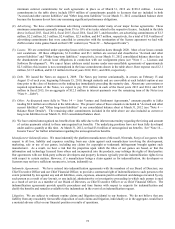

22. Subsequent Events

Licensor relationship

On June 1, 2012, we entered into an agreement to transfer our license to develop future games based on the Ultimate Fighting

Championship ("UFC"). After the write-off of the capitalized software development related to the UFC game currently under

development, we estimate that this will result in a small gain. We also expect this action to result in the closure of the studio

developing the UFC game, which could result in additional cash charges of up to $1.1 million related to severance, up to $1.3

million in cash charges related to leased facilities and non-cash charges of up to $0.5 million related to long-lived assets. We