THQ 2012 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

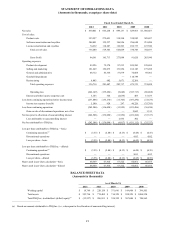

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Our business is subject to many risks and uncertainties which may affect our future financial performance. For a discussion of

our risk factors, see "Part I—Item 1A. Risk Factors."

Overview

The following overview is a top level discussion of our financial results, as well as trends that have, or that we reasonably

believe will, impact our operations. Management believes that an understanding of these trends and drivers is important in

order to understand our results for fiscal 2012, as well as our future prospects. This summary is not intended to be exhaustive,

nor is it intended to be a substitute for the detailed discussion and analysis provided elsewhere in this 10-K and in other

documents we have filed with the SEC.

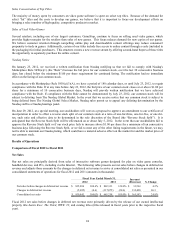

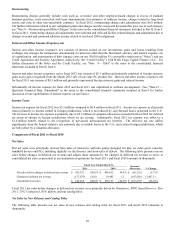

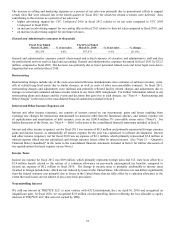

Fiscal 2012 Summary

Current Product Updates

• Several of our games, including: MX vs. ATV Alive; Red Faction: Armageddon; Warhammer 40,000: Space Marine; and

uDraw performed significantly below our expectations and have generated significant losses. This resulted in the

discontinuance of future products based on these intellectual properties, the reassessment of our continuing portfolio of

games, and additional charges related to organizational changes (as further discussed below).

• In fiscal 2012 we shipped approximately 4.2 million units of internally developed and owned intellectual property Saints

Row: The Third. Saints Row is THQ's largest owned franchise, having shipped more than 11 million units globally. With

its robust post-launch digital content, Saints Row: The Third also generated the highest digital revenue of any title in our

history. We recently announced a standalone franchise extension, Saints Row: The Third-Enter The Dominatrix, scheduled

for release in September 2012.

• After a successful rebranding of the franchise, we shipped more than 2.2 million units of WWE '12 in fiscal 2012. WWE'

12 brings our franchise total of lifetime units sold to more than 52 million.

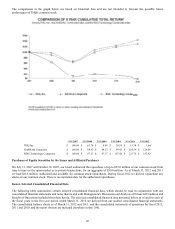

• Our fiscal 2012 digital revenues, before the impact of changes in deferred net revenue, were 62% higher than in fiscal

2011.

Future Product Updates

• We entered into a collaboration with South Park Digital Studios LLC, the joint venture between "South Park" creators Trey

Parker and Matt Stone and Viacom Media Networks, and Obsidian Entertainment, Inc. to develop South Park: The Stick of

Truth. The game is currently scheduled for release in fiscal 2013.

• Patrice Désilets, creative director of the Assassin's Creed franchise, joined THQ in June 2011 to develop a new intellectual

property out of our video game development studio in Montreal, Quebec.

• We entered into an agreement with Turtle Rock Studios Inc., the creators of the multiple award-winning "Left 4 Dead," to

publish a new core title scheduled to be released in calendar 2013.

• We also entered into an agreement with Crytek, a leader in the creation of first person shooters, to develop the next

installment of the Homefront franchise, scheduled for release in fiscal 2014.

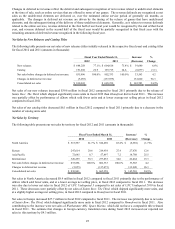

Strategic Plan and Business Realignments

Our strategy is to develop a select number of titles with a significant digital component targeted at the core gamer. Our goal is

to build franchises over time, by delivering a high-quality gaming experience, building a dedicated community around the title,

and delivering a significant level of online services and digital content. Our focus is on building franchises based primarily on

our owned intellectual properties such as Saints Row and Homefront. We intend to launch new intellectual properties on new

platforms as they emerge. Our current focus does not include casual games on social networks or handheld devices.

During fiscal 2012, we made a number of changes to our organization and product lineup. We discontinued a number of titles

in our product pipeline that did not fit our strategic objectives, thus reducing future product development expenses. We

reduced the number of internal development studios from eleven to five. We exited markets, sold or reconfigured games and

product lines that did not meet internal profitability thresholds or were no longer central to our go-forward strategy. We

negotiated with our kids' and movie-based licensors to reduce our future license commitments. We reduced costs and

headcount in our corporate and global publishing organizations as well as our studios impacted by the changes in our product

line-up. In January 2012, we implemented a plan of restructuring in order to better align our operating expenses with the lower

expected revenues under the updated strategy. In connection with this realignment, we significantly reduced other future

product development expenditures which do not align with our current strategy. The majority of the restructuring was