THQ 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

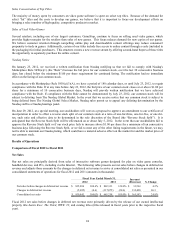

our cash and cash equivalents decreased $9.6 million, from $85.6 million at March 31, 2011 to $76.0 million at March 31,

2012. The decrease in our cash balance was primarily due to investments in software development, payments of accounts

payable and other liabilities, and capital expenditures, offset by collection of accounts receivable from late fourth quarter fiscal

2011 releases. For further information regarding the movement in our cash balance during fiscal 2012, refer to the

Consolidated Statement of Cash Flows for that period which is included in Part II, Item 8.

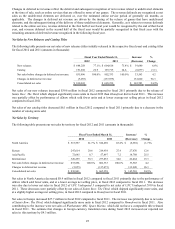

Our business is cyclical and thus our working capital needs are impacted by seasonality, and the timing of new product

releases. Cash used in operations tends to be at its highest during the first part of the third fiscal quarter, as we invest heavily in

inventory for the holiday buying season. During fiscal 2012, in order to help fund our working capital needs during the holiday

season, we borrowed and repaid $52.0 million under our Credit Facility (as discussed below) and we expect to borrow

additional amounts during fiscal 2013, as needed. We did not borrow any funds during the three months ended March 31,

2012. In addition, in order to expedite collections on our accounts receivable, we have sold, and expect to continue to sell

certain of our accounts receivables from Walmart Stores, Inc. ("Walmart") without recourse, to Wells Fargo Bank, N.A.

("Wells") (as discussed below).

Walmart Purchase Agreement.

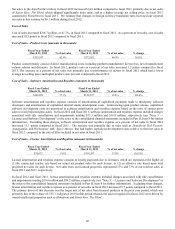

In November 2010, we entered into a Receivables Purchase Agreement ("Purchase Agreement") with Wells. The Purchase

Agreement gives us the option to sell our Walmart receivables to Wells, at our discretion, and significantly expedite our

Walmart receivables collections. Wells will pay us the value of any receivables we elect to sell, less LIBOR + 1.25% per

annum, and then collect the receivables from Walmart. Prior to March 31, 2012, to expedite our receivables collections from

Walmart, we sold $8.5 million of accounts receivable under the Purchase Agreement, without recourse, that would have

otherwise been collected subsequent to March 31, 2012. In fiscal 2012 we recognized a loss of $0.2 million related to interest

on the transaction, which is classified in "Interest and other income (expense), net" in our consolidated statements of

operations. We expect to continue to sell our Walmart accounts receivable pursuant to the Purchase Agreement to further

expedite collections.

Credit Facility.

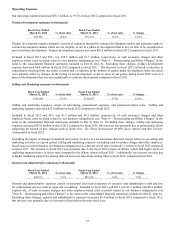

On September 23, 2011, we entered into a Credit Agreement and a Security Agreement (collectively, the “Credit Facility”) with

Wells Fargo Capital Finance, LLC (“Wells Fargo”). The Credit Facility provides for a $50.0 million revolving facility during

its term. During fiscal 2012, the availability under the Credit Facility was increased to $75.0 million for the period from

October 1, 2011 through December 14, 2011. The Credit Facility allows up to $10.0 million of the total to be used as a letter of

credit subfacility.

The Credit Facility has a four-year term; provided, however, it will terminate on June 16, 2014 if any obligations are still

outstanding under the Notes. Borrowings under the Credit Facility bear interest at a rate equal to an applicable margin plus, at

our option, either a variable base rate or a LIBOR rate. The applicable margin for base rate loans ranges from 2.25% to 2.5%

and for LIBOR rate loans ranges from 3.75% to 4.0%, in each case, depending on the level of our borrowings. We are required

to pay other customary fees, including an unused line fee based on usage under the Credit Facility as well as fees in respect of

letters of credit.

The Credit Facility provides for certain events of default such as nonpayment of principal and interest when due, breaches of

representations and warranties, noncompliance with covenants, acts of insolvency, default on certain agreements related to

indebtedness, including the Notes, and entry of certain judgments against us. Upon the occurrence of a continuing event of

default and at the option of the required lenders (as defined in the Credit Facility), all of the amounts outstanding under the

Credit Facility are currently due and payable and any amount outstanding bears interest at 2.0% above the interest rate

otherwise applicable. In the event availability on the Credit Facility is below 12.5% of the maximum revolver amount of $50.0

million, the Credit Facility would require that we maintain certain financial covenants. During the year ended March 31, 2012,

we had availability in excess of 12.5% and therefore we were not subject to the financial covenants. In the event the financial

covenants become applicable, we would be required to have EBITDA, as defined in the Credit Facility, of $9.8 million for the

four quarters ended June 30, 2012. Beginning September 30, 2012, the EBITDA requirements are replaced with a requirement

that we maintain an annual fixed charge coverage ratio of 1.1 to 1.0.

The Credit Facility is guaranteed by most of our domestic subsidiaries and secured by substantially all of our assets. The Credit

Facility contains customary affirmative and negative covenants, including, among other terms and conditions, and limitations

(subject to certain permitted actions) on our ability to: create, incur, guarantee or be liable for indebtedness; dispose of assets

outside the ordinary course; acquire, merge or consolidate with or into another person or entity; create, incur or allow any lien

on any of their respective properties; make investments or capital expenditures; or pay dividends or make distributions.

During the year ended March 31, 2012 we borrowed $52.0 million under the Credit Facility, which was repaid as of December

31, 2011. In fiscal 2012 interest expense was $0.2 million and amortization of debt costs related to the Credit Facility was $0.2