THQ 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

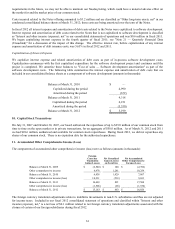

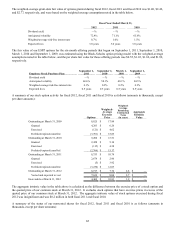

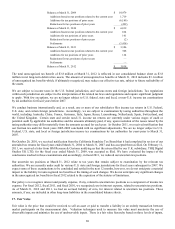

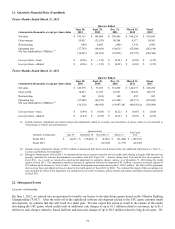

Balance at March 31, 2009 $ 10,979

Additions based on tax

p

ositions related to the current

y

ea

r

1,719

Additions for tax

p

ositions of

p

rior

y

ears

(

6,180

)

Reductions for tax

p

ositions of

p

rior

y

ears

(

499

)

Balance at March 31, 2010 $ 6,019

Additions based on tax

p

ositions related to the current

y

ea

r

624

Additions for tax

p

ositions of

p

rior

y

ears 161

Reductions for tax

p

ositions of

p

rior

y

ears

(

2

)

Settlements

(

3,416

)

Balance at March 31, 2011 $ 3,386

Additions based on tax

p

ositions related to the current

y

ea

r

308

Additions for tax

p

ositions of

p

rior

y

ears 124

Reductions for tax

p

ositions of

p

rior

y

ears

—

Settlements

—

Balance at March 31, 2012 $ 3,818

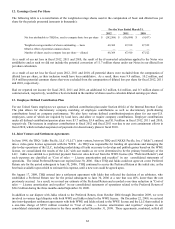

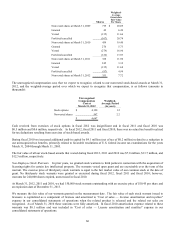

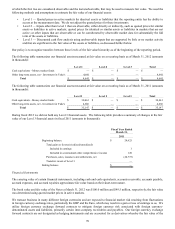

The total unrecognized tax benefit of $3.8 million at March 31, 2012 is reflected in our consolidated balance sheet as $3.8

million in net long-term deferred tax assets. The amount of unrecognized tax benefits at March 31, 2012 includes $3.1 million

of unrecognized tax benefits which, if ultimately recognized, may reduce our effective tax rate, subject to future realizability of

the assets.

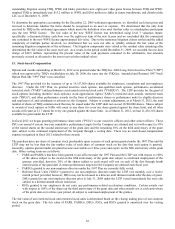

We are subject to income taxes in the U.S. federal jurisdiction, and various states and foreign jurisdictions. Tax regulations

within each jurisdiction are subject to the interpretation of the related tax laws and regulations and require significant judgment

to apply. With few exceptions, we are no longer subject to U.S. federal, state and local, or non-U.S. income tax examinations

by tax authorities for fiscal years before 2007.

We conduct business internationally and, as a result, one or more of our subsidiaries files income tax returns in U.S. Federal,

U.S. state, and certain foreign jurisdictions. Accordingly, we are subject to examination by taxing authorities throughout the

world, including Australia, China, France, Germany, Italy, Japan, Korea, Luxembourg, Netherlands, Spain, Switzerland, and

the United Kingdom. Certain state and certain non-U.S. income tax returns are currently under various stages of audit or

potential audit by applicable tax authorities and the amounts ultimately paid, if any, upon resolution of the issues raised by the

taxing authorities may differ materially from the amounts accrued for each year. In October 2011, we received notification that

our German tax audit for fiscal years 2005-2009 concluded with no significant adjustments. We are no longer subject to U.S.

Federal, U.S. state, and local or foreign jurisdiction income tax examinations by tax authorities for years prior to March 31,

2007.

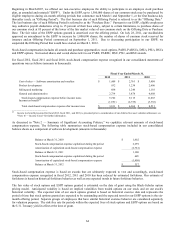

On October 20, 2010, we received notification from the California Franchise Tax Board that it had completed its review of our

amended tax returns for fiscal years ended March 31, 2004 to March 31, 2007 and has accepted them as filed. On February 11,

2011, we received a letter from HM Revenue & Customs notifying us that the return filed by our U.K. subsidiary, THQ Digital

Studios UK LTD, for the fiscal year ended March 31, 2009, was accepted as filed. We have evaluated the impact of the

conclusions reached in these examinations and accordingly, in fiscal 2011, we reduced our uncertain tax positions.

Our uncertain tax positions at March 31, 2012 relate to tax years that remain subject to examination by the relevant tax

authorities. We are currently under audit by various U.S. state and foreign jurisdictions for fiscal years subsequent to 2007. We

expect some of these examinations to be concluded and settled in the next 12 months, however, we do not anticipate a material

impact to the liability for unrecognized tax benefits or the timing of such changes. We do not anticipate any significant changes

in the unrecognized tax benefits in fiscal 2012 related to the expiration of the statutes of limitations.

Our policy is to recognize interest and penalty expense, if any, related to uncertain tax positions as a component of income tax

expense. For fiscal 2012, fiscal 2011, and fiscal 2010, we recognized zero in interest expense, related to uncertain tax positions.

As of March 31, 2012 and 2011, we had an accrued liability of zero, for interest related to uncertain tax positions. These

amounts, if any, are included in other long-term liabilities in the consolidated balance sheets.

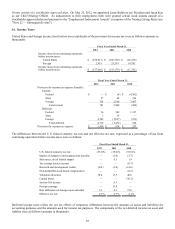

17. Fair Value

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between

market participants on the measurement date. Valuation techniques used to measure fair value must maximize the use of

observable inputs and minimize the use of unobservable inputs. There is a fair value hierarchy based on three levels of inputs,