THQ 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

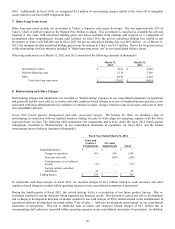

2010. Additionally in fiscal 2010, we recognized $2.9 million of restructuring charges related to the write-off of intangible

assets related to our fiscal 2009 realignment plan.

7. Other Long-Term Assets

Other long-term assets include our investment in Yuke's, a Japanese video game developer. We own approximately 15% of

Yuke's, which is publicly traded on the Nippon New Market in Japan. This investment is classified as available-for-sale and

reported at fair value with unrealized holding gains and losses excluded from earnings and reported as a component of

accumulated other comprehensive income until realized. In fiscal 2012 the pre-tax unrealized holding loss related to our

investment in Yuke's was $45,000 and in fiscal 2011 the pre-tax unrealized holding loss was $0.9 million. As of March 31,

2012, the inception-to-date unrealized holding gain on our investment in Yuke's was $1.5 million. Due to the long-term nature

of this relationship, this investment is included in "Other long-term assets, net" in our consolidated balance sheets.

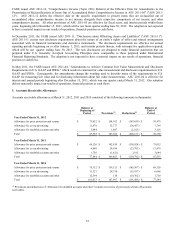

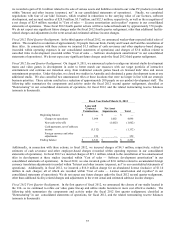

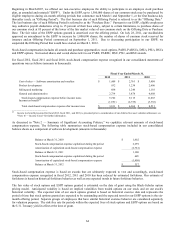

Other long-term assets as of March 31, 2012 and 2011 consisted of the following (amounts in thousands):

March 31,

2012

March 31,

2011

Investment in Yuke's $4,641 $ 4,686

Deferred financin

g

costs 1,510 2,146

Othe

r

6,536 3,182

Total other lon

g

-ter

m

assets $12,687 $ 10,014

8. Restructuring and Other Charges

Restructuring charges and adjustments are recorded as "Restructuring" expenses in our consolidated statements of operations

and generally include costs such as, severance and other employee-based charges in excess of standard business practices, costs

associated with lease abandonments (less estimates of sublease income), charges related to long-lived assets, and costs of other

non-cancellable contracts.

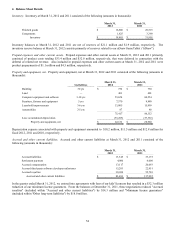

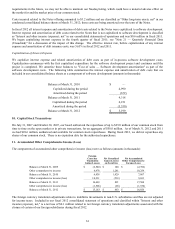

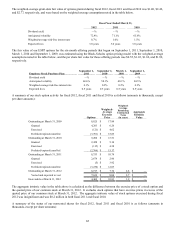

Fiscal 2012 Fourth Quarter Realignment and other associated charges. On January 26, 2012, we initiated a plan of

restructuring in connection with our updated business strategy in order to better align our operating expenses with the lower

expected future revenue. The following table summarizes the components and activity under the fiscal 2012 fourth quarter

realignment, classified as "Restructuring" in our consolidated statements of operations, for fiscal 2012, and the related

restructuring reserve balances (amounts in thousands):

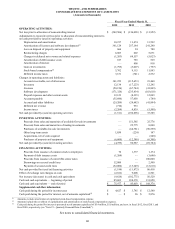

Fiscal Year Ended March 31, 2012

Lease and

Contract

Terminations

Net Asset

Im

p

airments Total

Be

g

innin

g

balance $

—

$

—

$

—

Char

g

es to o

p

erations 561 589 1,150

Non-cash write-offs

—

(

589

)

(

589

)

Cash payments, net of sublease

income

(

77

)

—

(

77

)

Foreign currency and other

ad

j

ustments 52

—

52

Endin

g

balance $ 536 $

—

$ 536

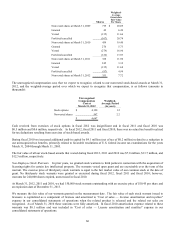

In connection with these actions, in fiscal 2012, we incurred charges of $6.3 million related to cash severance and other

employee-based charges (recorded within operating expenses in our consolidated statements of operations).

During the fourth quarter of fiscal 2012, the revised strategy led to a re-evaluation of our future product line-up. This re-

evaluation resulted in various decisions which impacted our financial results. Our decision to cancel one title in development

and a change in development direction of another resulted in non-cash charges of $52.6 million related to the abandonment of

capitalized software development (recorded within "Cost of sales — Software development amortization" in our consolidated

statements of operations). This led to additional cash severance and employee related charges of $2.1 million due to

corresponding staff reductions (recorded within operating expenses in our consolidated statements of operations). In addition,