THQ 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

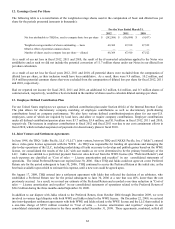

53

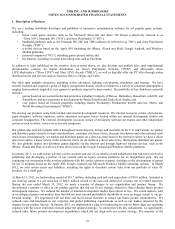

FASB issued ASU 2011-12, "Comprehensive Income (Topic 220): Deferral of the Effective Date for Amendments to the

Presentation of Reclassifications of Items Out of Accumulated Other Comprehensive Income in ASU 2011-05" ("ASU 2011-

12"). ASU 2011-12 defers the effective date of the specific requirement to present items that are reclassified out of

accumulated other comprehensive income to net income alongside their respective components of net income and other

comprehensive income. All other provisions of ASU 2011-05 are effective for fiscal years, and interim periods within those

years, beginning after December 15, 2011, which will be our fiscal quarter ending June 30, 2012. The adoption is not expected

to have a material impact on our results of operations, financial position or cash flows.

In December 2011, the FASB issued ASU 2011-11, "Disclosures about Offsetting Assets and Liabilities" ("ASU 2011-11").

ASU 2011-11 creates new disclosure requirements about the nature of an entity’s rights of offset and related arrangements

associated with its financial instruments and derivative instruments. The disclosure requirements are effective for annual

reporting periods beginning on or after January 1, 2013, and interim periods therein, with retrospective application required,

which will be our quarter ending June 30, 2013. The new disclosures are designed to make financial statements that are

prepared under U.S. Generally Accepted Accounting Principles more comparable to those prepared under International

Financial Reporting Standards. The adoption is not expected to have a material impact on our results of operations, financial

position or cash flows.

In May 2011, the FASB issued ASU 2011-04, "Amendments to Achieve Common Fair Value Measurement and Disclosure

Requirements in U.S. GAAP and IFRSs," which results in common fair value measurement and disclosure requirements in U.S.

GAAP and IFRSs. Consequently, the amendments change the wording used to describe many of the requirements in U.S.

GAAP for measuring fair value and for disclosing information about fair value measurements. ASU 2011-04 is effective for

interim and annual periods beginning after December 15, 2011, which was our quarter ended March 31, 2012. Our adoption

did not materially impact our results of operations, financial position or cash flows.

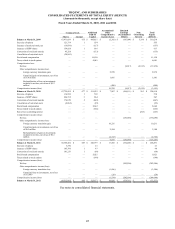

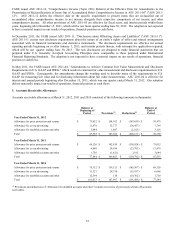

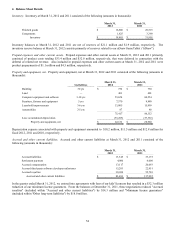

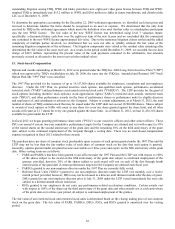

3. Accounts Receivable Allowances

Accounts receivable allowances at March 31, 2012, 2011 and 2010 consisted of the following (amounts in thousands):

Balance at

Beginning of

Period Provisions(1) Deductions(1)

Balance at

End of

Period

Year Ended March 31, 2012

Allowance for

p

rice

p

rotection and returns $ 73,032 $ 154,102 $

(

167,659

)

$ 59,475

Allowance for co-o

p

advertisin

g

11,479 32,777

(

36,457

)

7,799

Allowance for doubtful accounts and othe

r

3,044 1,087

(

1,015

)

3,116

Total $ 87,555 $ 187,966 $

(

205,131

)

$ 70,390

Year Ended March 31, 2011

Allowance for

p

rice

p

rotection and returns $ 69,126 $ 142,830 $

(

138,924

)

$ 73,032

Allowance for co-o

p

advertisin

g

6,668 28,594

(

23,783

)

11,479

Allowance for doubtful accounts and othe

r

1,750

(

1,621

)

2,915 3,044

Total $ 77,544 $ 169,803 $

(

159,792

)

$ 87,555

Year Ended March 31, 2010

Allowance for

p

rice

p

rotection and returns $ 75,312 $ 139,121 $

(

145,307

)

$ 69,126

Allowance for co-o

p

advertisin

g

13,327 28,758

(

35,417

)

6,668

Allowance for doubtful accounts and othe

r

12,394 118

(

10,762

)

1,750

Total $ 101,033 $ 167,997 $

(

191,486

)

$ 77,544

(1) Provisions and deductions of “Allowance for doubtful accounts and other” includes recoveries of previously written off accounts

receivables.