THQ 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

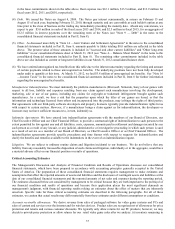

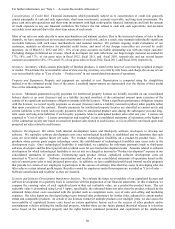

46

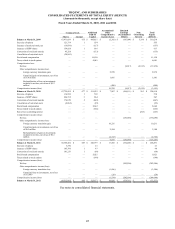

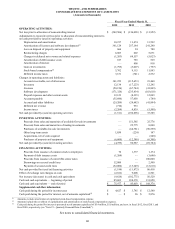

THQ INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

Fiscal Year Ended March 31,

2012 2011 2010

OPERATING ACTIVITIES:

Net loss

p

rior to allocation of noncontrollin

g

interest $

(

242,506

)

$

(

136,098

)

$

(

11,952

)

Adjustments to reconcile net loss prior to allocation of noncontrolling interest to

net cash

p

rovided b

y

(

used in

)

o

p

eratin

g

activities:

De

p

reciation and amortization 10,217 11,474

13,592

Amortization of licenses and software develo

p

ment(1) 361,124 257,184

241,240

Loss on dis

p

osal of

p

ro

p

ert

y

and e

q

ui

p

ment 666 24

780

Restructurin

g

char

g

es 6,803 602

5,671

Chan

g

es in deferred net revenue and related ex

p

enses

(

1,263

)

68,557

(

5,023

)

Amortization of debt issuance costs 187 785

529

Amortization of interest

—

808

818

Gain on investments

(

1,795

)

(

3,007

)

(

797

)

Stoc

k

-

b

ased com

p

ensation(2) 5,762 9,115

11,883

Deferred income taxes 3,151

(

741

)

2,532

Chan

g

es in o

p

eratin

g

assets and liabilities:

Accounts receivable, net of allowances 141,253

(

115,653

)

23,460

Inventor

y

12,134

(

17,223

)

12,245

Licenses

(

50,156

)

(

67,744

)

(

41,809

)

Software develo

p

ment

(

171,326

)

(

235,434

)

(

183,610

)

Pre

p

aid ex

p

enses and other current assets 12,123

(

8,335

)

12,009

Accounts

p

a

y

able

(

55,696

)

57,658

(

789

)

Accrued and other liabilities

(

29,209

)

(

24,642

)

(

41,894

)

Deferred net revenue

(

716

)

933

—

Income taxes

(

2,264

)

4,839

(

5,500

)

Net cash

p

rovided b

y

(

used in

)

o

p

eratin

g

activities

(

1,511

)

(

196,898

)

33,385

INVESTING ACTIVITIES:

Proceeds from sales and maturities of available-fo

r

-sale investments

—

151,565

25,776

Proceeds from sales and maturities of tradin

g

investments

—

22,775

8,000

Purchases of available-fo

r

-sale investments

—

(

64,781

)

(

96,559

)

Other lon

g

-term assets 1,850

(

224

)

147

Ac

q

uisitions, net of cash ac

q

uire

d

—

—

(

840

)

Purchases of

p

ro

p

ert

y

and e

q

ui

p

ment

(

6,609

)

(

12,348

)

(

6,308

)

Net cash

p

rovided b

y

(

used in

)

investin

g

activities

(

4,759

)

96,987

(

69,784

)

FINANCING ACTIVITIES:

Proceeds from issuance of common stock to em

p

lo

y

ees 70 1,377

1,174

Pa

y

ment of debt issuance costs

(

1,264

)

—

(

3,646

)

Proceeds from issuance of convertible senior notes

—

—

100,000

Borrowin

g

s on secured credit lines 52,000

—

2,500

Pa

y

ment of secured credit lines

(

52,000

)

(

13,249

)

(

13,610

)

Net cash

p

rovided b

y

(

used in

)

financin

g

activities

(

1,194

)

(

11,872

)

86,418

Effect of exchan

g

e rate chan

g

es on cash

(

2,162

)

9,008

6,501

Net increase

(

decrease

)

in cash and cash e

q

uivalents

(

9,626

)

(

102,775

)

56,520

Cash and cash e

q

uivalents

—

b

e

g

innin

g

of

p

erio

d

85,603 188,378

131,858

Cash and cash e

q

uivalents

—

end of

p

erio

d

$ 75,977 $ 85,603

$ 188,378

Su

pp

lemental cash flow information:

Cash

p

aid durin

g

the

p

eriod for income taxes $ 4,627 $ 3,745

$ 12,580

Cash

p

aid durin

g

the

p

eriod for interest, net of amounts ca

p

italize

d

(3) $

—

$ 26

$ 2,876

________________________________

(1) Amounts exclude amortization of capitalized stock-based compensation expense.

(2) Amounts include the net effects of capitalization and amortization of stock-based compensation expense.

(3) Cash paid during the period for interest is presented net of amounts capitalized of $5.4 million, $5.0 million, and zero, in fiscal 2012, fiscal 2011, and

fiscal 2010, respectively (see "Note 21 - Quarterly Financial Data (Unaudited)").

See notes to consolidated financial statements.