THQ 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

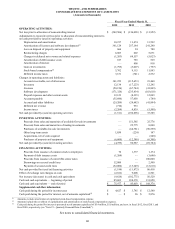

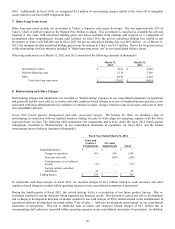

restructuring was completed by March 31, 2012. We expect remaining severance amounts of $5.0 million to be paid by

September 30, 2012. These actions will have reduced headcount by approximately 370 people. With our focused product plan,

lower cost structure, cash balance, existing credit facility and other sources of external liquidity, we believe we have adequate

resources to execute on our plan and deliver on our strong multi-year pipeline of games.

Although we believe our current business plan is achievable, should we fail to achieve the sales, gross margin levels, and

maintain the vendor credit terms we anticipate, or if we were to incur significant unplanned cash outlays, it would become

necessary for us to obtain additional sources of liquidity or make further cost cuts (including future product development) to

fund our operations, which could result in additional restructuring and impairment charges. However, there is no assurance that

we would be able to obtain additional financing on favorable terms, if at all, or to successfully further reduce costs in such a

way that would continue to allow us to operate our business. In addition, if for any reason our projections do not materialize,

we may not be able to comply with the requirements of our credit and debt facilities (see "Note 9 — Debt" ).

2. Summary of Significant Accounting Policies

Principles of Consolidation. Our consolidated financial statements include the accounts of THQ Inc. and our wholly-owned

subsidiaries. The results of operations for acquired companies have been included in our consolidated statements of operations

beginning on the closing date of acquisition. All material intercompany balances and transactions have been eliminated in

consolidation. Our consolidated financial statements also include the THQ / JAKKS Pacific LLC ("LLC") joint venture, which

was comprised of THQ and JAKKS Pacific, Inc. ("Jakks"), through December 31, 2009, the date the LLC was dissolved (see

"Note 14 — Joint Venture and Settlement Agreements").

Prior to April 30, 2010, we consolidated the results of THQ*ICE LLC (a joint venture with ICE Entertainment, Inc.) in the

consolidated financial statements as we believed we were the primary beneficiary and would have received the majority of

expected returns or absorbed the majority of expected losses of THQ*ICE LLC. We sold our interest in THQ*ICE LLC on

April 30, 2010 and recognized an insignificant gain.

Fiscal Year. We report our fiscal year on a 52/53-week period with our fiscal year ending on the Saturday nearest March 31.

For simplicity, all fiscal periods in our consolidated financial statements and accompanying notes are presented as ending on a

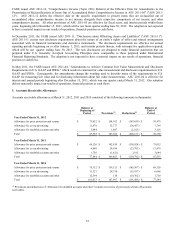

calendar month end. The results of operations for the fiscal years ended March 31, 2012 , 2011, and 2010 contain the following

number of weeks:

Fiscal Period Number of Weeks Fiscal Period End Date

Year ended March 31, 2012

(

"fiscal 2012"

)

52 weeks March 31, 2012

Year ended March 31, 2011

(

"fiscal 2011"

)

52 weeks A

p

ril 2, 2011

Year ended March 31, 2010

(

"fiscal 2010"

)

53 weeks A

p

ril 3, 2010

Pervasiveness of Estimates. The preparation of financial statements in conformity with accounting principles generally

accepted in the United States of America requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the

reported amounts of net sales and expenses during the reporting period. Actual results could differ from those estimates. The

most significant estimates relate to accounts receivable allowances, licenses, software development, revenue recognition, stock-

based compensation expense and income taxes.

Foreign Currency Translation. Assets and liabilities of foreign operations are translated at current rates of exchange while

results of operations are translated at average rates in effect for the period. Translation gains or losses are shown as a separate

component of accumulated other comprehensive income. Foreign currency transaction gains and losses result from exchange

rate changes for transactions denominated in currencies other than the functional currency and are included in "Interest and

other income (expense), net" in our consolidated statements of operations. For fiscal 2012, foreign currency transaction gains

were $2.3 million, compared to a gain of $0.3 million and a loss of $1.1 million in fiscal 2011 and 2010, respectively.

Cash, Cash Equivalents and Investment Securities. We consider all money market funds and highly liquid investments with

maturities of three months or less when purchased to be cash equivalents.

Investments designated as trading securities are bought and held principally for the purpose of selling them in the near term and

are reported at fair value, with unrealized gains and losses recognized in earnings. Investments designated as available-for-sale

securities are carried at fair value based on quoted market prices or estimated based on quoted market prices for financial

instruments with similar characteristics. Unrealized gains and losses of our available-for-sale securities are excluded from

earnings and reported as a component of accumulated other comprehensive income. Additionally, we assess whether an other-

than-temporary impairment loss on its available-for-sale securities has occurred due to declines in fair value or other market