THQ 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

The calculation of our tax liabilities involves dealing with uncertainties in the application of complex tax regulations. We

recognize liabilities for anticipated tax audit issues in the U.S. and other tax jurisdictions based on our estimate of whether, and

the extent to which, additional taxes will be due. Our estimate for the potential outcome for any uncertain tax issue, including

our claims for research and development income tax credits, requires judgment. We believe we have adequately provided for

any reasonably foreseeable outcome related to these matters. However, our future results may include favorable or unfavorable

adjustments to our estimated tax liabilities in the period in which they are resolved or when statutes of limitation on potential

assessments expire. We recognize the financial statement benefit of a tax position only after determining that the relevant tax

authority would more likely than not sustain the position following an audit. For tax positions meeting the "more likely than

not" threshold, the amount recognized in the financial statements is the largest benefit that has a greater than 50% likelihood of

being realized upon ultimate settlement with the relevant tax authority.

Recently Issued Accounting Pronouncements

In June 2011, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2011-05,

"Comprehensive Income (Topic 220): Presentation of Comprehensive Income" ("ASU 2011-05"). ASU 2011-05 requires

companies to present the components of net income and other comprehensive income either as one continuous statement or as

two consecutive statements and it eliminates the option to present components of other comprehensive income as part of the

statement of changes in stockholders' equity. ASU 2011-05 does not change the items which must be reported in other

comprehensive income, how such items are measured or when they must be reclassified to net income. In December 2011, the

FASB issued ASU 2011-12, "Comprehensive Income (Topic 220): Deferral of the Effective Date for Amendments to the

Presentation of Reclassifications of Items Out of Accumulated Other Comprehensive Income in ASU 2011-05" ("ASU 2011-

12"). ASU 2011-12 defers the effective date of the specific requirement to present items that are reclassified out of

accumulated other comprehensive income to net income alongside their respective components of net income and other

comprehensive income. All other provisions of ASU 2011-05 are effective for fiscal years, and interim periods within those

years, beginning after December 15, 2011, which will be our fiscal quarter ending June 30, 2012. The adoption is not expected

to have a material impact on our results of operations, financial position or cash flows.

In December 2011, the FASB issued ASU 2011-11, "Disclosures about Offsetting Assets and Liabilities" ("ASU 2011-11").

ASU 2011-11 creates new disclosure requirements about the nature of an entity’s rights of offset and related arrangements

associated with its financial instruments and derivative instruments. The disclosure requirements are effective for annual

reporting periods beginning on or after January 1, 2013, and interim periods therein, with retrospective application required,

which will be our quarter ending June 30, 2013. The new disclosures are designed to make financial statements that are

prepared under U.S. Generally Accepted Accounting Principles more comparable to those prepared under International

Financial Reporting Standards. The adoption is not expected to have a material impact on our results of operations, financial

position or cash flows.

In May 2011, the FASB issued ASU 2011-04, “Amendments to Achieve Common Fair Value Measurement and Disclosure

Requirements in U.S. GAAP and IFRSs,” which results in common fair value measurement and disclosure requirements in

U.S. GAAP and IFRSs. Consequently, the amendments change the wording used to describe many of the requirements in U.S.

GAAP for measuring fair value and for disclosing information about fair value measurements. ASU 2011-04 is effective for

interim and annual periods beginning after December 15, 2011, which was our quarter ended March 31, 2012. Our adoption did

not materially impact our results of operations, financial position or cash flows.

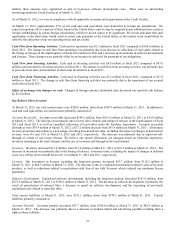

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Market Risk

We are exposed to certain market risks arising from transactions in the normal course of business, principally risks associated

with interest rate and foreign currency fluctuations. Market risk is the potential loss arising from changes in market rates and

market prices. We employ established policies and practices to manage these risks. We use foreign currency exchange option

and forward contracts to hedge anticipated exposures or mitigate some existing exposures subject to foreign currency exchange

rate risk as discussed below. We do not enter into derivatives or other financial instruments for trading or speculative purposes.

Interest Rate Risk

At March 31, 2012, our $76.0 million of cash and cash equivalents were comprised of cash and time deposits and money

market funds; none of our cash equivalents are classified as trading securities. We generally manage our interest rate risk by

maintaining an investment portfolio generally consisting of debt instruments of high credit quality and relatively short

maturities. However, because short-term investments mature relatively quickly and are generally reinvested at the then current

market rates, interest income on a portfolio consisting of cash equivalents and short-term investments is more subject to market

fluctuations than a portfolio of longer-term investments. The value of these investments may fluctuate with changes in interest