THQ 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

of which the first two are considered observable and the last unobservable, that may be used to measure fair value. We used the

following methods and assumptions to estimate the fair value of our financial assets:

• Level 1 — Quoted prices in active markets for identical assets or liabilities that the reporting entity has the ability to

access at the measurement date. We do not adjust the quoted prices for these investments.

• Level 2 — Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar

assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not

active; or other inputs that are observable or can be corroborated by observable market data for substantially the full

term of the assets or liabilities.

• Level 3 — Discounted cash flow analysis using unobservable inputs that are supported by little or no market activity

and that are significant to the fair value of the assets or liabilities, as discussed further below.

Our policy is to recognize transfers between these levels of the fair value hierarchy as of the beginning of the reporting period.

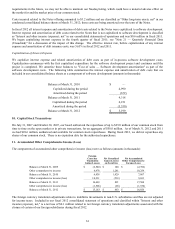

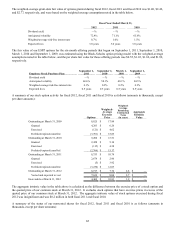

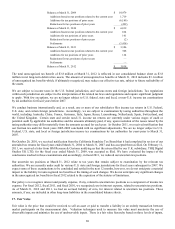

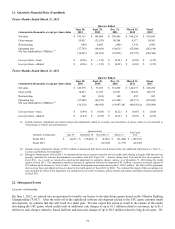

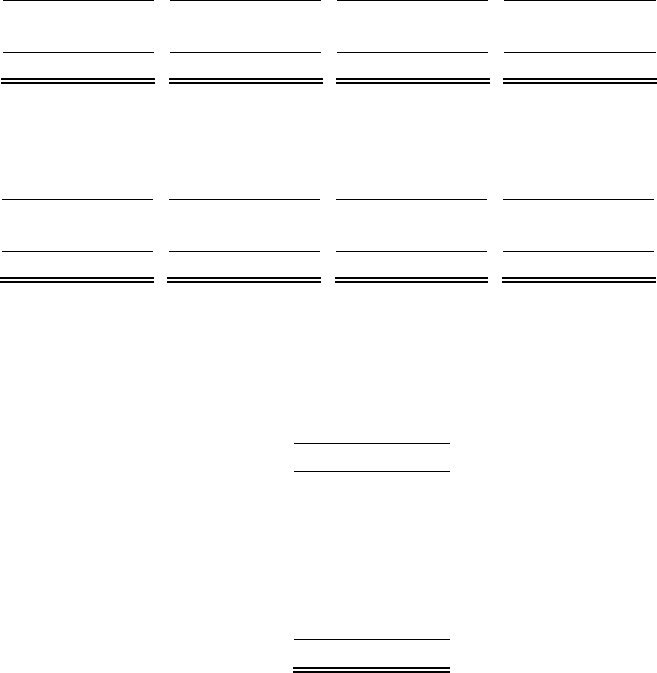

The following table summarizes our financial assets measured at fair value on a recurring basis as of March 31, 2012 (amounts

in thousands):

Level 1 Level 2 Level 3 Total

Cash e

q

uivalents - Mone

y

market funds $

—

$

—

$

—

$

—

Other lon

g

-term assets, net - Investment in Yuke's 4,641

—

—

4,641

Total $ 4,641 $

—

$

—

$ 4,641

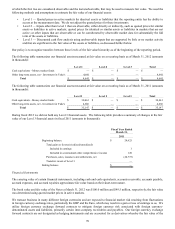

The following table summarizes our financial assets measured at fair value on a recurring basis as of March 31, 2011 (amounts

in thousands):

Level 1 Level 2 Level 3 Total

Cash e

q

uivalents - Mone

y

market funds $ 30,461 $

—

$

—

$ 30,461

Other lon

g

-term assets, net - Investment in Yuke's 4,686

—

—

4,686

Total $ 35,147 $

—

$

—

$ 35,147

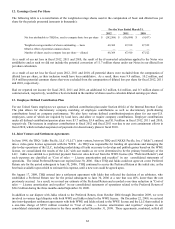

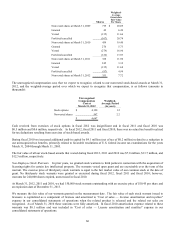

During fiscal 2012 we did not hold any Level 3 financial assets. The following table provides a summary of changes in the fair

value of our Level 3 financial assets in fiscal 2011 (amounts in thousands):

Fiscal Year Ended

March 31,

2011

Be

g

innin

g

balance $ 24,625

Total

g

ains or

(

losses

)

(

realized/unrealized

)

:

Included in earnin

g

s1

Included in accumulated other com

p

rehensive income 149

Purchases, sales, issuances and settlements, net

(

24,775

)

Transfers in/out of Level 3

—

Endin

g

balance $

—

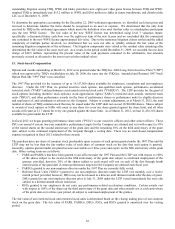

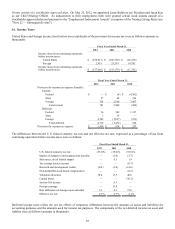

Financial Instruments

The carrying value of certain financial instruments, including cash and cash equivalents, accounts receivable, accounts payable,

accrued expenses, and accrued royalties approximate fair value based on their short-term nature.

The book value and fair value of the Notes at March 31, 2012 was $100.0 million and $49.5 million, respectively; the fair value

was determined using quoted market prices in active markets.

We transact business in many different foreign currencies and are exposed to financial market risk resulting from fluctuations

in foreign currency exchange rates, particularly the GBP and the Euro, which may result in a gain or loss of earnings to us. We

utilize foreign currency exchange forward contracts to mitigate foreign currency risk associated with foreign currency-

denominated assets and liabilities, primarily certain inter-company receivables and payables. Our foreign currency exchange

forward contracts are not designated as hedging instruments and are accounted for as derivatives whereby the fair value of the