THQ 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

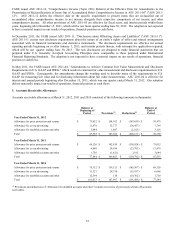

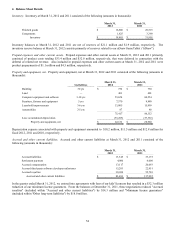

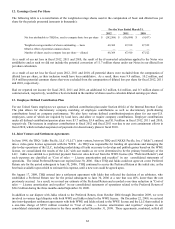

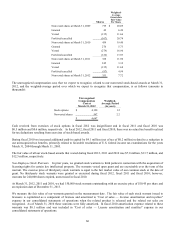

Fiscal Year Ended March 31, 2012

Lease and

Contract

Terminations

Net Asset

Im

p

airments Total

Be

g

innin

g

balance $

—

$

—

$

—

Char

g

es to o

p

erations 634 117 751

Non-cash write-offs

—

(

117

)

(

117

)

Cash payments, net of sublease

income

(

181

)

—

(

181

)

Foreign currency and other

ad

j

ustments 132

—

132

Endin

g

balance $ 585 $

—

$ 585

Additionally, in connection with the U.K. studio closure, in fiscal 2012, we incurred $1.7 million of cash severance and other

employee-based charges related to the notification to employees of position eliminations (recorded within operating expenses in

our consolidated statements of operations). In fiscal 2012, we also incurred a $1.6 million loss related to accumulated foreign

currency translation adjustments (recorded within "Interest and other income (expense), net" in our consolidated statements of

operations). We do not expect any future charges under the fiscal 2012 first quarter realignment, other than additional facility

related charges and adjustments in the event actual and estimated sublease income changes.

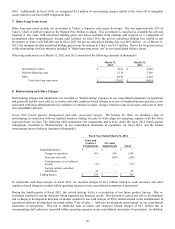

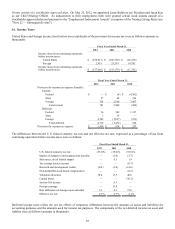

Fiscal 2011 Fourth Quarter Realignment. In the fourth quarter of fiscal 2011, we performed an assessment of our product

development and publishing staffing models. This resulted in a change to our staffing plans to better address peak service

periods, as well as to better utilize shared services and more cost-effective locations. The following table summarizes the

components and activity under the fiscal 2011 fourth quarter realignment, classified as "Restructuring" in our consolidated

statements of operations, for fiscal 2012, and the related restructuring reserve balances (amounts in thousands):

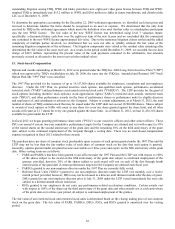

Fiscal Year Ended March 31, 2012

Lease and

Contract

Terminations

Net Asset

Im

p

airments Total

Be

g

innin

g

balance $ 41 $

—

$ 41

Char

g

es to o

p

erations 405 90 495

Non-cash write-offs

—

(

90

)

(

90

)

Cash payments, net of sublease

income

(

320

)

—

(

320

)

Foreign currency and other

ad

j

ustments 195

—

195

Endin

g

balance $ 321 $

—

$ 321

Since the inception of the fiscal 2011 fourth quarter realignment through March 31, 2012, total restructuring charges amounted

to $0.6 million.

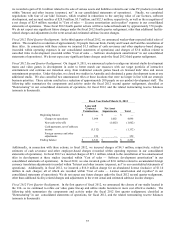

Additionally, in connection with this change, in fiscal 2012, we incurred charges of $1.8 million related to estimates of cash

severance and other employee-based charges (recorded within operating expenses in our consolidated statements of operations),

as well as a $0.5 million loss related to accumulated foreign currency translation adjustments (recorded within "Interest and

other income (expense), net" in our consolidated statements of operations). In fiscal 2011 we incurred $1.3 million of cash

severance charges related to the elimination of positions (recorded within operating expenses in our consolidated statements of

operations) and $76,000 of lease and other contract termination charges (recorded within "Restructuring" in our consolidated

statement of operations). We do not expect any future charges under the fiscal 2011 fourth quarter realignment, other than

additional facility related charges and adjustments in the event actual and estimated sublease income changes.

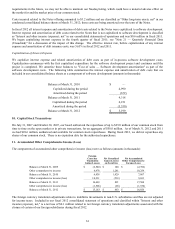

Fiscal 2011 Third Quarter Realignment. In the third quarter of our fiscal 2011, we reevaluated our strategy of adapting certain

Western content for free-to-play online games in Asian markets. As a result, we cancelled two games, eliminated certain

positions, and closed our Korean support office. There were no significant charges recorded in fiscal 2012 related to this

realignment. Restructuring expenses recorded during fiscal 2011 related to the closure of our Korean support office were