THQ 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

$49,000, and consisted of lease and other contract termination charges and write-offs of related long-lived assets. The

cancellation of the games, Company of Heroes Online and WWE Online, resulted in charges of $9.9 million during fiscal 2011,

recorded in "Cost of sales — Software amortization and royalties" in our consolidated statements of operations. Additionally,

in fiscal 2011, we incurred $0.9 million of cash severance charges related to eliminated positions, which were classified within

operating expenses in our consolidated statements of operations. We do not expect any future charges in relation to these

items.

Fiscal 2009 Realignment. During the twelve months ended March 31, 2009 ("fiscal 2009"), we updated our strategic plan in an

effort to increase our profitability and cash flow generation. We significantly realigned our business to focus on fewer, higher

quality games, and established an operating structure that supports our more focused product strategy. The fiscal 2009

realignment included the cancellation of several titles in development, the closure or spin-off of several of our development

studios, and the streamlining of our corporate organization in order to support the new product strategy, including reductions in

worldwide personnel. We do not expect any future charges under the fiscal 2009 realignment, other than additional facility

related charges and adjustments in the event actual and estimated sublease income changes.

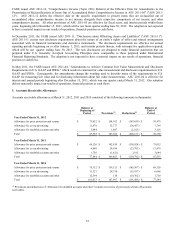

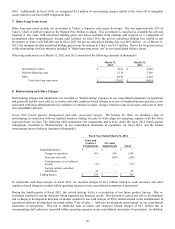

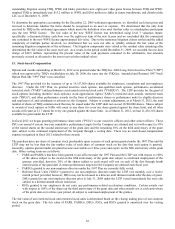

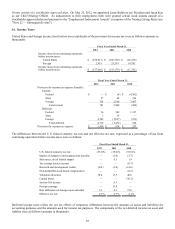

The following table summarizes the restructuring lease and contract termination activity under the fiscal 2009 realignment for

the years ended March 31, 2012 and 2011, and the related restructuring reserve balances (amounts in thousands):

Fiscal Year Ended March 31, 2012 Fiscal Year Ended March 31, 2011

Lease and

Contract

Terminations

Net Asset

Im

p

airments Total

Lease and

Contract

Terminations

Net Asset

Im

p

airments Total

Be

g

innin

g

balance $ 1,335 $

—

$ 1,335 $ 2,392

$

—

$ 2,392

Char

g

es

(

benefit

)

to o

p

erations 311

—

311 477

—

477

Non-cash write-offs

—

—

—

—

—

—

Cash payments, net of sublease

income

(

507

)

—

(

507

)

(

1,788

)

—

(

1,788

)

Foreign currency and other

ad

j

ustments 72

—

72 254

—

254

Endin

g

balance $ 1,211 $

—

$ 1,211 $ 1,335 $

—

$ 1,335

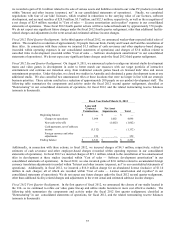

Since the inception of the fiscal 2009 realignment through March 31, 2012, total restructuring charges amounted to $18.7

million.

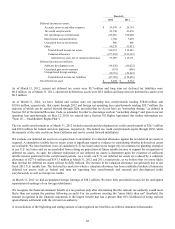

The aggregated restructuring accrual balances at March 31, 2012 and 2011 of $5.0 million and $1.3 million, respectively,

related to future lease payments for facilities vacated under all of our realignment plans (offset by estimates of future sublease

income), and accruals for other non-cancellable contracts. As of March 31, 2012, $1.9 million of the restructuring accrual is

included in "Accrued and other current liabilities" and $3.1 million is included in "Other long-term liabilities" in our

consolidated balance sheet. As of March 31, 2011, $0.7 million of the restructuring accrual was included in "Accrued and other

current liabilities" and $0.6 million was included in "Other long-term liabilities" in our consolidated balance sheet. We expect

the final settlement of this accrual to occur by August 1, 2015, which is the last payment date under our lease agreements that

were vacated.

9. Debt

Credit Facility

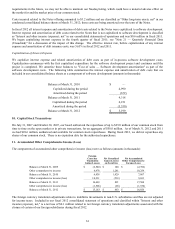

On September 23, 2011, we entered into the Credit Facility. The Credit Facility provides for a $50.0 million revolving facility

during its term, however, the availability under the Credit Facility increased to $75.0 million during the period from October 1,

2011 through December 14, 2011. The Credit Facility allows for up to $10.0 million to be used as a letter of credit subfacility.

The Credit Facility has a four-year term; however, it will terminate on June 16, 2014 if any obligations are still outstanding

under the $100.0 million 5% convertible senior notes more fully described below. Borrowings under the Credit Facility bear

interest at a rate equal to an applicable margin plus, at our option, either a variable base rate or a LIBOR rate. The applicable

margin for base rate loans ranges from 2.25% to 2.5% and for LIBOR rate loans ranges from 3.75% to 4.0%, in each case,

depending on the level of our borrowings. Debt issuance costs capitalized in connection with the Credit Facility totaled $1.3

million; these costs are being amortized over the term of the Credit Facility. We are required to pay other customary fees,

including an unused line fee based on usage under the Credit Facility as well as fees in respect of letters of credit.