THQ 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60

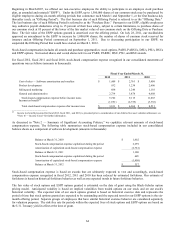

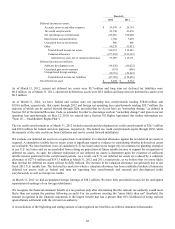

During the fiscal 2012 we borrowed $52.0 million under the Credit Facility; all borrowings were made in the three months

ended December 31, 2011 and were repaid in the same period. In fiscal 2012 interest expense was $0.2 million and

amortization of debt costs related to the Credit Facility was $0.2 million; these amounts were capitalized as part of in-process

software development costs (as further discussed below). There were no outstanding borrowings under the Credit Facility as of

March 31, 2012.

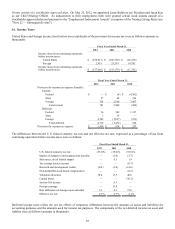

The Credit Facility provides for certain events of default such as nonpayment of principal and interest when due, breaches of

representations and warranties, noncompliance with covenants, acts of insolvency, default on certain agreements related to

indebtedness, including the $100.0 million 5% convertible senior notes more fully described below, and entry of certain

judgments against us. Upon the occurrence of a continuing event of default and at the option of the required lenders (as defined

in the Credit Facility), all of the amounts outstanding under the Credit Facility are currently due and payable and any amount

outstanding bears interest at 2.0% above the interest rate otherwise applicable. In the event availability on the Credit Facility is

below 12.5% of the maximum revolver amount, the Credit Facility requires that we maintain certain financial covenants.

During the year ended March 31, 2012, we had availability in excess of 12.5% and therefore we were not subject to the

financial covenants. In the event the financial covenants become applicable, we would be required to have EBITDA, as defined

in the Credit Facility, of $9.8 million for the four quarters ended June 30, 2012. Beginning September 30, 2012, the EBITDA

requirements are replaced with a requirement that we maintain an annual fixed charge coverage ratio of 1.1 to 1.0.

The Credit Facility is guaranteed by most of our domestic subsidiaries and secured by substantially all of our assets. The

Credit Facility contains customary affirmative and negative covenants, including, among other terms and conditions, and

limitations (subject to certain permitted actions) on our ability to: create, incur, guarantee or be liable for indebtedness; dispose

of assets outside the ordinary course; acquire, merge or consolidate with or into another person or entity; create, incur or allow

any lien on any of their respective properties; make investments or capital expenditures; or pay dividends or make distributions.

As of March 31, 2012, we were in compliance with all applicable covenants and requirements under the Credit Facility.

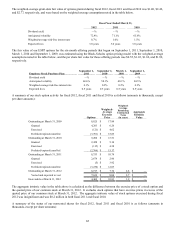

Convertible Senior Notes

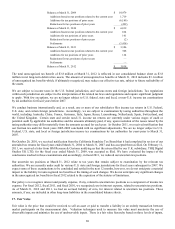

On August 4, 2009, we issued $100.0 million 5% convertible senior notes ("Notes"). After offering costs, the net proceeds to

THQ were $96.8 million. The Notes are due August 15, 2014, unless earlier converted, redeemed or repurchased. The Notes

pay interest semiannually, in arrears on February 15 and August 15 of each year, beginning February 15, 2010, through

maturity and are convertible at each holder's option at any time prior to the close of business on the trading day immediately

preceding the maturity date. The Notes are our unsecured and unsubordinated obligations.

The Notes are initially convertible into shares of our common stock at a conversion rate of 117.4743 shares of common stock

per $1,000 principal amount of Notes, equivalent to an initial conversion price of approximately $8.51 per share. At this

conversion rate and upon conversion of 100% of our Notes outstanding at March 31, 2012, our Notes would convert into 11.7

million shares of common stock. The conversion rate is subject to adjustment in certain events such as a stock split, the

declaration of a dividend or the issuance of additional shares. Also, the conversion rate will be subject to an increase in certain

events constituting a make-whole fundamental change; provided, however, that the maximum number of shares to be issued

thereunder cannot exceed 14.7 million, subject to adjustment. We considered all our other commitments that may require the

issuance of stock (e.g., stock options, restricted stock units, warrants, and other potential common stock issuances) and have

determined that as of March 31, 2012, we have sufficient authorized and unissued shares available for the conversion of the

Notes during the maximum period the Notes could remain outstanding. The Notes will be redeemable, in whole or in part, at

our option, at any time after August 20, 2012 for cash, at a redemption price of 100% of the principal amount of the Notes, plus

accrued but unpaid interest, if the price of a share of our common stock has been at least 150% of the conversion price then in

effect for specified periods.

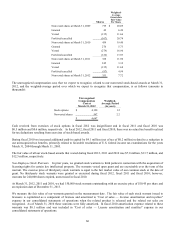

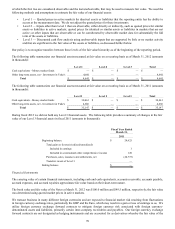

In the case of certain events such as the acquisition or liquidation of THQ, or delisting of our common stock from a U.S.

national securities exchange, holders may require us to repurchase all or a portion of the Notes for cash at a purchase price of

100% of the principal amount of the Notes, plus accrued and unpaid interest. On January 25, 2012, we received a written

notification from Nasdaq notifying us that we fail to comply with Nasdaq's Marketplace Rule 5450(a)(1) (the “Rule”) because

the bid price for our common stock, over the last 30 consecutive business days, has closed below the minimum $1.00 per share

requirement for continued listing. The notification had no immediate effect on the listing of our common stock. Our intention

is to comply with the rule and to that end, on June 29, 2012, at a special meeting, our stockholders will vote on a proposal to

approve an amendment to our certificate of incorporation in order to effect a reverse stock split of our common stock at a ratio

of one-for-three, one-for-five, or one-for-ten, such ratio and effective date to be determined in the sole discretion of the Board

(the “Reverse Stock Split”). It is anticipated that the Reverse Stock Split will be effectuated on or about July 5, 2012. In the

event that our stockholders fail to approve the Reverse Stock Split or if our stock price fails to increase above $1.00 per share

for a minimum of ten consecutive business days following the Reverse Stock Split, or we fail to meet any of the other listing