THQ 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

contracts are reported as "Prepaid expenses and other current assets" or "Accrued and other current liabilities" in our

consolidated balance sheets, and the associated gains and losses from changes in fair value are reported in "Interest and other

income (expense), net" in our consolidated statements of operations.

Cash Flow Hedging Activities. From time to time, we may elect to hedge a portion of our foreign currency risk related to

forecasted foreign currency-denominated sales and expense transactions by entering into foreign currency exchange forward

contracts that generally have maturities of less than 90 days. Our hedging programs reduce, but do not entirely eliminate, the

impact of currency exchange rate movements in net sales and operating expenses. During fiscal 2012 and 2011, we did not

enter into any foreign exchange forward contracts related to cash flow hedging activities.

Balance Sheet Hedging Activities. The foreign currency exchange forward contracts related to balance sheet hedging activities

generally have a contractual term of one month or less and are transacted near month-end. Therefore, the fair value of the

forward contracts are generally not significant at each month-end.

At March 31, 2012 and 2011, we had foreign currency exchange forward contracts related to balance sheet hedging activities in

the notional amount of $92.2 million and $100.6 million, respectively, with a fair value that approximates zero at both

March 31, 2012 and 2011. We estimated the fair value of these contracts using Level 1 inputs, specifically, inputs obtained in

quoted public markets. The net gain recognized from these contracts during fiscal 2012 was $0.8 million. The net gain

recognized from these contracts during fiscal 2011 was $6.9 million. Net gains and losses recognized from these contracts are

included in "Interest and other income (expense), net" in our consolidated statements of operations.

18. Stockholders' Rights Plan

THQ's stockholders hold their stock subject to a Section 382 Rights Agreement (the "Rights Agreement"), entered into by and

between the Company and Computershare Trust Company, N.A., as rights agent, on May 12, 2010. Pursuant to the Rights

Agreement, each share of THQ common stock is accompanied by a right for the holder of such share to purchase one one-

thousandth of a share of Series A Junior Participating Preferred Stock of the Company, par value $.01 (the "Preferred Stock"),

at a purchase price of $35.00. If issued, each such fractional share of Preferred Stock would give the stockholder approximately

the same dividend, voting and liquidation rights as does one share of the Company's common stock. However, prior to

exercise, a right does not give its holder any rights as a stockholder of the Company, including, without limitation, any

dividend, voting or liquidation rights. The rights will not be exercisable until the earlier of (i) ten business days after a public

announcement that a person has become an "Acquiring Person" by acquiring beneficial ownership of 4.9% or more of the

Company's outstanding common stock (or, in the case of a person that had beneficial ownership of 4.9% or more of the

Company's outstanding common stock as of the close of business on May 12, 2010, by obtaining beneficial ownership of

additional shares of the Company's common stock representing three-tenths of one percent (0.3%) of the common stock then

outstanding) and (ii) ten business days (or such later date as may be specified by the Company's board prior to such time as any

person becomes an Acquiring Person) after the commencement of a tender or exchange offer by or on behalf of a person that, if

completed, would result in such person becoming an Acquiring Person.

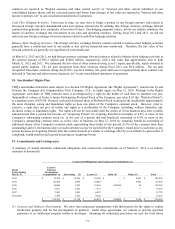

19. Commitments and Contingencies

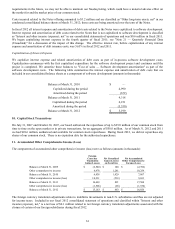

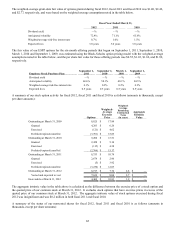

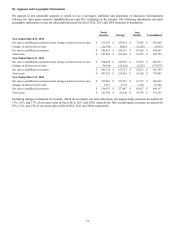

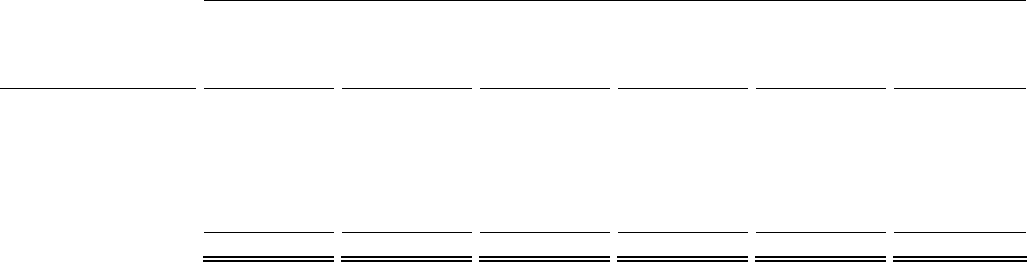

A summary of annual minimum contractual obligations and commercial commitments as of March 31, 2012 is as follows

(amounts in thousands):

Contractual Obli

g

ations and Commercial Commitments

(

6

)

Fiscal

Years Ending

March 31,

License /

Software

Development

Commitments (1) Advertisin

g

(2) Leases (3) Debt (4) Other (5) Total

2013 $ 74,304 $ 15,634 $ 14,940 $

—

$ 4,061 $ 108,939

2014 20,429 4,056 14,088

—

4,062 42,635

2015 14,600 3,093 12,603 100,000 62 130,358

2016 7,651

2,961 7,727

—

—

18,339

2017 7,905

3,025 4,822

—

—

15,752

Thereafte

r

3,349

5,025 9,842

—

—

18,216

$ 128,238 $ 33,794 $ 64,022 $ 100,000 $ 8,185 $ 334,239

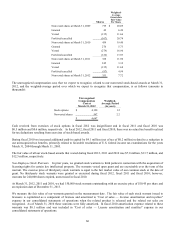

(1) Licenses and Software Development. We enter into contractual arrangements with third parties for the rights to exploit

intellectual property and for the development of products. Under these agreements, we commit to provide specified

payments to an intellectual property holder or developer. Assuming all contractual provisions are met, the total future