THQ 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

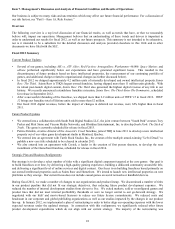

Sales Concentration of Top Titles

The majority of money spent by consumers on video game software is spent on select top titles. Because of the demand for

select “hit” titles and the costs to develop our games, we believe that it is important to focus our development efforts on

bringing a select number of high-quality, competitive products to market.

Sales of Used Video Games

Several retailers, including one of our largest customers, GameStop, continue to focus on selling used video games, which

provides higher margins for the retailers than sales of new games. This focus reduces demand for new copies of our games.

We believe customer retention through compelling online play and downloadable content offerings may reduce consumers'

propensity to trade in games. Additionally, certain of our titles include free access to online content through a code (included in

the packaging) for initial purchasers. This structure creates a new revenue stream by offering second-hand buyers of these titles

the opportunity to separately purchase the online content.

Nasdaq Notice

On January 25, 2012, we received a written notification from Nasdaq notifying us that we fail to comply with Nasdaq's

Marketplace Rule 5450(a)(1) (the “Rule”) because the bid price for our common stock, over the last 30 consecutive business

days, has closed below the minimum $1.00 per share requirement for continued listing. The notification had no immediate

effect on the listing of our common stock.

In accordance with Marketplace Rule 5810(c)(3)(A), we have a period of 180 calendar days, or until July 23, 2012, to regain

compliance with the Rule. If at any time before July 23, 2012, the bid price of our common stock closes at or above $1.00 per

share for a minimum of 10 consecutive business days, Nasdaq will provide written notification that we have achieved

compliance with the Rule. If compliance with the Rule cannot be demonstrated by July 23, 2012, our common stock will be

subject to delisting from The Nasdaq Global Market. In the event that we receive notice that our common stock is subject to

being delisted from The Nasdaq Global Select Market, Nasdaq rules permit us to appeal any delisting determination by the

Nasdaq staff to a Nasdaq hearings panel.

On June 29, 2012, at a special meeting, our stockholders will vote on a proposal to approve an amendment to our certificate of

incorporation in order to effect a reverse stock split of our common stock at a ratio of one-for-three, one-for-five, or one-for-

ten, such ratio and effective date to be determined in the sole discretion of the Board (the “Reverse Stock Split”). It is

anticipated that the Reverse Stock Split will be effectuated on or about July 5, 2012. In the event that our stockholders fail to

approve the Reverse Stock Split or if our stock price fails to increase above $1.00 per share for a minimum of ten consecutive

business days following the Reverse Stock Split, or we fail to meet any of the other listing requirements in the future, we may

not be able to maintain our Nasdaq listing, which could have a material adverse effect on the market for and the market price of

our common stock.

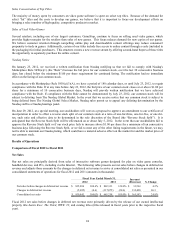

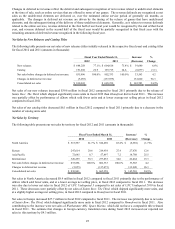

Results of Operations

Comparison of Fiscal 2012 to Fiscal 2011

Net Sales

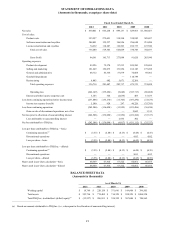

Our net sales are principally derived from sales of interactive software games designed for play on video game consoles,

handheld devices, and PCs, including via the Internet. The following table presents our net sales before changes in deferred net

revenue and adjusts those amounts by the changes in deferred net revenue to arrive at consolidated net sales as presented in our

consolidated statements of operations for fiscal 2012 and 2011 (amounts in thousands):

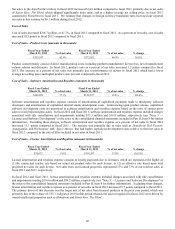

Fiscal Year Ended March 31, Increase/

(

Decrease

)

% Chan

g

e 2012 2011

Net sales before chan

g

es in deferred net revenue $ 835,896 100.6% $ 802,333 120.6 % $ 33,563 4.2%

Chan

g

es in deferred net revenue

(

5,055

)

(

0.6

)

(

137,075

)

(

20.6

)

132,020 96.3

Consolidated net sales $ 830,841 100.0% $ 665,258 100.0 % $ 165,583 24.9%

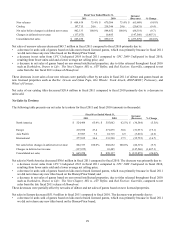

Fiscal 2012 net sales before changes in deferred net revenue were primarily driven by the release of our owned intellectual

property title Saints Row: The Third, WWE '12, and catalog titles (titles released in fiscal years prior to the respective fiscal

year).