THQ 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

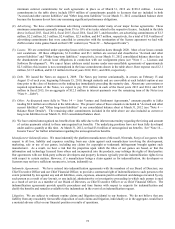

66

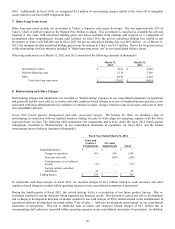

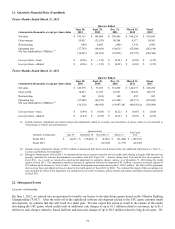

Shares

Weighted-

Average

Grant-date

Fair Value

Per Share

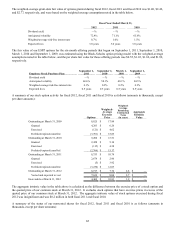

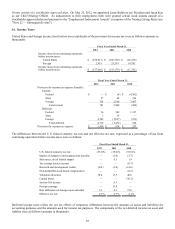

Nonvested shares at March 31, 2009 719 $ 20.09

Grante

d

42 6.49

Veste

d

(

135

)

11.66

Forfeited/cancelle

d

(

167

)

20.74

Nonvested shares at March 31, 2010 459 19.40

Grante

d

270 5.73

Veste

d

(

279

)

16.90

Forfeited/cancelle

d

(

122

)

13.93

Nonvested shares at March 31, 2011 328 11.90

Grante

d

245 3.32

Veste

d

(

135

)

11.68

Forfeited/cancelle

d

(

87

)

4.99

Nonvested shares at March 31, 2012 351 7.72

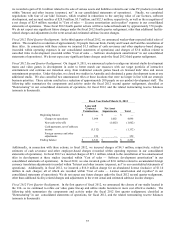

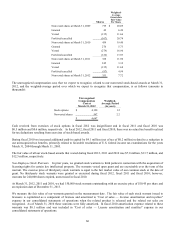

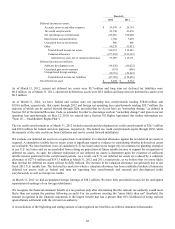

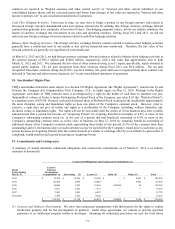

The unrecognized compensation cost, that we expect to recognize, related to our nonvested stock-based awards at March 31,

2012, and the weighted-average period over which we expect to recognize that compensation, is as follows (amounts in

thousands):

Unrecognized

Compensation

Cost at

March 31, 2012

Weighted-

Average Period

(

in

y

ears

)

Stock o

p

tions $ 4,120 1.2

Nonvested shares 567 2.2

$ 4,687

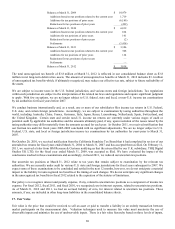

Cash received from exercises of stock options in fiscal 2012 was insignificant and in fiscal 2011 and fiscal 2010 was

$0.5 million and $0.6 million, respectively. In fiscal 2012, fiscal 2011 and fiscal 2010, there was no actual tax benefit realized

for tax deductions resulting from exercises of stock-based awards.

During fiscal 2010 we increased additional paid-in capital by $4.1 million (net of tax of $0.2 million) related to a reduction in

our unrecognized tax benefits, primarily related to favorable resolutions of U.S. federal income tax examinations for the years

March 31, 2004 through March 31, 2005.

The fair value of all our stock-based awards that vested during fiscal 2012, 2011 and 2010 was $7.0 million, $13.7 million, and

$12.5 million, respectively.

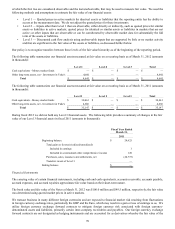

Non-Employee Stock Warrants. In prior years, we granted stock warrants to third parties in connection with the acquisition of

licensing rights for certain key intellectual property. The warrants vested upon grant and are exercisable over the term of the

warrant. The exercise price of third-party stock warrants is equal to the fair market value of our common stock at the date of

grant. No third-party stock warrants were granted or exercised during fiscal 2012, fiscal 2011 and fiscal 2010; however,

warrants for 240,000 shares expired, unexercised in fiscal 2010.

At March 31, 2012, 2011 and 2010, we had 150,000 stock warrants outstanding with an exercise price of $10.45 per share and

an expiration date of December 31, 2013.

We measure the fair value of our warrants granted on the measurement date. The fair value of each stock warrant issued to

licensors is capitalized as a component of licenses and amortized to "Cost of sales — License amortization and royalties"

expense in our consolidated statements of operations when the related product is released and the related net sales are

recognized. As of March 31, 2010 these warrants were fully amortized. In fiscal 2010 amortization expense related to these

warrants was $0.1 million and was included in "Cost of sales — License amortization and royalties" expense in our

consolidated statements of operations.