THQ 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

Grants outside of a stockholder-approved plan. On May 25, 2012, we appointed Jason Rubin as our President and Jason Kay

as our Chief Strategy Officer. As inducements to their employment, both were granted certain stock awards outside of a

stockholder-approved plan and pursuant to the “Employment Inducement Awards” exemption of the Nasdaq Listing Rules (see

"Note 22 — Subsequent Events").

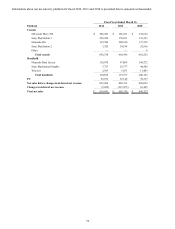

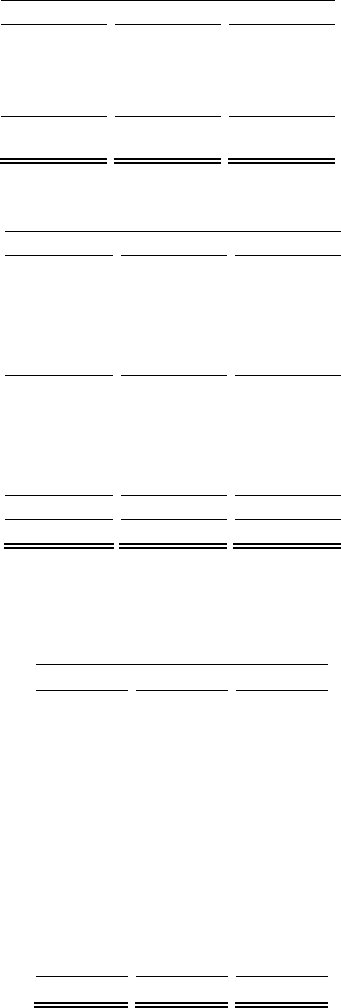

16. Income Taxes

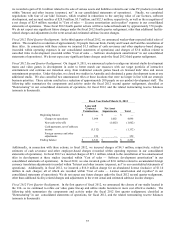

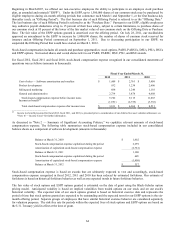

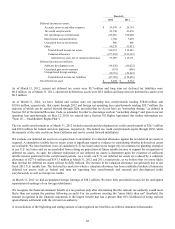

United States and foreign income (loss) before taxes and details of the provision for income tax were as follows (amounts in

thousands):

Fiscal Year Ended March 31,

2012 2011 2010

Income (loss) from continuing operations

b

efore income taxes:

United States $

(

239,921

)

$

(

160,709

)

$

(

26,470

)

Forei

g

n 2,915 25,539 14,765

Income (loss) from continuing operations

b

efore income taxes $

(

237,006

)

$

(

135,170

)

$

(

11,705

)

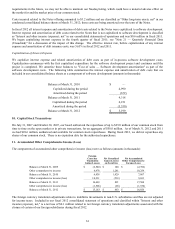

Fiscal Year Ended March 31,

2012 2011 2010

Provision for income tax ex

p

ense

(

benefit

)

:

Current:

Federal $

—

$

(

4

)

$

(

4,302

)

State 57 44 316

Forei

g

n 724 2,360 3,487

Total current 781 2,400

(

499

)

Deferred:

Federal 16 309 1,337

State 1 36

—

Forei

g

n 4,702

(

1,817

)

(

591

)

Total deferre

d

4,719

(

1,472

)

746

Provision for income tax ex

p

ense $ 5,500 $ 928 $ 247

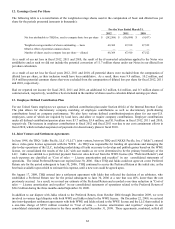

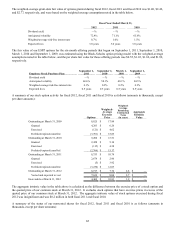

The differences between the U.S. federal statutory tax rate and our effective tax rate, expressed as a percentage of loss from

continuing operations before income taxes were as follows:

Fiscal Year Ended March 31,

2012 2011 2010

U.S. federal statutor

y

tax rate

(

35.0

)

%

(

35.0

)

%

(

35.0

)

%

Im

p

act of chan

g

es in unreco

g

nized tax benefits

—

(

1.0

)

(

2.7

)

State taxes, net of federal im

p

act

—

0.1 1.8

Tax exem

p

t interest income

—

—

(

0.7

)

Research and develo

p

ment credits

(

0.4

)

(

1.0

)

(

14.6

)

Non-deductible stoc

k

-

b

ased com

p

ensation

—

—

(

0.2

)

Valuation allowance 34.4 17.5 46.0

Ca

p

ital losses

—

—

(

30.1

)

Section 956 income

—

6.1

—

Forei

g

n earnin

g

s

—

13.9

—

Rate differences in forei

g

n taxes and othe

r

3.3 0.1 37.6

Effective tax rate 2.3 % 0.7 % 2.1 %

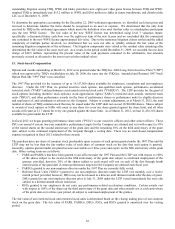

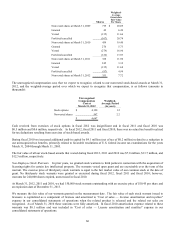

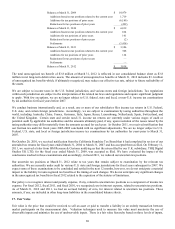

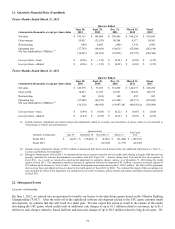

Deferred income taxes reflect the net tax effects of temporary differences between the amounts of assets and liabilities for

accounting purposes and the amounts used for income tax purposes. The components of the net deferred income tax asset and

liability were as follows (amounts in thousands):