THQ 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

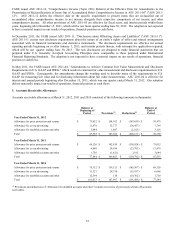

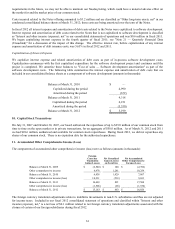

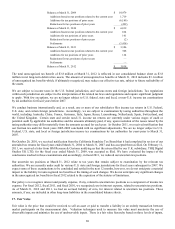

12. Earnings (Loss) Per Share

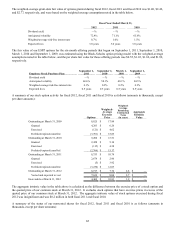

The following table is a reconciliation of the weighted-average shares used in the computation of basic and diluted loss per

share for the periods presented (amounts in thousands):

For the Year Ended March 31,

2012 2011 2010

Net loss attributable to THQ Inc. used to com

p

ute basic loss

p

er share $

(

242,506

)

$

(

136,098

)

$

(

9,017

)

Wei

g

hte

d

-avera

g

e number of shares outstandin

g

—

b

asic 68,369 67,910 67,522

Dilutive effect of

p

otential common shares

—

—

—

Number of shares used to com

p

ute loss

p

er share

—

dilute

d

68,369 67,910 67,522

As a result of our net loss in fiscal 2012, 2011 and 2010, the result of the if-converted calculation applied to the Notes was

antidilutive and as such we did not include the potential conversion of 11.7 million shares under our Notes in our diluted loss

per share calculation.

As a result of our net loss for fiscal years 2012, 2011 and 2010, all potential shares were excluded from the computation of

diluted loss per share, as their inclusion would have been antidilutive. As a result, there were 9.9 million, 10.2 million, and

10.4 million potential common shares that were excluded from the computation of diluted loss per share for fiscal 2012, 2011

and 2010, respectively.

Had we reported net income for fiscal 2012, 2011 and 2010, an additional 0.2 million, 0.4 million, and 0.3 million shares of

common stock, respectively, would have been included in the number of shares used to calculate diluted earnings per share.

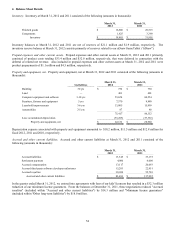

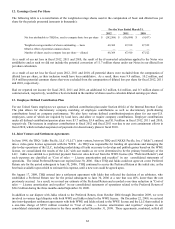

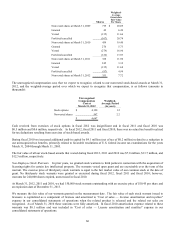

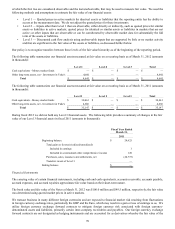

13. Employee Defined Contribution Plan

For our United States employees we sponsor a defined contribution plan under Section 401(k) of the Internal Revenue Code.

The plan allows for discretionary company matching of employee contributions as well as discretionary profit-sharing

contributions based on company performance. We also have various defined contribution/pension plans for our non-U.S.

employees, some of which are required by local laws, and allow or require company contributions. Employer contributions

under all defined contribution/pension plans were $3.7 million, $3.4 million, and $1.9 million in fiscal 2012, 2011 and 2010,

respectively. The increase in employer contributions in fiscal 2012 and fiscal 2011 was due to our cost containment efforts in

fiscal 2010, which included suspension of payments for discretionary plans in fiscal 2010.

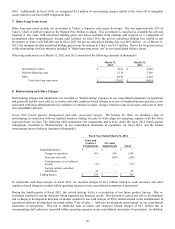

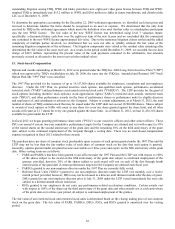

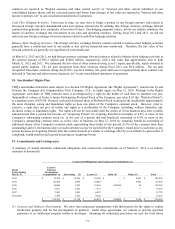

14. Joint Venture and Settlement Agreements

In June 1998, the THQ / Jakks Pacific, LLC (“LLC”) joint venture, between THQ and JAKKS Pacific, Inc. (“Jakks”), entered

into a video game license agreement with the WWE. As THQ was responsible for funding all operations and managing the

day-to-day operations of the LLC, including undertaking all tasks necessary to develop and publish games based on the WWE

license, we consolidated the results of the LLC with our results as we were determined to be the primary beneficiary of the

LLC. Jakks was entitled to a preferred payment from net sales derived from the WWE license (the “Preferred Return”) and

such expenses are classified as “Cost of sales — License amortization and royalties” in our consolidated statements of

operations. The initial Preferred Return rate expired June 30, 2006. Since THQ and Jakks could not agree on a new Preferred

Return rate for the period subsequent to June 30, 2006, THQ continued to accrue the Preferred Return at the initial rate, as the

best basis available upon which to estimate this expense, until a new rate could be agreed upon.

On August 17, 2009, THQ entered into a settlement agreement with Jakks that reflected the decision of an arbitrator, who

established a Preferred Return rate for the period subsequent to June 30, 2006 at a rate that was 40% lower than the rate

previously accrued. As a result, we revised our estimate of the Preferred Return and recorded a one-time reduction in “Cost of

sales — License amortization and royalties” in our consolidated statements of operations related to the Preferred Return of

$24.2 million during the three months ended September 30, 2009.

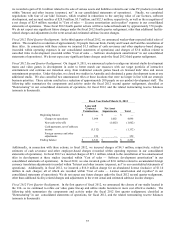

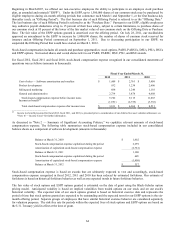

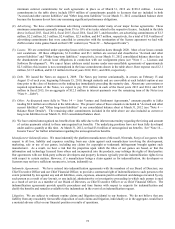

In addition to our dispute with Jakks related to the Preferred Return, from October 2004 through December 2009, we were

involved in various legal disputes with both WWE and Jakks related to the WWE license. On December 22, 2009, we entered

into inter-dependent settlement agreements with both WWE and Jakks related to the WWE license and the LLC that resulted in

a one-time charge of $29.5 million recorded in “Cost of sales — License amortization and royalties” expense in our

consolidated statements of operations in the three months ended December 31, 2009. These agreements, combined, settled all