THQ 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

they are recognized as a reduction of net sales. Advertising costs, included in "Selling and marketing" expense in our

consolidated statements of operations, for fiscal 2012, 2011 and 2010 are $105.6 million, $78.0 million, and $69.7 million,

respectively.

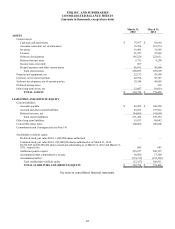

Other Intangible Assets. Intangible assets include licenses, software development and other intangible assets. Intangible assets

are included in "Other long-term assets, net," except licenses and software development, which are reported separately in our

consolidated balance sheets. Other than licenses and software development, we did not have any other net intangible asset

balances at March 31, 2012 and 2011. As of March 31, 2010 all identifiable intangible assets, other than licenses and software

development, were fully amortized. Finite-lived other intangible assets were amortized using the straight-line method over the

lesser of their estimated useful lives or the agreement terms, typically from one and one-half to ten years and were assessed for

impairment whenever events or changes in circumstances indicated that their carrying amount may not have been recoverable.

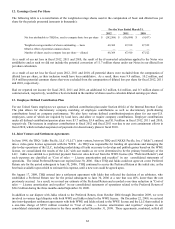

Stock-based compensation. We estimate the fair value of stock options and our employee stock purchase plan on the date of

grant using the Black-Scholes option pricing model which requires the input of subjective assumptions, including the expected

volatility of our common stock and an option's expected life. The fair value of our restricted stock and restricted stock units is

determined based on the closing trading price of our common stock on the grant date. The amount of expense recognized

represents the expense associated with the stock-based awards we expect to ultimately vest based upon an estimated rate of

forfeitures. Our estimate of forfeitures is based on historical forfeiture behavior as well as any expected trends in future

forfeiture behavior; this rate of forfeitures is updated as necessary and any adjustments needed to recognize the fair value of

options that actually vest or are forfeited are recorded. The fair value for awards that are expected to vest is then amortized on a

straight-line basis over the requisite service period of the award, which is generally the option vesting term. As a result, the

financial statements include amounts that are based upon our best estimates and judgments relating to the expenses recognized

for stock-based compensation.

Capitalization of interest expense. We capitalize interest expense related to in-process software development costs.

Capitalization commences with the first capitalized expenditure for the software development project and continues until the

project is completed. We amortize capitalized interest to "Cost of sales — Software amortization and royalties" as part of the

software development costs; see "Note 9 — Debt." We began capitalizing interest expense in the fourth quarter of fiscal 2011;

see "Note 21 — Quarterly Financial Data (Unaudited)" for a discussion of the impact of this change.

Income Taxes. The provision for income taxes is computed using the asset and liability method, under which deferred tax

assets and liabilities are recognized based on their expected future tax carrying value. Deferred tax assets and liabilities are

measured using the enacted tax rates expected to apply to taxable income in effect for the years in which those tax assets are

anticipated to be realized or settled. We record a valuation allowance to reduce deferred tax assets to the amount that is believed

more likely than not to be realized.

The calculation of tax liabilities involves judgment, assumptions and estimates in evaluating the application of authoritative

accounting guidance, enacted tax laws, our interpretation of tax laws and potential outcomes of audits conducted by tax

authorities. Material changes in tax laws, our interpretation of tax laws, or the resolution of tax audits, if and when conducted

by tax authorities, could significantly impact the amount of income tax expense in our consolidated financial statements.

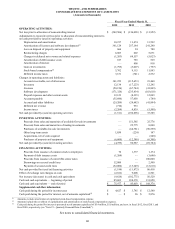

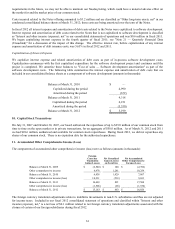

Basic and Diluted Loss Per Share. Basic loss per share is computed as net loss attributable to THQ Inc. divided by the

weighted-average number of shares outstanding for the period. Diluted loss per share reflects the potential dilution that could

occur from common shares issuable through stock-based compensation plans including stock options, stock-based awards,

purchase opportunities under our employee stock purchase plan, and the conversion of our convertible senior notes. On

August 4, 2009, we issued $100.0 million 5% convertible senior notes ("Notes"); see "Note 9 — Debt." Under the provisions

of the if-converted method, the Notes are assumed to have been converted at the beginning of the respective period or at the

time of issuance if later, and are included in the denominator of the diluted calculation. The after-tax interest expense,

amortization of previously capitalized interest expense, and amortization of debt issuance costs in connection with the Notes

are added back to the numerator of the diluted calculation. However, the if-converted amounts are only included in the

numerator and denominator of the diluted calculation if the result of the if-converted calculation is dilutive.

Recently Issued Accounting Pronouncements. In fiscal 2012, we did not have any material changes to our significant

accounting policies.

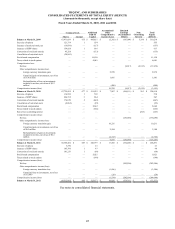

In June 2011, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2011-05,

"Comprehensive Income (Topic 220): Presentation of Comprehensive Income" ("ASU 2011-05"). ASU 2011-05 requires

companies to present the components of net income and other comprehensive income either as one continuous statement or as

two consecutive statements and it eliminates the option to present components of other comprehensive income as part of the

statement of changes in stockholders' equity. ASU 2011-05 does not change the items which must be reported in other

comprehensive income, how such items are measured or when they must be reclassified to net income. In December 2011, the