THQ 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 THQ annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

requirements in the future, we may not be able to maintain our Nasdaq listing, which could have a material adverse effect on

the market for and the market price of our common stock.

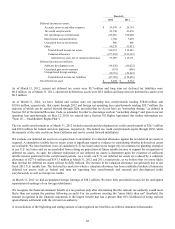

Costs incurred related to the Notes offering amounted to $3.2 million and are classified as "Other long-term assets, net" in our

condensed consolidated balance sheets at March 31, 2012; these costs are being amortized over the term of the Notes.

In fiscal 2012 all interest expense and amortization of debt costs related to the Notes were capitalized to software development.

Interest expense and amortization of debt costs related to the Notes that is not capitalized to software development is classified

as "Interest and other income (expense), net" in our consolidated statements of operations and was $0.6 million in fiscal 2011.

We began capitalizing interest expense in the fourth quarter of fiscal 2011; see "Note 21 — Quarterly Financial Data

(Unaudited)" for a discussion of the impact of this change. The effective interest rate, before capitalization of any interest

expense and amortization of debt issuance costs, was 5.65% in fiscal 2012 and 2011.

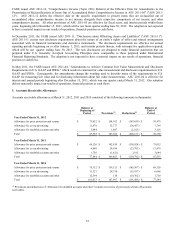

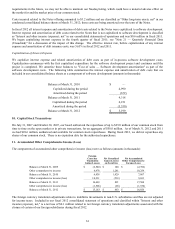

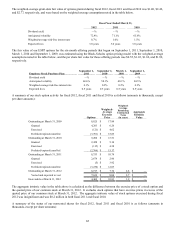

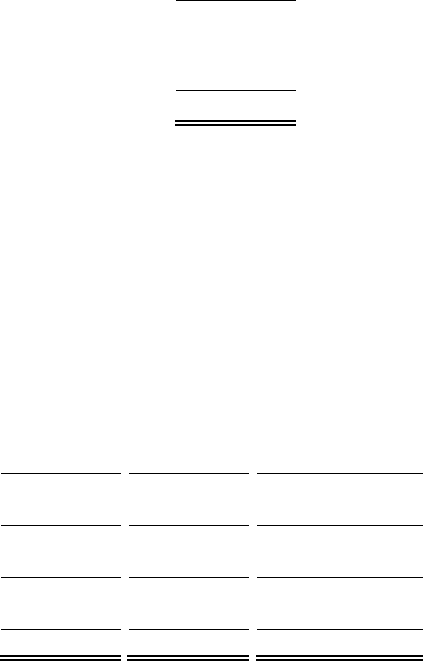

Capitalization of Interest Expense

We capitalize interest expense and related amortization of debt costs as part of in-process software development costs.

Capitalization commences with the first capitalized expenditure for the software development project and continues until the

project is completed. We amortize these balances to "Cost of sales — Software development amortization" as part of the

software development costs. The following table summarizes the interest expense and amortization of debt costs that are

included in our consolidated balance sheets as a component of software development (amounts in thousands):

Balance at March 31, 2010 $

—

Ca

p

italized durin

g

t

he

p

erio

d

4,990

Amortized durin

g

the

p

erio

d

(

672

)

Balance at March 31, 2011 4,318

Ca

p

italized durin

g

the

p

erio

d

6,231

Amortized durin

g

the

p

erio

d

(

5,350

)

Balance at March 31, 2012 $ 5,199

10. Capital Stock Transactions

On July 31, 2007 and October 30, 2007, our board authorized the repurchase of up to $25.0 million of our common stock from

time to time on the open market or in private transactions, for an aggregate of $50.0 million. As of March 31, 2012 and 2011

we had $28.6 million, authorized and available for common stock repurchases. During fiscal 2012, we did not repurchase any

shares of our common stock. There is no expiration date for the authorized repurchases.

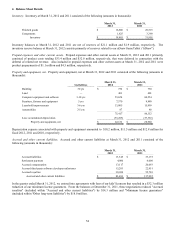

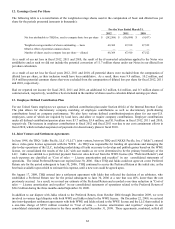

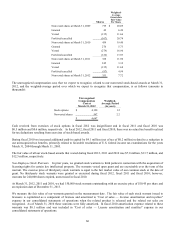

11. Accumulated Other Comprehensive Income (Loss)

The components of accumulated other comprehensive income (loss) were as follows (amounts in thousands):

Foreign

Currency

Translation

Gains (Losses)

Net Unrealized

Gains (Losses)

on Securities

Net Accumulated

Other Comprehensive

Income (Loss)

Balance at March 31, 2009 $

(

2,540

)

$ 148 $

(

2,392

)

Other com

p

rehensive income 8,978 1,281 10,259

Balance at March 31, 2010 6,438 1,429 7,867

Other com

p

rehensive income

(

loss

)

10,231

(

538

)

9,693

Balance at March 31, 2011 16,669 891 17,560

Other co

m

p

rehensive income

(

loss

)

(

1,506

)

(

28

)

(

1,534

)

Balance at March 31, 2012 $ 15,163 $ 863 $ 16,026

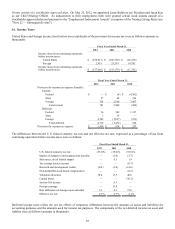

The foreign currency translation adjustments relate to indefinite investments in non-U.S. subsidiaries and thus are not adjusted

for income taxes. Included in our fiscal 2012 consolidated statement of operations and classified within "Interest and other

income (expense), net," is a net loss of $0.1 million related to net foreign currency translation adjustments associated with the

closure of certain of our foreign subsidiaries during fiscal 2012.