TCF Bank 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

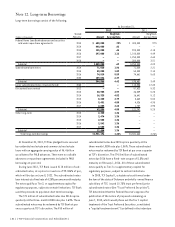

governing the Trust Preferred Securities), which allowed

TCF to redeem the Trust Preferred Securities. The Trust

Preferred Securities were redeemed on July 30, 2012, at

the redemption price of $25 per Trust Preferred Security

plus accumulated and unpaid distributions, totaling

$115 million. The redemption was funded with a portion of the

net proceeds from TCF’s offering of Series A Non-Cumulative

Perpetual Preferred Stock, which closed in June 2012.

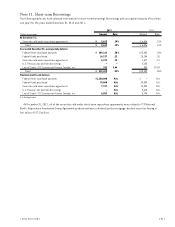

During March 2012, as part of TCF’s balance sheet

repositioning, the Company borrowed $2.1 billion of

fixed and floating rate FHLB advances, both long-and

short-term, with a weighted-average interest rate of .5%,

and also sold $1.9 billion of U.S. government-sponsored

mortgage-backed securities at a gain of $77 million.

Proceeds were used to terminate $2.1 billion of FHLB

advances with a weighted-average fixed rate of 4.4%, and

$1.5 billion of repurchase agreements with a weighted-

average fixed rate of 4.2%. At December 31, 2012, the

aggregate carrying value of pledged loans available as

collateral for FHLB advances was $6.4 billion. Such loans are

secured by residential real estate, commercial real estate

loans, and FHLB stock.

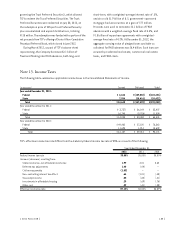

Note 13. Income Taxes

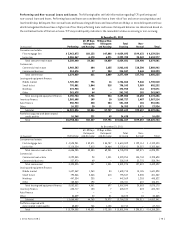

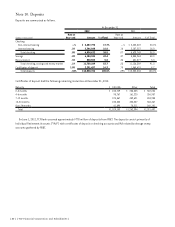

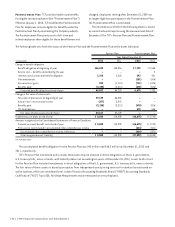

The following table summarizes applicable income taxes in the Consolidated Statements of Income.

(In thousands) Current Deferred Total

Year ended December 31, 2012:

Federal $ 6,646 $(129,082) $(122,436)

State 7,994 (18,416) (10,422)

Total $14,640 $(147,498) $(132,858)

Year ended December 31, 2011:

Federal $ (2,737) $ 56,144 $ 53,407

State 16,740 (5,706) 11,034

Total $ 14,003 $ 50,438 $ 64,441

Year ended December 31, 2010:

Federal $ 49,462 $ 27,100 $ 76,562

State 11,695 1,914 13,609

Total $ 61,157 $ 29,014 $ 90,171

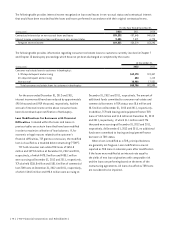

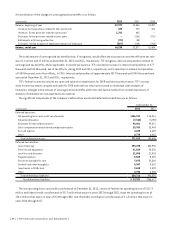

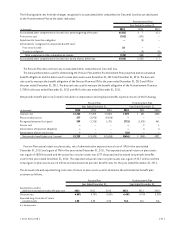

TCF’s effective income tax rate differs from the statutory federal income tax rate of 35% as a result of the following.

Year Ended December 31,

2012 2011 2010

Federal income tax rate 35.00% 35.00% 35.00%

Increase (decrease) resulting from:

State income tax, net of federal income tax 1.99 4.01 3.62

Deferred tax adjustments 1.40 (.04) –

Civil money penalty (1.03) – –

Non-controlling interest tax effect .64 (1.01) (.48)

Tax exempt income .55 (.82) (.41)

Investments in affordable housing .29 (.69) (.76)

Other, net .29 (.41) (.08)

Effective income tax rate 39.13% 36.04% 36.89%

{ 2012 Form 10K } { 83 }