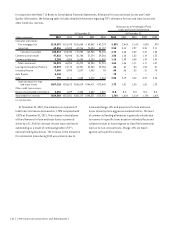

TCF Bank 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

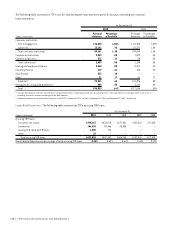

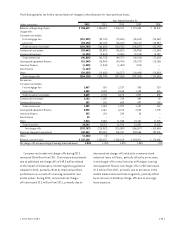

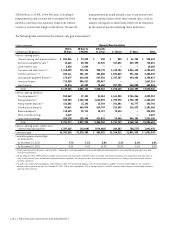

The following table is a reconciliation of the non-GAAP financial measures of tangible realized common equity and tangible

assets to the GAAP measures of total equity and total assets.

At December 31,

(Dollars in thousands) 2012 2011 2010 2009 2008

Computation of tangible realized common equity

to tangible assets:

Total equity $ 1,876,643 $ 1,878,627 $ 1,480,163 $ 1,179,755 $ 1,493,776

Less: Non-controlling interest in subsidiaries 13,270 10,494 8,500 4,393 –

Total TCF Financial Corporation stockholders’ equity 1,863,373 1,868,133 1,471,663 1,175,362 1,493,776

Less:

Preferred stock 263,240 – – – 348,437

Goodwill 225,640 225,640 152,599 152,599 152,599

Other intangibles 8,674 7,134 1,232 1,405 –

Accumulated other comprehensive income 12,443 56,826 – 1,660 23,685

Add:

Accumulated other comprehensive loss –– 15,692 – –

Tangible realized common equity $ 1,353,376 $ 1,578,533 $ 1,333,524 $ 1,019,698 $ 969,055

Total assets $18,225,917 $18,979,388 $18,465,025 $17,885,175 $16,740,357

Less:

Goodwill 225,640 225,640 152,599 152,599 152,599

Other intangibles 8,674 7,134 1,232 1,405 –

Tangible assets $17,991,603 $18,746,614 $18,311,194 $17,731,171 $16,587,758

Tangible realized common equity to tangible assets 7.52% 8.42% 7.28% 5.75% 5.84%

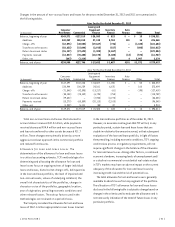

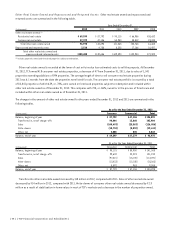

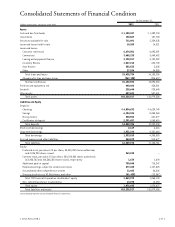

At December 31, 2012 and 2011, regulatory capital for TCF and TCF Bank exceeded their regulatory capital requirements and

were considered “well-capitalized” under guidelines established by the Federal Reserve and the OCC. See Notes 14 and 15 of

Notes to Consolidated Financial Statements.

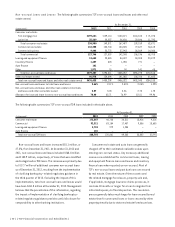

The following table is a reconciliation of Tier 1 risk-based capital to Tier 1 common capital.

At December 31,

(In thousands) 2012 2011

Tier 1 risk-based capital ratio:

Total Tier 1 capital $ 1,633,336 $ 1,706,926

Total risk-weighted assets 14,733,203 13,475,330

Total Tier 1 risk-based capital ratio 11.09% 12.67%

Tier 1 common capital ratio:

Total Tier 1 capital $ 1,633,336 $ 1,706,926

Less:

Preferred stock 263,240 –

Qualifying non-controlling interest in subsidiaries 13,270 10,494

Qualifying trust preferred securities – 115,000

Total Tier 1 common capital $ 1,356,826 $ 1,581,432

Total risk-weighted assets $14,733,203 $13,475,330

Total Tier 1 common capital ratio 9.21% 11.74%

{ 48 } { TCF Financial Corporation and Subsidiaries }