TCF Bank 2012 Annual Report Download - page 63

Download and view the complete annual report

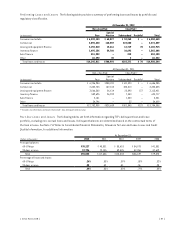

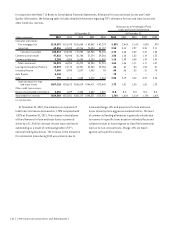

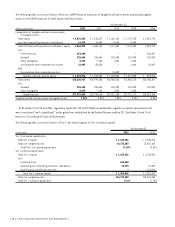

Please find page 63 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Commitments to extend credit are agreements to

lend to a customer provided there is no violation of any

condition in the contract. These commitments generally

have fixed expiration dates or other termination clauses

and may require payment of a fee. Since certain of the

commitments are expected to expire without being

drawn upon, the total commitment amounts do not

necessarily represent future cash requirements. Collateral

predominantly consists of residential and commercial

real estate. The credit facilities established for inventory

finance customers are discretionary credit arrangements

which do not obligate the Company to lend.

Unrecognized tax benefits, projected benefit obligations

and demand deposits with indeterminate maturities have been

excluded from the contractual obligations presented above.

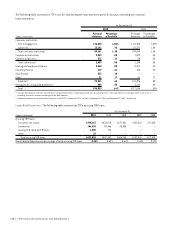

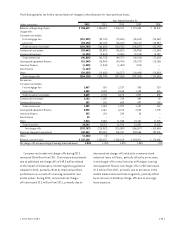

Campus marketing agreements consist of fixed or

minimum obligations for exclusive marketing and naming

rights with seven campuses. TCF is obligated to make

various annual payments for these rights in the form of

royalties and scholarships through 2029. TCF also has

various renewal options, which may extend the terms of

these agreements. Campus marketing agreements are an

important element of TCF’s campus banking strategy.

See Note 18 of Notes to Consolidated Financial

Statements for information on commitments to extend

credit and standby letters of credit and guarantees on

industrial revenue bonds.

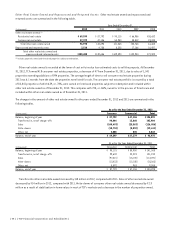

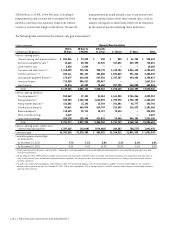

Capital Resources

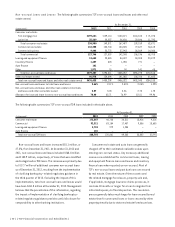

Preferred Stock On June 25, 2012, TCF completed the

public offering of 6,900,000 depositary shares, each

representing a 1/1,000th interest in a share of the Series

A Preferred Stock, par value $.01 per share, at a public

offering price of $25 per depositary share. Net proceeds of

the offering to TCF, after deducting underwriting discounts,

commissions and estimated offering costs of $5.8 million,

were $166.7 million. Dividends are payable on the Series

A Preferred Stock if, as, and when declared by TCF’s Board

of Directors on a non-cumulative basis on March 1, June 1,

September 1, and December 1 of each year, at a per annum

rate of 7.5%.

On December 19, 2012, TCF completed the public offering

of 4,000,000 shares of 6.45% Series B Non-Cumulative

Perpetual Preferred Stock, par value $.01 per share,

with a liquidation preference of $25 per share (“Series B

Preferred Stock”). Net proceeds of the offering to TCF,

after deducting underwriting discounts, commissions and

estimated offering costs of $3.5 million, were $96.5 million.

Dividends are payable on the Series B Preferred Stock if, as,

and when declared by TCF’s Board of Directors on a non-

cumulative basis on March 1, June 1, September 1, and

December 1 of each year, at a per annum rate of 6.45%.

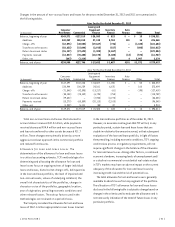

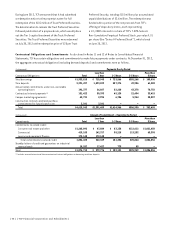

Equity Dividends to common stockholders on a per

share basis totaled 5 cents for each of the quarters ended

December 31, 2012 and December 31, 2011. TCF’s dividend

payout ratio was 34% for the quarter ended December 31,

2012. The Company’s primary funding sources for dividends

are earnings and dividends received from TCF Bank.

At December 31, 2012, TCF had 5.4 million shares remain-

ing in its stock repurchase program authorized by its Board of

Directors, but would need approval from the Federal Reserve

before repurchasing stock pursuant to this authorization.

Tangible realized common equity at December 31, 2012,

was $1.4 billion, or 7.52% of total tangible assets,

compared with $1.6 billion, or 8.42% of total tangible

assets, at December 31, 2011. Tangible realized common

equity is a non-GAAP financial measure and represents

common equity less goodwill, other intangible assets,

accumulated other comprehensive income and non-

controlling interest in subsidiaries. Tangible assets

represent total assets less goodwill and other intangible

assets. When evaluating capital adequacy and utilization,

management considers financial measures such as Tangible

Realized Common Equity to Tangible Assets and the Tier 1

Common Capital Ratio. These measures are non-GAAP

financial measures and are viewed by management as

useful indicators of capital levels available to withstand

unexpected market or economic conditions, and also provide

investors, regulators, and other users with information to be

viewed in relation to other banking institutions.

{ 2012 Form 10K } { 47 }