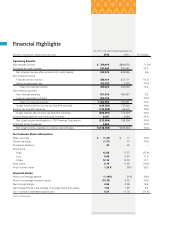

TCF Bank 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

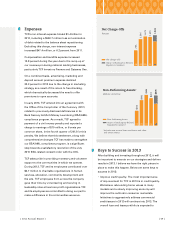

Expenses

TCF’s non-interest expense totaled $1.4 billion in

2012, including a $550.7 million loss on termination

of debt related to the balance sheet repositioning.

Excluding this charge, non-interest expense

increased $47.4 million, or 6.2 percent from 2011.

Compensation and benefits expense increased

12.9 percent during the year due to the ramp-up of

our revenue-producing national lending businesses,

particularly TCF Inventory Finance and Gateway One.

On a combined basis, advertising, marketing and

deposit account premium expense declined

23.3 percent in 2012 due to the change in marketing

strategy as a result of the return to free checking,

which dramatically decreased the need to offer

premiums to open accounts.

In early 2013, TCF entered into an agreement with

the Office of the Comptroller of the Currency (OCC)

related to previously disclosed deficiencies in its

Bank Secrecy Act/Anti-Money Laundering (BSA/AML)

compliance program. As a result, TCF agreed to

payment of a civil money penalty and reported a

charge to earnings of $10 million, or 6 cents per

common share, in the fourth quarter of 2012 for this

penalty. We believe that this settlement, along with

comprehensive changes TCF has made to strengthen

our BSA/AML compliance program, is a significant

step towards a satisfactory resolution of the July

2010 BSA-related consent order with the OCC.

TCF takes pride in providing monetary and volunteer

support to the communities in which we operate.

During 2012, TCF and its employees contributed over

$2.7 million to charitable organizations in human

services, education, community development and

the arts. TCF employees from across the company

gave their time by volunteering and serving in

leadership roles at local non-profit organizations. TCF

and its employees are committed to doing our part to

make a difference in the communities we serve.

Keys to Success in 2013

After building and investing throughout 2012, it will

be important to execute on our strategies and deliver

results in 2013. I believe we have the right pieces in

place to make this happen. Below are some keys to

success in 2013:

• Improve credit quality. The most important area

of improvement for TCF in 2013 is in credit quality.

We believe rebounding home values in many

markets and a slowly improving economy will

improve the outlook in consumer real estate.

Initiatives to aggressively address commercial

credit issues in 2012 will continue into 2013. The

overall loan and lease portfolio is expected to

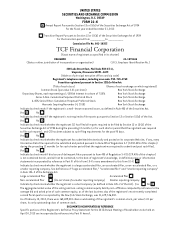

Net Charge-Offs

Percent

1211100908

1.54%

.78%

1.34%

1.47%

1.45%

Impact of Bankruptcy-Related

Regulatory Guidance

Net Charge-Offs

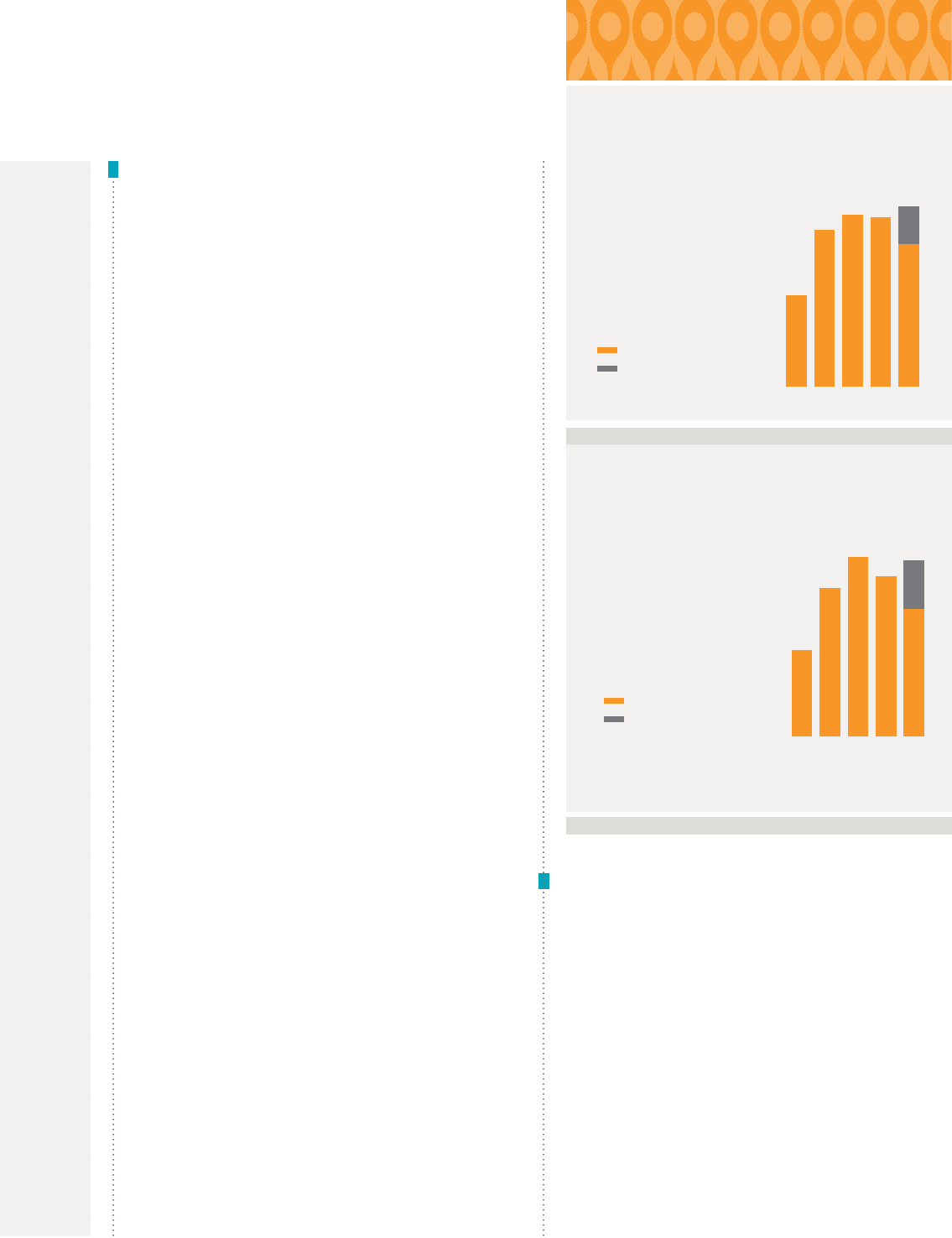

Non-Performing Assets1

Millions of Dollars

1211100908

$476

$234

$402

$486

$433

Non-Performing Assets

Impact of Bankruptcy-Related

Regulatory Guidance

1

Includes non-accrual loans and leases and other

real estate owned

{ 2012 Annual Report } { 09 }