TCF Bank 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

{ 08 } { TCF Financial Corporation and Subsidiaries }

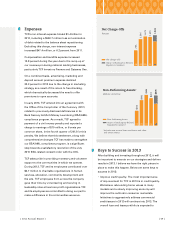

Credit Quality

Credit quality was again the most significant head-

wind for TCF in 2012. Recovery from the financial

crisis has taken longer than expected, but progress is

being made. Despite a persistent, sluggish economy,

we saw improvements in several leading indicators

throughout the year, including consumer delinquen-

cies and commercial classified assets. In 2012, we

were able to work through many of our challenges

and believe we have positioned ourselves for a

better 2013.

Credit quality in 2012 was impacted by the imple-

mentation of clarifying regulatory guidance requiring

consumer loans discharged in a Chapter 7 bankruptcy

to be reported as non-accrual loans and written

down to the estimated collateral value, less cost to

sell, regardless of delinquency status. The guidance

has resulted in an additional $49.3 million of consumer

net charge-offs and $117.7 million of consumer loans

being classified as non-accrual. While this regulatory

accounting guidance had a significant impact on

TCF’s credit metrics, it had no impact on the underly-

ing credit risk profile of the portfolio. In fact, 87.5

percent of the non-accrual assets associated with

the regulatory accounting guidance were less than

60 days past due as of December 31, 2012.

Provision for loan and lease losses in 2012 increased

$46.6 million, or 23.2 percent, from 2011 primarily

due to regulatory Chapter 7 bankruptcy guidance

and the aggressive management of commercial

credit issues. Net charge-offs of 1.54 percent were

also impacted by the regulatory guidance and

increased 9 basis points. Excluding the regulatory

guidance, net charge-offs decreased 12 percent

from 2011.

Non-performing assets, which includes non-accrual

loans and leases and other real estate owned,

increased 10 percent in 2012 including the impact

of the regulatory Chapter 7 bankruptcy guidance

which resulted in additional loans being classified

as non-accrual. Excluding this impact, non-

performing assets showed a moderate decline of

$74.4 million during the year. Other real estate

owned totaled $97 million at year-end, a decrease

of $37.9 million from 2011. At December 31, 2012,

TCF owned 639 consumer real estate properties and

21 commercial properties, compared with 723 and

35 properties, respectively, at December 31, 2011.

The leading indicator of consumer real estate credit

quality, over 60-day delinquencies, showed steady

improvement throughout the year. At year-end,

1.38 percent of consumer real estate loans were over

60-days delinquent, down 25 basis points from 2011.

Performing classified assets, the leading indicator for

commercial, also saw significant improvement in

2012, decreasing $106 million to $224 million at

December 31, 2012. Meanwhile, the national lending

businesses continue to perform with very strong credit

metrics including low delinquencies and charge-offs.

While there is still work to be done, we are

encouraged by the trends we have seen during

2012. Home values, which are a significant factor in

consumer credit quality because they impact both

the willingness of the customer to make payments

and the charge we recognize should they default,

started to recover in many markets and we were

able to work through many of the problems in the

commercial portfolio in 2012.

A Better Way of

Revenue Generation

“TCF, as a result of its large deposit account

base, has long been regarded as having a

strong fee-based revenue stream. With the

implementation of Regulation E in 2010 and the

Durbin Amendment in 2011, TCF has moved

toward becoming more of a spread-based

business through its balance sheet reposition-

ing and emphasis on national lending.”